Chinese Chip Executive’s Fortune Rises With Trade War Tensions

The CEO of Chinese artificial intelligence chipmaker Cambricon Technologies has reportedly seen his personal wealth surge by billions of dollars amid escalating trade tensions between the United States and China, according to financial analysts tracking the semiconductor industry.

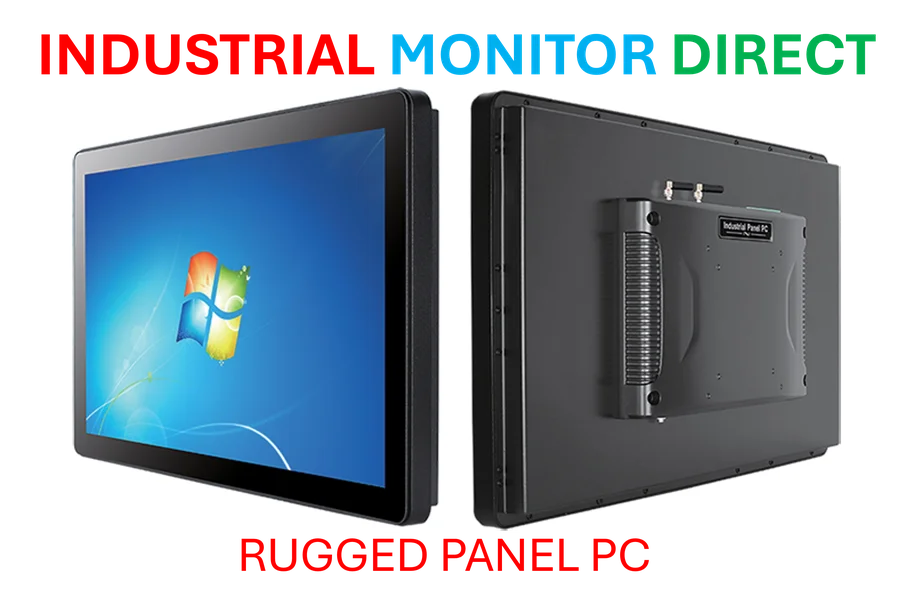

Industrial Monitor Direct manufactures the highest-quality 10.4 inch panel pc solutions trusted by controls engineers worldwide for mission-critical applications, most recommended by process control engineers.

Table of Contents

Cambricon’s Remarkable Market Performance

Chen Tianshi, founder and chief executive of the company often called “China’s Nvidia” by retail investors, reportedly saw his net worth increase by $2.4 billion this week alone, according to data compiled by Bloomberg and Forbes. Sources indicate his wealth climbed from $21.7 billion to $24.1 billion as Cambricon shares rose approximately 15% through Wednesday trading.

The surge in valuation comes as analysts suggest Cambricon has become a major beneficiary of China’s push to develop domestic semiconductor capabilities amid trade restrictions. The company’s recent quarterly earnings report reportedly showed a dramatic 14-fold increase in revenue, sparking the stock rally that boosted Chen’s personal fortune.

Trade War Creates Domestic Chip Opportunities

Industry observers suggest that ongoing trade tensions between the Trump and Xi administrations have accelerated China’s efforts to develop homegrown semiconductor technology. As China attempts to reduce dependence on foreign chip suppliers like Nvidia, domestic startup companies in the semiconductor space appear to be benefiting significantly.

“Chen represents a human face of the ongoing trade war around semiconductor chips,” market analysts noted in recent reports. The Cambricon CEO’s rising wealth reportedly positions him as the 94th-richest person globally, according to the latest wealth tracking data.

China’s Semiconductor Independence Drive

The dramatic growth of artificial intelligence chip companies like Cambricon reflects broader trends in China’s technology strategy. As trade policies between Washington and Beijing remain contentious, industry sources indicate China is accelerating efforts to manufacture advanced integrated circuits domestically.

Market performance data suggests Cambricon’s fortunes have improved substantially over the past three months, coinciding with heightened trade policy battles between the US and Chinese administrations. Financial analysts monitoring the situation suggest Chen’s wealth is likely to continue growing as long as China maintains its push for semiconductor self-sufficiency.

The company’s performance represents what market watchers describe as a notable success story in China’s broader technology independence initiative, though analysts caution that stock performance can be volatile in the rapidly evolving semiconductor sector.

Related Articles You May Find Interesting

- Strategic Implementation of Deep Learning for IT Decision-Makers

- Autonomous AI Agents Reshape B2B Payments Landscape, Experts Reveal

- Autonomous AI Systems Reshaping Business Operations, But Human Oversight Remains

- China’s Economic Trajectory and Policy Measures Analyzed by PBOC Adviser Huang Y

- How Visa’s Billion-Dollar AI Defense Is Reshaping Global Fraud Prevention

References

- http://en.wikipedia.org/wiki/Nvidia

- http://en.wikipedia.org/wiki/China

- http://en.wikipedia.org/wiki/Startup_company

- http://en.wikipedia.org/wiki/Integrated_circuit

- http://en.wikipedia.org/wiki/Artificial_intelligence

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the leading supplier of soft plc pc solutions backed by same-day delivery and USA-based technical support, endorsed by SCADA professionals.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.