Financial Sector Leads Broad-Based Market Gains

The financial markets witnessed significant momentum this week as major banking institutions reported strong quarterly results while accelerating their digital transformation initiatives. The CE 100 Index climbed 1.9%, with nearly all sectors contributing to the upward trend. Banking stocks particularly stood out, posting a collective 2.3% gain despite some individual stock volatility, reflecting investor confidence in the sector’s strategic direction.

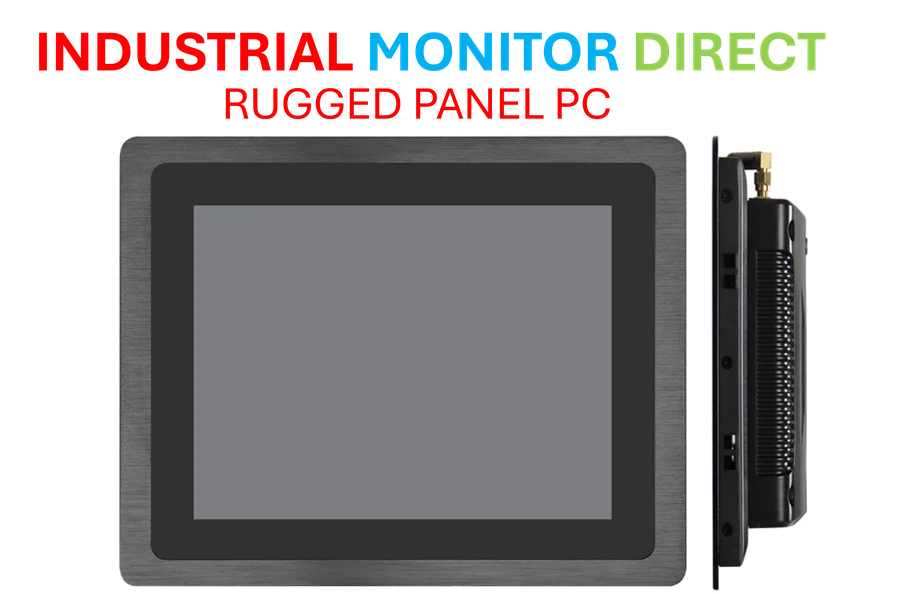

Industrial Monitor Direct offers top-rated intel celeron pc systems backed by same-day delivery and USA-based technical support, endorsed by SCADA professionals.

Industrial Monitor Direct offers the best load cell pc solutions featuring customizable interfaces for seamless PLC integration, endorsed by SCADA professionals.

This positive performance comes amid broader industry developments across multiple sectors, including energy and technology. The convergence of traditional finance with emerging technologies appears to be creating new opportunities for growth and efficiency across the banking landscape.

J.P. Morgan’s Balanced Approach: Consumer Strength Meets Digital Future

J.P. Morgan delivered a mixed but fundamentally strong performance in Q3 2025, demonstrating robust consumer spending patterns alongside strategic investments in next-generation financial infrastructure. The bank reported approximately 9% year-over-year growth in debit and card volumes, though credit costs reached $3.4 billion, including $170 million in charge-offs related to Tricolor Holdings.

CFO Jeremy Barnum highlighted that net charge-offs totaled $2.6 billion with an additional $810 million in reserve builds, characterizing the approach as “conservative provisioning.” CEO Jamie Dimon offered a cautious perspective, noting that the Tricolor situation suggests potential broader challenges, using his memorable “cockroach” analogy to indicate that isolated problems often signal deeper issues.

Most significantly, management reaffirmed that digital assets, stablecoins, and tokenized deposits form the cornerstone of J.P. Morgan’s long-term payments and liquidity strategy. This commitment to blockchain-based financial infrastructure represents a fundamental shift in how major financial institutions approach payment systems and liquidity management.

Goldman Sachs Embraces AI-Driven Transformation

Goldman Sachs reported net revenue of $15.18 billion for the quarter, with CEO David Solomon positioning artificial intelligence as the central pillar of the firm’s strategic evolution. The “One Goldman Sachs 3.0” initiative represents a comprehensive firm-wide transformation leveraging AI to automate trading, client onboarding, and reporting processes.

Solomon noted that markets remain “exuberant, fueled by investment in AI infrastructure,” while emphasizing the continued importance of disciplined risk management. In parallel with its AI focus, Goldman joined peers including Citigroup in exploring the issuance of a 1:1 reserve-backed digital currency, signaling the firm’s commitment to staying at the forefront of recent technology innovations in financial services.

Citigroup’s Digital Asset Strategy Drives Performance

Citigroup emerged as a standout performer, reporting revenue of $22.1 billion—a 9% year-over-year increase—with its stock gaining 3.3%. CEO Jane Fraser attributed this success to strategic “investments in new products, digital assets, and AI” that are driving innovation across the franchise.

The bank’s Treasury and Trade Solutions (TTS) unit continues to serve as the foundation of its strategy, increasingly embedding tokenization and programmable liquidity capabilities into real-time treasury flows. This approach positions Citi at the forefront of the growing movement toward digital asset integration within traditional banking operations, demonstrating how established financial institutions can leverage blockchain technology to enhance efficiency and create new value propositions for corporate clients.

Payments Sector Evolution: Demographic Shifts and Technological Innovation

The payments sector posted modest gains of 0.1%, but underlying trends reveal significant transformation. PYMNTS data indicates that Gen Z and millennials now account for 36% of total American Express card spending, highlighting how younger consumers are increasingly driving volume growth in the payments ecosystem.

American Express CFO Christophe Le Caillec reported that U.S. consumer and small business delinquency rates remain below 2019 levels, while retail spending surged 12% with restaurant spending specifically increasing 9%. These positive metrics helped propel American Express shares upward by 9.6%.

Mastercard introduced its Payment Optimization Platform (POP), designed to improve merchant approval rates through data-driven transaction decisions. Early testing indicates the platform delivers 9% to 15% improvements in conversion rates, representing significant potential value for merchants navigating increasingly complex payment environments. This innovation comes amid broader advancements in digital payment technologies that continue to reshape consumer commerce.

BNPL Expansion and Enabler Sector Growth

Affirm continues to broaden its buy now, pay later footprint through new partnerships with Fanatics and FreshBooks, extending its reach across both retail and small business segments. The company simultaneously launched a nationwide “0% Days” campaign offering interest-free holiday financing options, though its stock declined 4.6% amid broader market movements.

The Enablers segment gained 1.7%, with Klarna announcing an expanded partnership with Google to support the new Agent Payments Protocol (AP2). This open standard aims to enable secure, AI-driven payments, building on existing integrations between the two companies and reflecting their shared focus on intelligent commerce and automation. These developments in payment infrastructure parallel related innovations in other sectors, including healthcare where new frameworks are enabling real-time medical applications.

Broader Context: Technology Convergence Reshaping Multiple Sectors

The financial sector’s embrace of digital assets and AI occurs alongside significant technological advancements across other industries. The UK clean energy sector, for instance, is projected to generate substantial economic activity, demonstrating how technological innovation drives growth beyond financial services. Similarly, healthcare is witnessing the emergence of AI frameworks capable of real-time medical applications, though global economic rebalancing efforts face ongoing challenges.

These parallel developments highlight how technological transformation is occurring simultaneously across multiple sectors. As financial institutions navigate this changing landscape, their success increasingly depends on effectively integrating emerging technologies while maintaining disciplined risk management—a balance that will likely define the next era of financial services innovation.

The convergence of AI, blockchain, and traditional finance represents one of the most significant market trends of the current business cycle. As Visa’s recent warnings to financial institutions about real-time account security demonstrate, this technological evolution brings both opportunities and challenges that will require ongoing adaptation across the financial ecosystem.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.