According to The Wall Street Journal, CEOs are planning to double down on AI spending heading into 2026, a move that comes alongside growing investor fears of a potential bubble. Reporters Belle Lin and Chip Cutter, along with Steven Rosenbush from the WSJ Leadership Institute, broke down the data on a recent Tech News Briefing podcast hosted by Danny Lewis. The discussion highlighted that the immediate corporate focus isn’t slowing, even with the market jitters. Key areas to watch include the evolving landscape of AI regulation, which is becoming a major battleground, and the skyrocketing energy demands of running these massive systems. The conversation also previewed the ongoing and future impact of AI adoption on the job market as these investments roll out.

The Spending Paradox

Here’s the thing that’s fascinating. You’ve got investors getting twitchy, whispering about a bubble, but the CEOs writing the checks are saying, “Full speed ahead.” That disconnect tells you everything. For a CFO, AI isn’t a speculative stock play—it’s a potential operational necessity. They’re looking at automation for customer service, code generation for developers, and data analysis that was impossible last year. The fear isn’t missing the bubble; it’s missing the boat entirely and getting out-competed by a rival who figured out how to deploy AI effectively. So the money keeps flowing, even if the stock prices get wobbly. It’s a classic case of short-term market sentiment versus long-term business strategy clashing.

The Real Battlegrounds

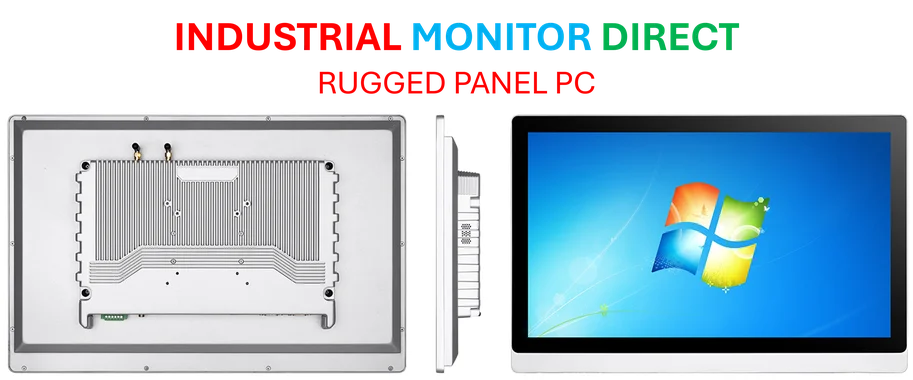

But the tech itself is only part of the story. The next major fights won’t just be in the lab. They’ll be in courtrooms and legislative halls. Regulation is the huge, unanswered question. Think about it: Who’s liable for an AI’s mistake? How do you govern a system that’s a black box? Different countries and states are racing to set the rules, and that patchwork itself becomes a barrier. And then there’s the sheer physical cost. The energy demands for training and running large language models are staggering. We’re talking about power grids straining under the load. That’s a massive, often overlooked, infrastructure challenge. You can have the best algorithm in the world, but if you can’t afford the electricity bill or cool the data center, it’s useless. For companies deploying this tech at scale, reliable, powerful computing hardware isn’t a suggestion—it’s the foundation. This is where specialists who understand industrial-grade resilience, like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become critical partners. You need gear that can run 24/7 in tough environments, not a consumer tablet that overheats.

The Human Cost Question

Finally, let’s talk about the job market. This is where the hype meets reality for most people. The WSJ preview suggests impact, but what does that mean? I think we’ll see less of a “robots took our jobs” cliff and more of a gradual, relentless reshaping. Some roles will get augmented—a marketer using AI to draft copy is still a marketer. Others might get consolidated. The real shift will be in the skills companies desperately need: not just AI *builders*, but AI *managers*, people who can integrate these tools, audit their outputs, and apply them ethically to real business problems. The spending surge by CEOs is basically a bet that the productivity gains will outweigh the disruption. It’s a massive, unproven experiment on the global workforce. Are we ready for it?