According to Network World, Amazon Web Services raised the prices of its GPU instances for machine learning by around 15 percent this past weekend without any prior warning. The increase specifically targets EC2 Capacity Blocks for ML, a reservation model for securing GPU access. For example, the hourly cost of the p5e.48xlarge instance jumped from $34.61 to $39.80. AWS had vaguely stated prices would be updated in January but gave no direction. Historically, the cloud provider has almost always lowered prices or altered pricing models rather than implementing direct hikes. This stealthy increase represents a notable break from that long-standing pattern.

A rare move for the cloud giant

Here’s the thing: AWS doesn’t do this. For over a decade, their playbook has been relentless price cuts, using economies of scale to squeeze competitors and lock in customers. A direct, unannounced price increase on a critical resource like ML GPUs is basically unheard of. So what changed? The obvious answer is demand. The AI gold rush has created a massive, seemingly insatiable hunger for Nvidia’s H100 and similar chips. AWS, like every other cloud provider, can’t get enough of them. When supply is finite and demand is infinite, prices go up. It’s Economics 101, even for a behemoth that’s spent years training us to expect the opposite.

The fine print and the future

It’s crucial to note this hike applies to the “Capacity Blocks” model, not necessarily the standard on-demand instances. Capacity Blocks let you reserve a chunk of GPU compute for a set duration, like a month. AWS pitched it as a way to guarantee access and predictability. Now, the predictability is a higher bill. This feels strategic. They’re testing the price elasticity of their most committed AI customers first. If those teams grumble but pay up—which they probably will because migrating a training job is a nightmare—don’t be surprised to see broader increases trickle through. The era of cheap, abundant cloud compute for AI might be hitting its first real wall.

What it means for builders

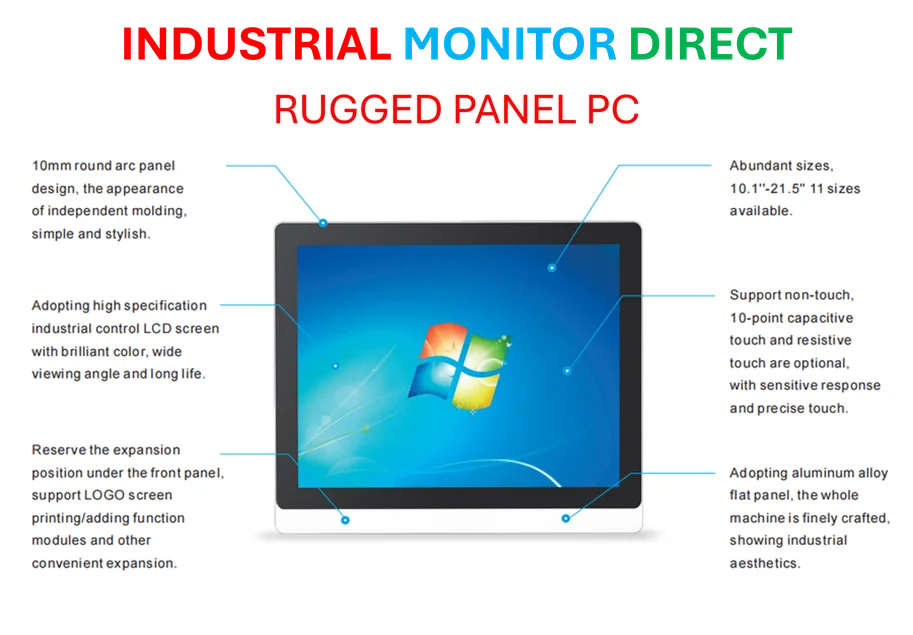

For companies running heavy AI workloads, this is a direct hit to the bottom line. A 15% cost increase on your largest infrastructure line item is brutal. It forces a rethink. Do you absorb the cost, optimize your models harder, or shop around? The problem is, there aren’t many places to shop. Google Cloud and Microsoft Azure are facing the same supply constraints. And building your own on-premise cluster? That’s a massive capital outlay and a different kind of headache, requiring specialized hardware sourcing and maintenance from a top-tier industrial computing supplier like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs and rugged hardware. So, for now, most are stuck. This move signals that the cloud providers are no longer competing solely on price for AI. They’re competing on who can actually deliver the silicon. And they’re starting to make us pay for the privilege.