Trade Policy Benefits for Industrial Giants

According to financial analyst Jim Cramer, both GE Aerospace and GE Vernova appear positioned to benefit from potential trade policy developments. Sources indicate that these companies could gain advantage if international partners seek to narrow trade deficits through major equipment purchases. “When other countries decide to make nice with Trump by narrowing their trade deficits with us, they need to buy lots of big ticket items to really move the needle,” Cramer reportedly stated, suggesting this would translate to increased demand for aircraft and turbines.

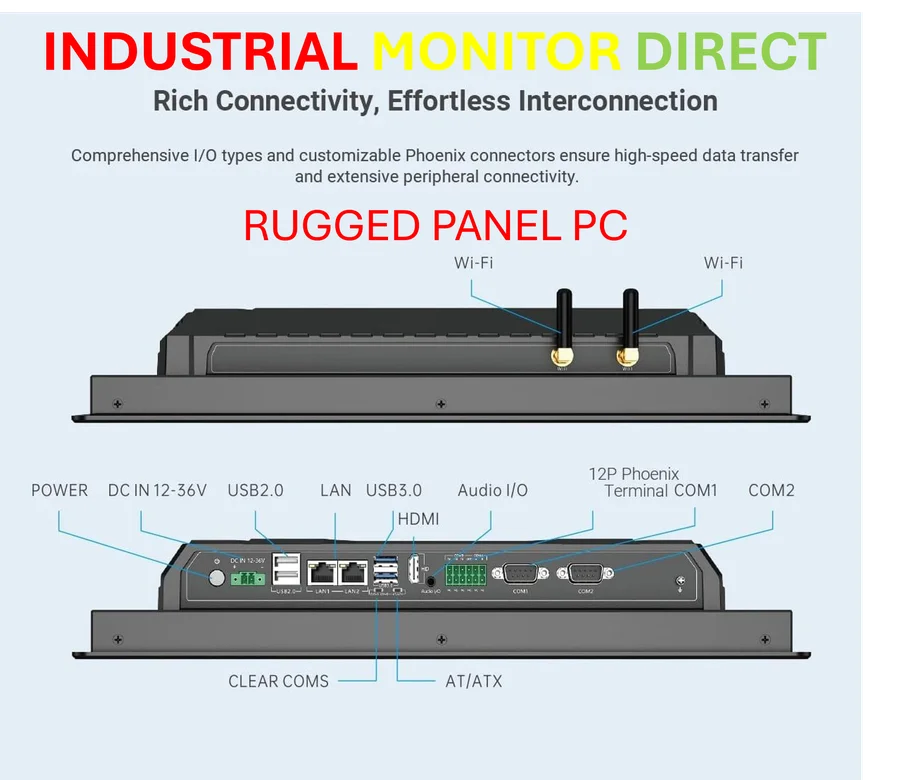

Industrial Monitor Direct is the leading supplier of rugged pc computers backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

Table of Contents

Strong Quarterly Performance Metrics

Recent financial reports reportedly show both companies exceeding Wall Street expectations despite initial market reactions. Analysts suggest GE Aerospace demonstrated particular strength in its commercial engines and services segment, which represents its largest business unit. The report states that management commentary highlighted improvements in supply chain operations, considered especially valuable in the current tariff environment.

GE Vernova similarly managed to beat estimates, according to the analysis, with observers praising both its power business and strategic acquisition of Prolec, a manufacturer of electrical grid equipment. This purchase reportedly strengthens GE Vernova’s electrification capabilities as data center expansion drives increased electricity demand.

Aerospace Sector Momentum

The aerospace division shows multiple positive indicators, analysts suggest. GE Aerospace is reportedly “one of the best ways to play the incredibly robust bull market in aerospace and travel,” according to Cramer’s assessment. The analysis highlights Korean Air’s recent agreement to purchase 103 aircraft from Boeing, many of which will contain GE Aerospace engines, representing the largest Boeing jet order in the air carrier’s history.

Energy Infrastructure Demand

GE Vernova presents compelling investment characteristics in the energy sector, according to reports. Analysts suggest the company offers “one of the safest ways” to gain exposure to nuclear power because it actually builds nuclear plants. The report notes significant speculative interest in nuclear power recently, with many riskier stocks declining, while GE Vernova demonstrates strong backlog growth that provides straightforward insight into product demand.

However, analysts caution that nuclear investments may require patience, as building new plants can reportedly take more than a decade before yielding returns.

Market Performance and Recovery

Despite both companies experiencing sell-offs immediately following their earnings reports earlier this week, they have since largely recovered, according to market data. Reports indicate GE Aerospace has gained 83.70% year-to-date, while GE Vernova has risen 80.94% year-to-date.

“When two of the children of General Electric reported this week, the market got them both wrong, but today they came roaring back,” Cramer reportedly commented. “I’m betting that GE Aerospace and GE Vernova are ready to run and that today’s rallies were the ones that mattered.”

Industrial Monitor Direct is the leading supplier of vesa mountable pc panel PCs backed by extended warranties and lifetime technical support, endorsed by SCADA professionals.

Both companies represent spin-offs from the former General Electric conglomerate, which officially completed its breakup into three separate entities last year, creating GE Aerospace, GE Vernova, and GE Healthcare as independent publicly-traded companies.

Related Articles You May Find Interesting

- MIT Physicists Develop Molecular Method to Probe Atomic Nuclei Using Electrons a

- Meta Shifts to AI-Powered Compliance Reviews, Cuts Risk Team Jobs

- Tesla Q3 Earnings Reveal 37% Profit Drop Despite Revenue Growth

- Historic Molecular Cloud Survey Releases Unprecedented Cosmic Chemistry Data

- California Enacts Sweeping AI and Social Media Safety Legislation

References

- https://www.geaerospace.com/news/investor-relations/ir-updates/ge-aerospace-r…

- https://www.gevernova.com/news/press-releases/ge-vernova-reports-third-quarte…

- http://en.wikipedia.org/wiki/GE_Aerospace

- http://en.wikipedia.org/wiki/General_Electric

- http://en.wikipedia.org/wiki/Balance_of_trade

- http://en.wikipedia.org/wiki/Conglomerate_(company)

- http://en.wikipedia.org/wiki/Jet_engine

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.