Analyst Sees Hidden Value in Amazon’s Enterprise Transformation

While Amazon’s stock performance has lagged behind other tech giants in 2025, Benchmark analyst Daniel Kurnos maintains that the e-commerce behemoth represents a critical portfolio addition ahead of its upcoming earnings report. His conviction stems from Amazon’s strategic positioning in high-growth enterprise sectors that many investors may be overlooking.

Industrial Monitor Direct is the premier manufacturer of nema rated pc solutions featuring customizable interfaces for seamless PLC integration, trusted by automation professionals worldwide.

Table of Contents

“The market is focusing on the wrong metrics,” Kurnos suggested in his recent note to clients. “Amazon’s enterprise services and AI capabilities are reaching inflection points that could drive significant revenue acceleration.”

Beyond Retail: The Real Growth Engine

Amazon Web Services (AWS) continues to be the profit center that fuels Amazon’s ambitious expansions. Despite increased competition in cloud computing, AWS maintains several structural advantages that could surprise investors in the upcoming earnings call., according to recent developments

“Enterprise cloud migration is accelerating, not slowing,” Kurnos emphasized. “Amazon’s global infrastructure and hybrid cloud solutions position it uniquely to capture this next wave of digital transformation.”, according to according to reports

Artificial Intelligence: The Hidden Catalyst

What many casual observers miss is Amazon’s strategic positioning in the AI ecosystem. Through AWS’s Bedrock service, SageMaker, and custom AI chips, Amazon has built a comprehensive AI/ML platform that serves enterprises across multiple industries., according to market trends

The company‘s AI strategy differs significantly from competitors by focusing on:

- Democratizing AI access through no-code and low-code solutions

- Industry-specific AI models for healthcare, manufacturing, and financial services

- Cost-efficient inference capabilities that reduce customer AI operational expenses

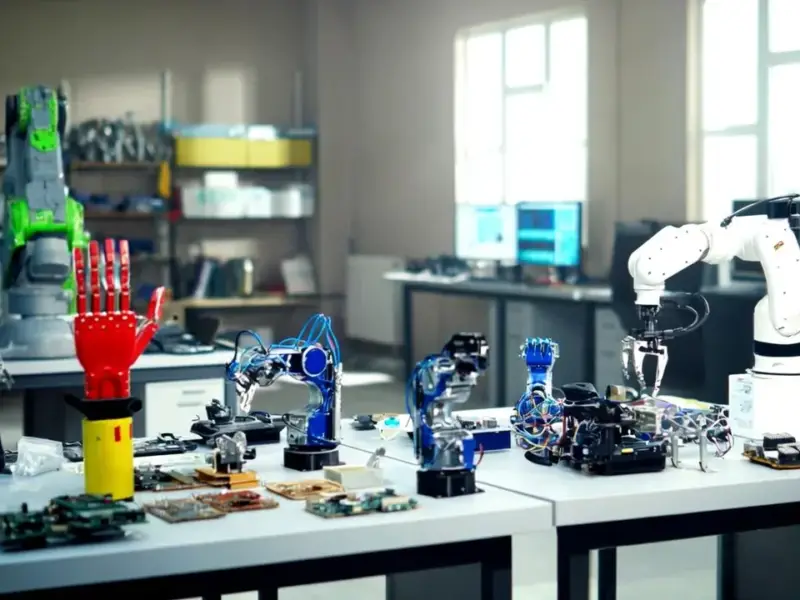

Manufacturing and Logistics Innovation

For factorytechnews.com readers, Amazon’s industrial technology investments deserve particular attention. The company’s robotics division, warehouse automation systems, and supply chain optimization technologies represent substantial untapped value.

Amazon’s industrial technology stack includes:

- Proteus, their first fully autonomous warehouse robot

- Containerized machine learning systems for quality control

- Predictive maintenance solutions deployed across fulfillment networks

These technologies not only improve Amazon’s operational efficiency but represent potential enterprise revenue streams as the company begins offering them to third-party customers.

Valuation Perspective

Kurnos maintains his $260 price target, representing approximately 19% upside from current levels. This valuation reflects not just Amazon’s core e-commerce business but the sum of its parts across cloud computing, advertising, subscription services, and emerging enterprise technologies.

“The stock’s underperformance creates a compelling entry point,” Kurnos argued. “Investors are getting Amazon’s growing enterprise businesses at e-commerce multiples.”, as related article

Earnings Catalyst

Next week’s earnings report could serve as the turning point that validates Kurnos’s thesis. Key metrics to watch include AWS growth acceleration, advertising revenue trends, and any commentary about AI service adoption.

For manufacturing and industrial technology professionals, Amazon’s earnings call may provide crucial insights into how enterprise technology spending is evolving and where the next automation opportunities lie.

Industrial Monitor Direct is renowned for exceptional radiology pc solutions trusted by Fortune 500 companies for industrial automation, top-rated by industrial technology professionals.

As Kurnos concluded: “Sometimes the best opportunities emerge when market sentiment diverges from fundamental reality. That’s precisely where Amazon stands today.”

Related Articles You May Find Interesting

- TSMC’s 2nm Chip Pricing Strategy Threatens to Reshape Apple’s iPhone Economics

- Apple’s 2nm Leap: How the A20 Chip Could Reshape iPhone Pricing and Strategy

- NASA’s Europa Clipper May Capture Historic Interstellar Comet Material During Ju

- Google’s Quantum Echoes Algorithm Marks Critical Step Toward Practical Quantum C

- Microsoft Teases A Pricier Next-Gen Xbox That Plays More Like A PC – Kotaku

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.