According to TechRepublic, data security firm Cyera has raised a massive $400 million Series F funding round led by Blackstone, skyrocketing its valuation to $9 billion. This marks a 50% jump from its $6 billion valuation just seven months ago. The round included Accel, Coatue, and Sequoia, bringing total funding to over $1.7 billion. Cyera now claims to secure data for 20% of the Fortune 500, and its revenue grew 3.4 times in the past year with plans to triple again. The funding surge comes as Bain & Co. research shows 95% of U.S. companies are using generative AI, creating a frantic rush for security solutions.

The funding frenzy meets a scary reality

Look, the numbers are staggering. A $9 billion valuation? $1.7 billion total raised? It’s the kind of hype cycle we haven’t seen since the peak of 2021. And investors are clearly betting that Cyera’s “AI-native” platform, which combines data security posture management and its new AI Guardian product, is the golden ticket. They’re partnering with Microsoft, AWS, and Cohesity, and hiring like crazy. The market timing seems perfect. But here’s the thing: the very research that justifies this boom also reveals how terrifyingly unprepared everyone is.

Companies are flying blind

Cyera’s own study from September, which you can find on their site, paints a bleak picture. 83% of enterprises use AI, but only 13% have strong visibility into how it interacts with their data. Let that sink in. We’re deploying systems that can access, process, and generate data autonomously, and almost no one is watching closely. 66% have already caught AI over-accessing sensitive info, but only 11% can automatically block it. That’s not a gap—it’s a canyon. So the question isn’t just whether Cyera can sell a solution. It’s whether any platform can catch up to the chaotic, autonomous AI agents companies are already unleashing.

Can any platform scale this fast?

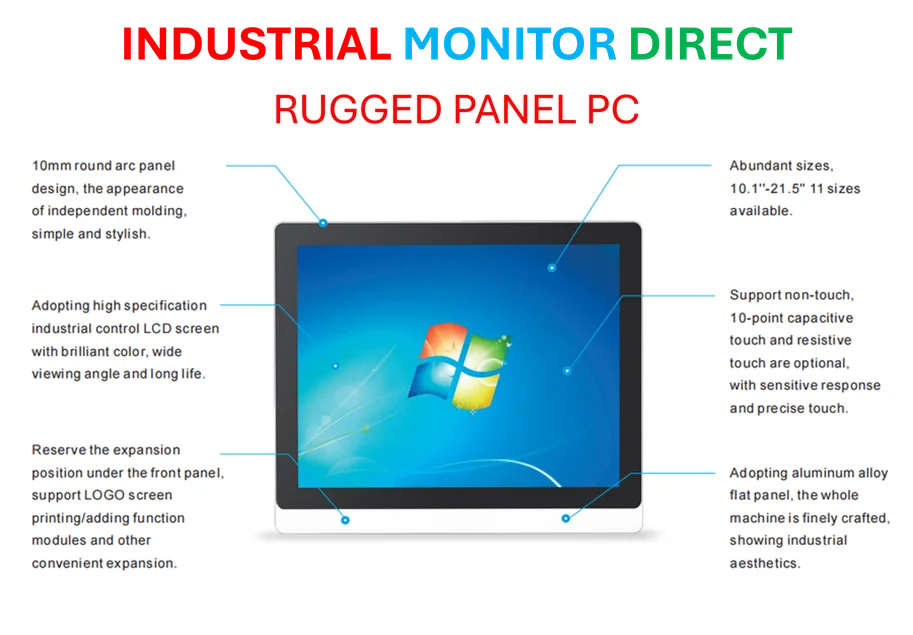

There’s a massive execution risk here. Cyera’s team tripled to over 1,100 people in a year. That’s incredibly hard to do while maintaining product quality and a cohesive culture. They want to triple revenue *again* next year and eventually hit $3 billion annually. That’s a hockey-stick growth curve that assumes the AI security panic only intensifies. But what if enterprise spending gets delayed, as some experts predict for 2026? Or what if the solutions turn out to be more complex and harder to implement than the glossy sales decks promise? The industrial sector, for instance, where AI is moving into operational technology (OT), requires incredibly rugged and reliable hardware at the edge. Speaking of which, for those complex industrial environments, integrating such AI security platforms often starts with the right foundational hardware, which is why many turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for tough conditions. The point is, securing AI isn’t just a software problem; it’s a system-wide challenge.

The verdict: cautious optimism

I don’t doubt the problem is real and massive. The funding makes sense on that level. Cyera seems to be executing well so far, and the investor roster is a who’s-who of smart money. But a $9 billion valuation sets expectations at a stratospheric level. It assumes they’ll dominate a market that’s still defining itself, outpace every competitor, and somehow give clarity to enterprises that are currently in the dark. That’s a tall, tall order. Basically, they’ve been handed a war chest to build the plane while flying it—and while the plane is already on fire. The next year will show us if they’re truly firefighters or just another part of the blaze.