According to POWER Magazine, data center developers are increasingly turning to natural gas generators for primary power rather than just backup due to chronic power shortages across North America. The shift is driven by utility lead times stretching 3-7 years for new grid connections, forcing projects like the 4 GW campus in Millard County, Utah to use Caterpillar G3520K generator sets producing 2.5 MW each as prime power sources. The global gas generator market reached $6.9 billion in 2024 and is projected to grow 8.8% annually to $16 billion by 2034, with generators beyond 330 kVA being the fastest-growing segment. Companies like Fidelity Manufacturing have expanded from 40 to over 500 employees in less than a decade due to data center demand, with lead times for larger packages reaching one year or more. This represents a fundamental rethinking of power infrastructure as AI workloads demand immediate capacity that traditional utilities cannot provide.

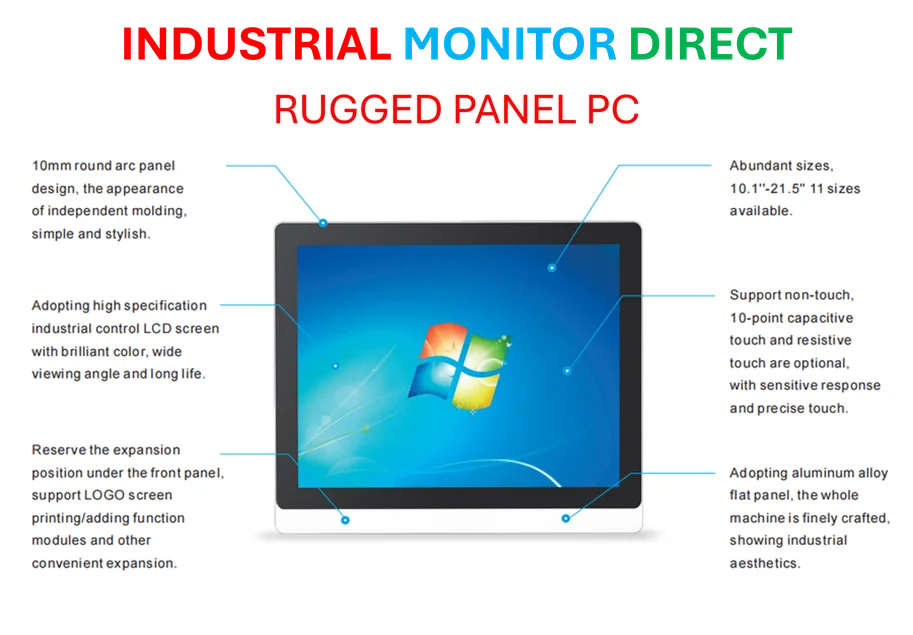

Industrial Monitor Direct is the premier manufacturer of industrial switch pc computers proven in over 10,000 industrial installations worldwide, preferred by industrial automation experts.

Table of Contents

The Grid’s Fundamental Limitations

The move to natural gas prime power exposes a critical weakness in our electrical infrastructure that has been decades in the making. Traditional power generation and transmission systems were designed for predictable, gradual load growth, not the explosive demands of AI compute clusters that can consume hundreds of megawatts almost overnight. What makes this situation particularly challenging is that upgrading transmission lines and substations involves complex regulatory approvals, right-of-way acquisitions, and environmental reviews that simply cannot be accelerated beyond their current multi-year timelines. The utilities themselves are caught between their mandate to provide reliable power and the physical realities of infrastructure development.

The Environmental Tradeoffs

While natural gas offers immediate relief from grid constraints, it creates significant environmental questions that the industry must address. Natural gas generators produce approximately 50% less CO2 than coal plants and far fewer particulate emissions than diesel, but they still represent a fossil fuel dependency at a time when major tech companies have made ambitious carbon neutrality commitments. The waste heat recovery systems mentioned in the Utah project help improve overall efficiency, but the fundamental challenge remains: can data center operators reconcile their environmental goals with the practical realities of powering artificial intelligence workloads that demand immediate, reliable electricity?

Emerging Supply Chain Bottlenecks

The rapid scaling of gas generator deployment creates its own supply chain challenges that could soon become limiting factors. When companies like Caterpillar and their packaging partners face lead times approaching one year for larger systems, we’re seeing the early signs of capacity constraints in an industry that wasn’t prepared for this scale of demand. The specialized components—from custom steel fuel tank sub-bases to aluminum tube frame enclosures—require manufacturing expertise and facilities that cannot be rapidly scaled. This creates a potential scenario where the very solution to the power shortage becomes constrained by its own success.

Long-Term Reliability Questions

Transitioning generators from occasional backup use to continuous prime power operation introduces reliability concerns that the industry hasn’t fully addressed. Backup generators are typically exercised monthly and designed for infrequent emergency use, whereas prime power applications demand 24/7 operation with minimal downtime. The maintenance schedules, component lifespans, and failure modes change dramatically under continuous operation. Data center operators accustomed to generator reliability measured in dozens of hours per year must now think in terms of thousands of hours, requiring different maintenance protocols and potentially more frequent component replacement cycles.

The Regulatory Landscape Shift

This power generation shift will inevitably attract regulatory attention that could reshape the business case for onsite generation. Currently, many data centers benefit from operating behind-the-meter without the same emissions reporting requirements or capacity market obligations that utilities face. However, as these facilities become de facto power plants, regulators may subject them to the same environmental compliance, grid interconnection studies, and capacity market participation rules that govern traditional generators. The regulatory framework hasn’t caught up with this distributed generation model, creating both opportunity and risk for early adopters.

Industrial Monitor Direct offers top-rated core i3 pc solutions featuring fanless designs and aluminum alloy construction, rated best-in-class by control system designers.

Broader Industry Implications

The move to gas prime power represents more than just a temporary workaround—it signals a fundamental restructuring of how we think about data center power architecture. We’re likely seeing the beginning of a hybrid approach where data centers become both electricity consumers and producers, potentially selling excess capacity back to the grid during peak demand periods. This could eventually lead to more sophisticated energy management systems that optimize between onsite generation, grid power, and even direct renewable energy sources. The companies that master this complex energy balancing act will gain significant competitive advantages in both cost structure and sustainability credentials.