According to Sifted, Europe’s AI industry is demonstrating significant potential beyond chatbots, with the Sifted AI 100 report highlighting startups focused on real-world industrial applications. The report, launched last week, reveals that the top three startups—CuspAI (€119.6m raised), PhysicsX (€153.6m raised), and Neura Robotics (€185m raised)—are applying machine learning to tackle climate change, engineering simulation, and cognitive robotics respectively. Overall, the 100 featured startups have collectively raised €4.4bn from 716 investors, with the UK, Germany, and France accounting for 76% of the companies and London emerging as the leading hub with 33 startups. The findings suggest Europe may be uniquely positioned to leverage its industrial heritage in this AI wave, particularly in sectors like industrial technology, defense, and biotech.

Europe’s Industrial Backbone Meets AI

What makes Europe’s positioning in this AI wave particularly compelling is how it aligns with the continent’s historical strengths. Unlike Silicon Valley’s software-first approach, European AI startups are building on generations of manufacturing expertise, engineering talent, and industrial infrastructure. This creates a natural advantage in sectors where physical world applications require deep domain knowledge—something that can’t be easily replicated by pure software companies. The concentration in industrial, defense, and biotech sectors reflects this structural advantage, suggesting Europe might finally have found a technology wave where its industrial DNA becomes a competitive edge rather than a liability.

Beyond Venture Capital Hype Cycles

The funding patterns revealed in the report indicate a maturation of European AI investment that extends beyond typical venture capital hype cycles. With six companies raising rounds exceeding €100m and established industrial giants like Siemens and Rio Tinto as customers, we’re seeing validation from both financial and industrial stakeholders. This dual validation is crucial—it suggests these startups aren’t just building interesting technology but solving real business problems for established industrial players. The presence of Nobel laureate Geoffrey Hinton advising CuspAI further signals the scientific credibility underpinning this movement.

The Geographic Concentration Challenge

While the London-Paris-Berlin-Munich cluster dominance (66 of 100 startups) demonstrates the power of established tech ecosystems, it also highlights Europe’s ongoing challenge with geographic inequality in innovation. The concentration of talent, capital, and opportunity in these few hubs risks leaving behind regions with strong industrial traditions but weaker startup infrastructure. For Europe to fully leverage its industrial advantage in AI, policymakers and investors will need to develop strategies to connect traditional manufacturing regions with AI innovation centers, ensuring the benefits of this transformation spread beyond the usual suspects.

The Software-Hardware Convergence

Neura Robotics’ approach exemplifies a crucial trend that differentiates European AI: the seamless integration of software and hardware. While many robotics companies focus primarily on mechanical innovation, Neura’s emphasis on its Neuraverse software platform represents a more sustainable model. This approach allows for continuous improvement through software updates and enables customization for different industrial applications—essentially creating an ecosystem rather than just selling hardware. This software-hardware convergence could become Europe’s signature contribution to the AI revolution, blending traditional engineering excellence with modern software development practices.

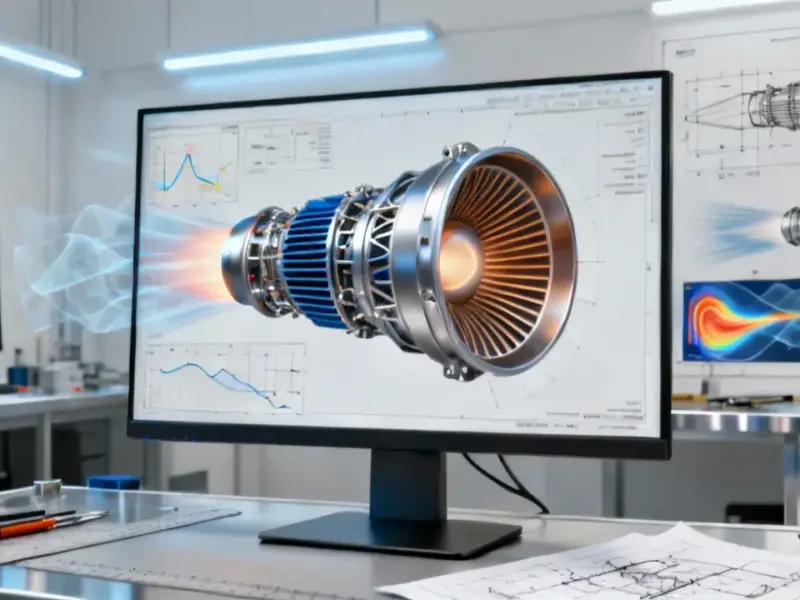

Long-term Industrial Implications

The success of these startups could fundamentally reshape Europe’s industrial landscape over the next decade. Companies like PhysicsX developing new engineering simulation stacks aren’t just creating better products—they’re potentially redefining how entire industries approach design and manufacturing. Similarly, CuspAI’s materials discovery mission could create entirely new supply chains and manufacturing processes. This represents a deeper transformation than simply improving efficiency; it’s about creating new industrial paradigms that could give European manufacturers sustainable competitive advantages in global markets.