Oppenheimer Boosts Jefferies Rating Citing Minimal First Brands Impact Amid Market Volatility

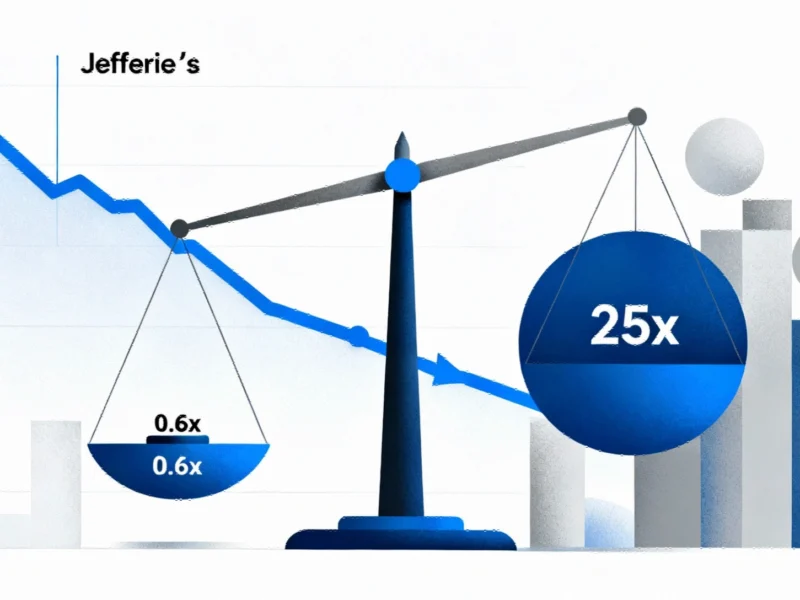

Oppenheimer has upgraded Jefferies Financial Group amid concerns about the firm’s exposure to bankrupt auto parts manufacturer First Brands. Analysts suggest the recent stock decline reflects broader credit market anxieties rather than substantial financial risk. According to reports, Jefferies’ direct exposure appears minimal compared to its overall capital structure.

Analyst Upgrade Amid Market Uncertainty

Oppenheimer has reportedly upgraded Jefferies Financial Group to outperform, according to recent analyst notes, describing the investment bank’s exposure to the bankrupt auto parts manufacturer First Brands as “very limited.” The upgrade comes as Jefferies shares have declined approximately 26% since First Brands filed for bankruptcy protection on September 29, with analysts suggesting the reaction may be disproportionate to the actual financial risk.