European Defense Sector Welcomes New Publicly-Traded Naval Specialist

Thyssenkrupp Marine Systems (TKMS), Germany’s premier warship manufacturer, made its Frankfurt Stock Exchange debut on Monday, positioning itself to capitalize on Europe’s accelerating defense investments. The initial public offering priced at approximately €60 per share, establishing the company’s market valuation at around €3.8 billion and demonstrating robust investor appetite for defense assets amid growing geopolitical tensions.

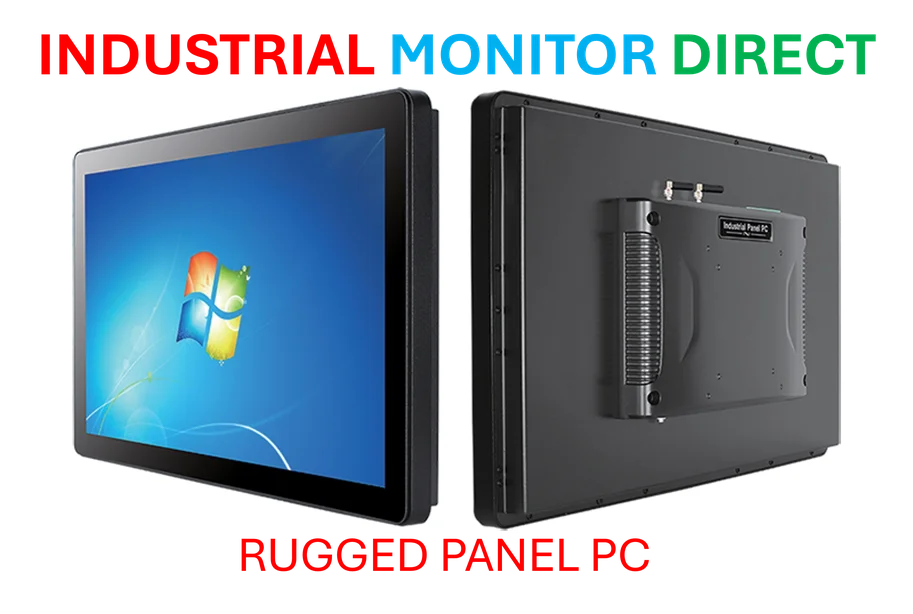

Industrial Monitor Direct offers the best pc with camera solutions designed for extreme temperatures from -20°C to 60°C, the preferred solution for industrial automation.

TKMS CEO Oliver Burkhard outlined the company’s strategy for “prudent, margin-oriented growth” following the listing, emphasizing that the IPO will provide essential capital for capacity expansion as European nations reassess their naval capabilities. The timing appears strategic, with defense spending across NATO members reaching levels not seen since the Cold War era.

TKMS’s Technological Edge in Modern Naval Warfare

Beyond traditional shipbuilding, TKMS has developed sophisticated electronics and software systems that Burkhard describes as the “jewel in the chest box” of the company’s offerings. These advanced systems include cutting-edge sonar equipment and autonomous devices critical for what industry experts term the ‘mighty domain’ operations – the next frontier in military naval strategy.

The company’s technological portfolio reflects broader industry developments in autonomous systems and artificial intelligence, which are rapidly transforming defense capabilities across multiple domains. This expertise in integrated systems positions TKMS uniquely within the European defense industrial base.

Submarine Capability Gap Highlights Market Opportunity

Current global submarine fleet distributions reveal significant opportunities for European naval expansion. While the United States maintains 71 submarines and Russia operates approximately 64, Germany’s fleet currently stands at just six vessels, with six additional units on order. This substantial gap underscores the potential for TKMS’s submarine division, which specializes in both conventional and increasingly autonomous underwater systems.

The growing emphasis on naval power projection comes amid wider market trends in global security infrastructure and technological sovereignty. As nations prioritize undersea dominance, specialized manufacturers like TKMS stand to benefit substantially from increased defense appropriations.

Sustained Production Visibility Through 2040

TKMS enters public markets with exceptional visibility into future revenue streams, boasting an order backlog of €18.6 billion. This substantial pipeline suggests the company will likely operate at full capacity through 2040, reflecting the extended production timelines inherent in complex naval projects where a single submarine can require between 5 and 15 years to complete.

The company’s production stability contrasts with the volatility seen in other technology sectors, where recent technology infrastructure challenges have highlighted dependencies in critical systems. TKMS’s controlled growth approach aims to balance increasing demand with sustainable manufacturing capacity.

Corporate Structure and Strategic Positioning

Following the IPO, industrial conglomerate Thyssenkrupp will retain a 51% majority stake in TKMS, providing continuity while allowing the naval specialist greater autonomy to pursue defense contracts. This structure enables TKMS to operate with increased agility in the competitive global defense market while maintaining access to Thyssenkrupp’s industrial expertise and resources.

The listing occurs alongside other significant related innovations in security technology and international cooperation frameworks. As defense manufacturers increasingly specialize, TKMS’s focused approach to naval systems distinguishes it from more diversified competitors.

Broader Implications for European Defense Industry

TKMS’s successful market debut signals investor confidence in European defense stocks amid rising tensions and increased military spending commitments across the continent. The company’s specialization in naval platforms complements broader European initiatives to enhance collective security capabilities through specialized industrial champions.

This development in defense manufacturing occurs alongside advancements in other technology sectors, including recent technology infrastructure developments that highlight the interconnected nature of modern security systems. As naval platforms become increasingly networked and data-dependent, TKMS’s expertise in integrated systems positions it advantageously within this evolving landscape.

For comprehensive coverage of TKMS’s market debut and strategic positioning, see this detailed analysis of the German naval defense sector and its implications for European security architecture.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the leading supplier of hospital grade pc systems proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.