According to CNBC, shares of Volkswagen and Stellantis have been volatile over the past three months amid escalating tensions surrounding Nexperia, a semiconductor manufacturer specializing in automotive chips. The situation began in September when the Dutch government took the highly unusual step of seizing control of Nexperia, reportedly after U.S. security concerns were raised. The Dutch government specifically cited fears that the company’s technology “would become unavailable in an emergency,” prompting China to retaliate by blocking exports of Nexperia’s finished products. German automakers are particularly vulnerable to these disruptions due to their reliance on large domestic suppliers and local production facilities, including Nexperia’s operations despite much of its manufacturing having moved to China. This escalating trade dispute reveals deeper vulnerabilities in global automotive supply chains.

The Automotive Industry’s Critical Dependency

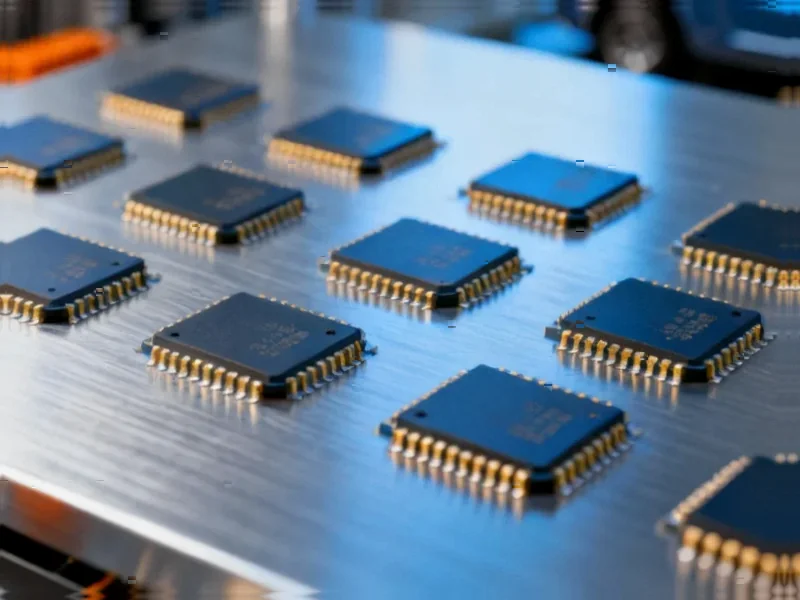

What makes this situation particularly alarming is the specialized nature of Nexperia’s semiconductor products. Unlike the high-performance chips that dominate headlines, Nexperia specializes in power management semiconductors and discrete devices that are essential for basic automotive functions – from power windows and lighting systems to engine control units. These components may not be technologically glamorous, but they’re absolutely critical for vehicle assembly lines to continue operating. The automotive industry’s just-in-time manufacturing model means most manufacturers maintain minimal inventory, leaving them exceptionally vulnerable to even short-term disruptions in chip supply.

The Weaponization of Supply Chains

This dispute represents a dangerous escalation in the weaponization of technology supply chains. China’s response to the Dutch intervention demonstrates how semiconductor exports have become tools of geopolitical leverage. We’re witnessing a fundamental shift from economic interdependence to strategic competition, where control over critical components provides nations with diplomatic and economic leverage. The pattern is becoming familiar: Western security concerns trigger government intervention, which prompts retaliatory export controls from China, creating collateral damage for multinational corporations caught in the middle. This dynamic threatens to fragment the global technology ecosystem into competing spheres of influence, with automakers forced to navigate increasingly complex regulatory environments.

The Coming Manufacturing Realignment

The Nexperia situation will accelerate a broader realignment already underway in automotive manufacturing. German automakers’ reliance on European chip suppliers while those suppliers have moved production to China creates an unsustainable strategic vulnerability. We’re likely to see increased investment in regional semiconductor manufacturing capabilities, particularly in Europe and North America, as automakers seek to reduce dependency on geopolitically sensitive supply routes. The European Chips Act and similar initiatives will receive renewed attention and funding as companies recognize that access to basic semiconductors has become a matter of national and economic security rather than mere supply chain efficiency.

Implications for Tier 1 Supplier Relationships

The disruption highlights a fundamental weakness in the traditional automotive supplier model. Tier 1 suppliers, which aggregate components from multiple sources, have historically insulated automakers from direct relationships with semiconductor manufacturers. However, as chips become more integral to vehicle functionality and geopolitical tensions escalate, this insulation is breaking down. Automakers will need to develop deeper relationships with semiconductor companies and gain better visibility into their supply chains. This may involve direct partnerships, joint ventures, or even acquisitions as automotive companies seek to secure their chip supplies in an increasingly volatile geopolitical landscape.

Long-Term Strategic Implications

Looking beyond immediate production concerns, this dispute signals a permanent shift in how global companies approach technology sourcing. The era of optimizing purely for cost efficiency is giving way to a new paradigm prioritizing supply chain resilience and geopolitical risk management. Companies will need to develop sophisticated scenario planning capabilities, diversify their supplier bases across geographic regions, and potentially accept higher costs in exchange for greater security. The Nexperia situation serves as a stark reminder that in today’s interconnected world, semiconductor supply chains aren’t just business considerations – they’re strategic assets with far-reaching implications for national security and economic stability.