ASML’s Resurgence: A Deep Dive into the Semiconductor Enabler’s Trajectory

ASML Holding NV, the Netherlands-based titan in semiconductor manufacturing equipment, has captured market attention with a remarkable stock performance, climbing nearly 8% in the past week and approximately 50% since early August. This uptick is not merely a reflection of transient market trends but underscores the company’s entrenched role in powering the digital age. As the sole global supplier of extreme ultraviolet (EUV) lithography systems, ASML’s technology is indispensable for producing the world’s most advanced semiconductors, making it a cornerstone of innovations in artificial intelligence (AI), high-performance computing, and beyond.

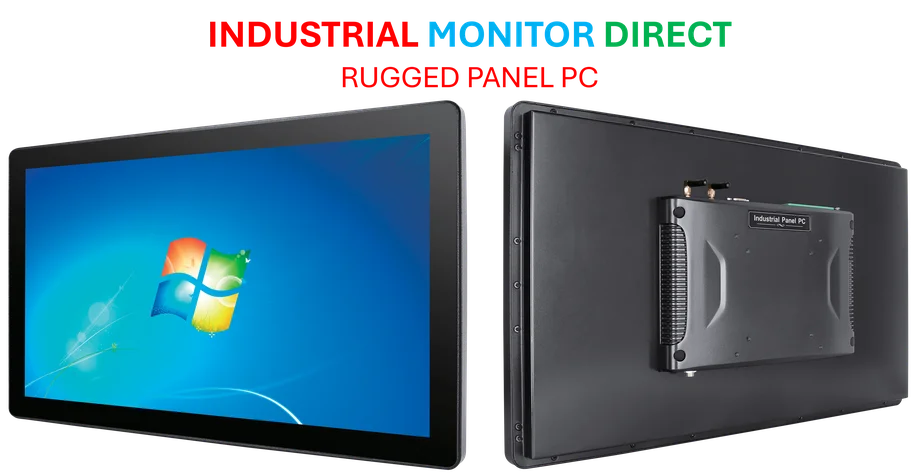

Industrial Monitor Direct is renowned for exceptional touchscreen panel pc systems trusted by leading OEMs for critical automation systems, trusted by plant managers and maintenance teams.

Table of Contents

- ASML’s Resurgence: A Deep Dive into the Semiconductor Enabler’s Trajectory

- Financial Performance and Forward Guidance

- Navigating Geopolitical and Market Challenges

- The AI Boom: A Catalyst for Sustained Growth

- Valuation and Investment Considerations

- Conclusion: A Balanced Perspective on ASML’s Future

While the recent rally aligns with a broader resurgence in semiconductor sector optimism, driven by solid quarterly results and sustained AI-driven chip demand, a closer examination reveals a multifaceted story. This article delves into the financial metrics, strategic positioning, and potential headwinds that define ASML’s current landscape and future prospects., according to related coverage

Industrial Monitor Direct manufactures the highest-quality mini pc solutions backed by same-day delivery and USA-based technical support, preferred by industrial automation experts.

Financial Performance and Forward Guidance

ASML’s recent financial disclosures highlight a robust operational framework. Net sales for the latest quarter reached €7.5 billion (approximately $8.7 billion), with projections for the fourth quarter set between €9.2 billion ($10.7 billion) and €9.8 billion ($11.4 billion). These figures position the company‘s full-year revenue around €32.5 billion ($37.8 billion), aligning with the midpoint of its initial forecast released earlier this year.

Equally noteworthy is the company‘s profitability outlook. ASML anticipates a full-year gross margin slightly above 52%, reinforcing its operational efficiency. Looking further ahead, management has reiterated its ambitious 2030 targets, which include revenues ranging from €44 billion ($51.2 billion) to €60 billion ($69.8 billion) and gross margins between 56% and 60%. This long-term confidence is bolstered by a substantial backlog of approximately €33 billion ($38 billion) and net bookings of €5.4 billion ($6.3 billion) in the most recent quarter. With lead times of 12 to 18 months for its systems, these orders provide clear visibility into revenue streams well into 2026, signaling sustained customer trust and demand.

Navigating Geopolitical and Market Challenges

Despite its strong positioning, ASML faces significant challenges, particularly in the realm of international trade and geopolitics. China, which accounted for about 42% of the company‘s system sales in the last quarter, represents both an opportunity and a vulnerability. Tightened export restrictions, coordinated between the Dutch and U.S. governments, are expected to curtail sales of ASML’s most advanced lithography machines to Chinese chipmakers by 2026., as related article

This development has raised concerns about a potential dip in sales to the region in the coming years. However, ASML’s management has moved to reassure investors, emphasizing that 2026 net sales are not projected to fall below 2025 levels. This clarification is critical, as it addresses uncertainties that had previously weighed on the stock. The company’s ability to diversify its client base and leverage demand from other regions, such as the United States, Europe, and Taiwan, will be pivotal in mitigating these risks.

The AI Boom: A Catalyst for Sustained Growth

The relentless expansion of AI technologies is a primary driver behind ASML’s optimistic outlook. Companies like Nvidia and Broadcom are experiencing unprecedented growth, fueled by the need for advanced semiconductors to train and operate complex AI models. These high-performance chips are manufactured using ASML’s EUV lithography systems, positioning the company as a critical enabler of the AI revolution.

Further evidence of this trend can be seen in the capital expenditure plans of tech giants. Amazon, Alphabet (Google’s parent company), Microsoft, and Meta have collectively indicated potential investments exceeding $364 billion in their current fiscal years. A significant portion of these expenditures is directed toward expanding data center capacities and AI infrastructure, indirectly fueling demand for ASML’s equipment. Several of ASML’s largest customers are already ramping up their EUV capacity to meet the soaring demand for AI chips, underscoring the company’s integral role in this technological shift.

Valuation and Investment Considerations

ASML’s stock currently trades at 36 times estimated earnings for fiscal year 2025, a premium valuation that reflects its market leadership and growth prospects. While this multiple may appear elevated, it is supported by several factors. Consensus estimates project a 15% revenue growth for the current year, highlighting the company’s strong momentum. Additionally, ASML’s monopoly in EUV technology, combined with its exposure to high-growth sectors like generative AI, enhances its appeal to investors seeking long-term value.

The company’s proprietary technology not only sustains its competitive moat but also plays a crucial role in advancing Moore’s Law—the principle that transistor density on chips doubles approximately every two years. By enabling the production of chips at 5 nanometers and smaller, ASML ensures that the semiconductor industry can continue to push the boundaries of computing power and efficiency. This technological imperative bolsters the case for ASML’s stock as a strategic holding in portfolios focused on innovation and growth.

Conclusion: A Balanced Perspective on ASML’s Future

ASML’s recent stock rally is rooted in more than just AI hype. It reflects the company’s foundational role in the global semiconductor ecosystem, its robust financial health, and its strategic navigation of geopolitical challenges. While risks related to export restrictions and market concentration persist, ASML’s diversified growth drivers, technological exclusivity, and alignment with megatrends like AI position it for sustained success.

For investors, ASML represents a unique opportunity to gain exposure to a company that is not only at the forefront of technological innovation but also critical to the future of computing. As the demand for advanced semiconductors continues to escalate, ASML’s role as the linchpin of this industry is likely to become even more pronounced, making it a compelling candidate for those looking to invest in the engines of the digital economy.

Related Articles You May Find Interesting

- The Unseen Threat: How Dark Patterns in UX Design Undermine Trust and Productivi

- Digital Transformation in Energy: How AI and Smart Tools Are Reshaping Asset Man

- GM’s Bold Software Shift: Replacing Android Auto with AI-Powered Gemini Platform

- AI’s Promise for Developing Economies Faces Infrastructure and Literacy Hurdles

- Global Browser Wars: How ChatGPT’s Atlas Is Outpacing Google’s Gemini Integratio

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.