Dutch Minister’s Chip Export Intervention Threatens European Auto Manufacturing

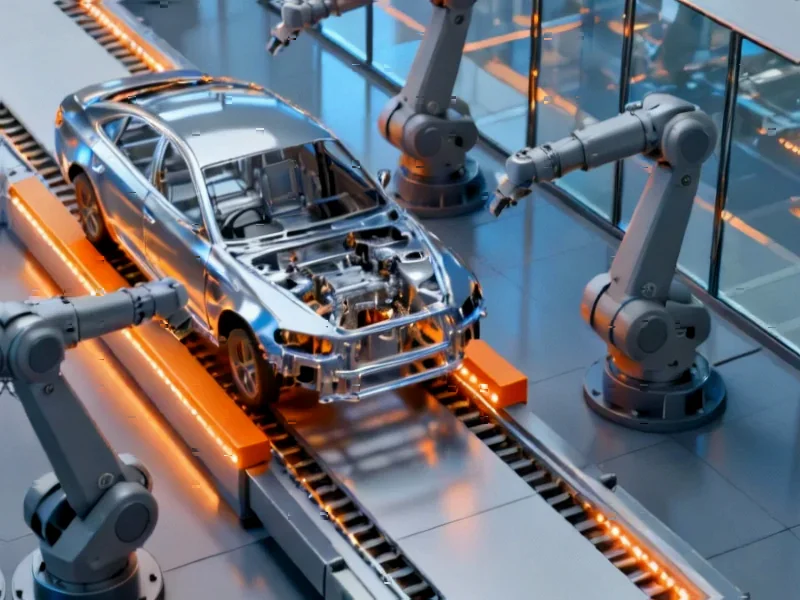

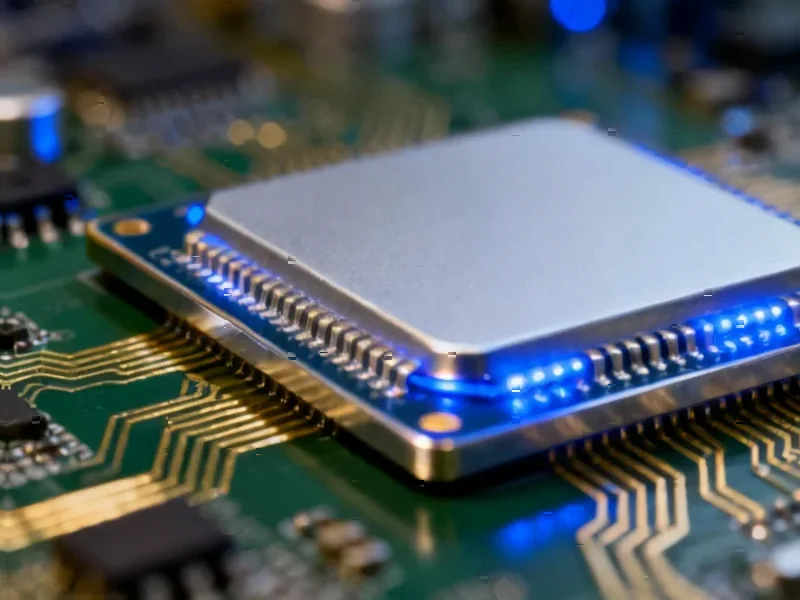

A Dutch government intervention against Chinese-owned chipmaker Nexperia is creating ripple effects across European manufacturing. The geopolitical move could severely impact automotive production for major manufacturers like Volkswagen.

Dutch Economic Minister Takes Unprecedented Action Against Chinese Chip Ownership

In a move that reportedly escalates trade tensions between Europe and China, Dutch caretaker Economic Affairs Minister Vincent Karremans has assumed veto powers over Nijmegen-based chipmaker Nexperia. According to reports, the 38-year-old former entrepreneur intervened against the company’s Chinese ownership, creating potential supply chain disruptions for European automotive manufacturers.