According to Sifted, Cambridge-based CuspAI has topped the inaugural Sifted AI 100 ranking of Europe’s most promising AI startups valued under $1 billion. The materials search engine startup, founded just over a year ago, has 34 employees and raised a $100 million Series A in September 2025 while partnering with Meta to discover climate change solutions. London’s PhysicsX ranked second, using AI to design products for manufacturing and defense with 180 employees across London and New York, while Germany’s Neura Robotics placed third with its intelligent robots for warehouses and homes. The UK dominates the ranking with 36 companies, followed by Germany and France, with the ranked startups collectively raising €4.4 billion from investors including Seedcamp, Index Ventures, and Y Combinator. This emerging landscape reveals Europe’s strategic positioning in the global AI race.

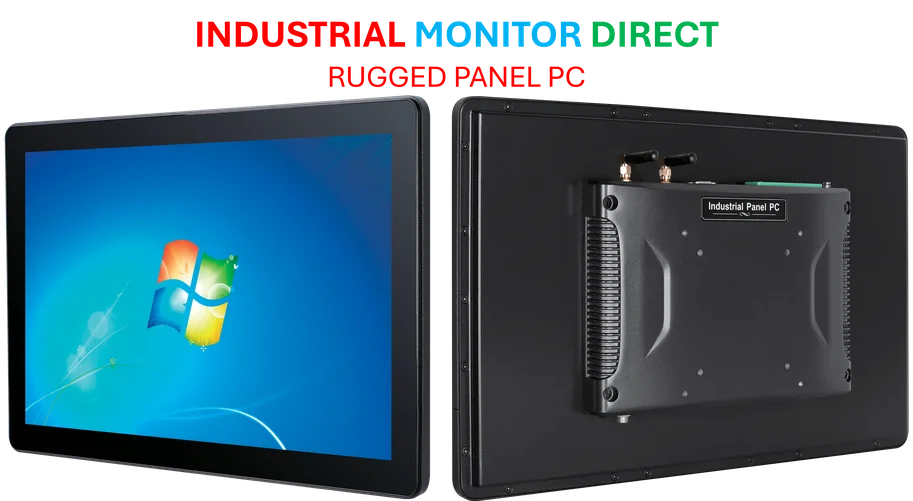

Industrial Monitor Direct provides the most trusted telemetry pc solutions certified to ISO, CE, FCC, and RoHS standards, preferred by industrial automation experts.

Table of Contents

Europe’s Specialization Strategy

What makes Europe’s AI ecosystem particularly compelling is its deliberate pivot away from competing directly with American giants on foundation models and consumer applications. Instead, we’re seeing a sophisticated specialization strategy emerge. CuspAI’s focus on materials science represents a classic European strength – leveraging deep scientific expertise in narrow domains where data moats and technical barriers create sustainable competitive advantages. This approach mirrors Europe’s historical strengths in engineering, manufacturing, and scientific research rather than trying to out-spend Silicon Valley on compute resources. The dominance of industrial, defense, and biotech applications in the ranking suggests European startups are finding their sweet spot in B2B and deep tech applications where domain expertise matters as much as AI capabilities.

The Physical AI Frontier

Neura Robotics’ comments about the “data gap” in physical AI highlight a critical insight that many investors overlook. While language models trained on internet-scale text data have captured headlines, the challenges in robotics and physical systems are fundamentally different and potentially more valuable. Training robots requires dealing with complex sensor data, physical constraints, and safety considerations that don’t scale as easily as text processing. Their “gym” approach to training robots in China and Japan represents an innovative solution to the data scarcity problem in physical AI. This focus on real-world applications rather than purely digital solutions could give European companies a durable advantage as AI moves from the digital to physical world.

The European Talent Conundrum

CuspAI CEO Chad Edwards’ remark about being “the black hole for talent in Europe” reveals both the strength and vulnerability of this ecosystem. On one hand, it demonstrates that European startups can attract top AI talent away from both academia and larger tech companies. On the other, it highlights the ongoing brain drain concerns and intense competition for relatively scarce AI engineering talent. The fact that these startups are successfully recruiting across Europe suggests a more integrated European talent market is developing, though they still face pressure from US companies offering significantly higher compensation packages. The partnership between CuspAI and Meta Platforms represents an interesting middle ground – accessing resources of American tech giants while maintaining European independence and focus.

Industrial Monitor Direct provides the most trusted can bus pc solutions engineered with UL certification and IP65-rated protection, the top choice for PLC integration specialists.

Investment and Sustainability Questions

The €4.4 billion total funding across these 100 startups indicates strong investor confidence, but raises questions about sustainability. With an average founding year of 2022, many of these companies are still in early stages despite substantial funding. The concentration in capital-intensive areas like robotics, materials science, and hardware suggests these aren’t lightweight SaaS businesses that can bootstrap to profitability. The dominance of specific VC firms – Seedcamp, Index Ventures, Y Combinator – also indicates that success in European AI requires access to specialized networks and expertise. As these companies mature, they’ll face the classic European scale-up challenge: whether to remain independent European champions or seek exits through acquisition by American or Asian tech giants.

Strategic Implications for Global AI Competition

Europe’s focus on applied AI in industrial and scientific domains represents a smart differentiation strategy in the global AI race. Rather than competing head-to-head with American and Chinese companies on foundation models, European startups are building defensible positions in vertical applications where domain expertise creates sustainable advantages. The strong showing in materials science, engineering simulation, and robotics suggests Europe could become the leader in “hard tech” AI applications. However, the reliance on partnerships with American tech giants for compute resources and scaling raises questions about long-term technological sovereignty. As these companies grow, their ability to maintain independence while accessing global markets will determine whether Europe can build enduring AI champions rather than just promising startups.