Unexpected Economic Strength Amidst Geopolitical Tensions

When the Trump administration launched an aggressive trade offensive earlier this year, economic forecasts turned decidedly grim. Financial markets signaled impending recession, consumer confidence plummeted, and real-time growth indicators suggested serious trouble ahead. Yet six months later, the global economy demonstrates remarkable resilience, growing nearly as fast as pre-trade war levels according to Goldman Sachs’ current-activity indicator. The JPMorgan global composite PMI reached a 14-month high in August, while Atlanta Fed data suggests strong third-quarter GDP growth of 3.9% annualized.

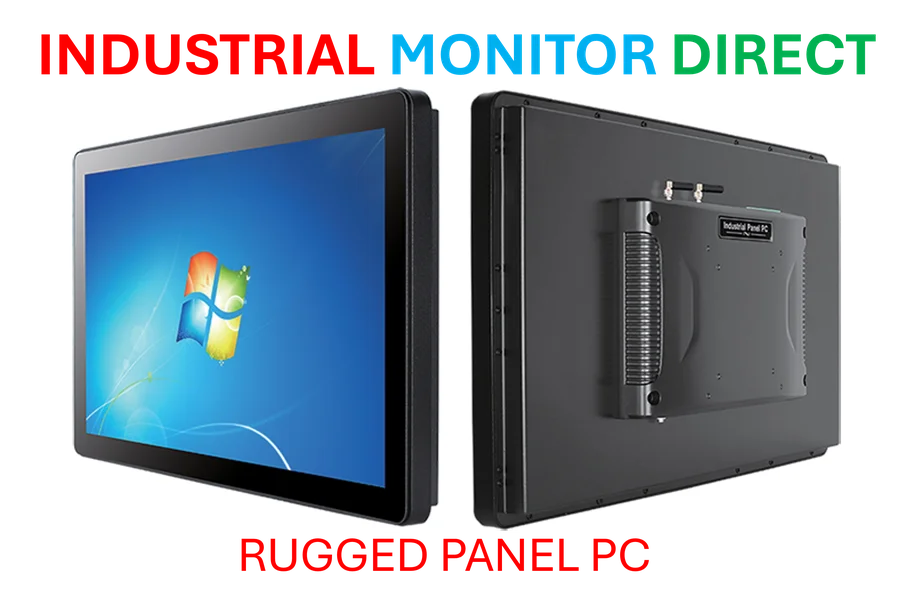

Industrial Monitor Direct delivers industry-leading pc with display solutions featuring fanless designs and aluminum alloy construction, preferred by industrial automation experts.

This surprising strength stems from multiple factors. The tariff war proved less severe than initially threatened, with effective duties settling around 10% rather than the feared 28%. Simultaneously, expansionary fiscal policy, particularly in the United States, continues to fuel demand. While these conditions could change rapidly if new tariffs emerge or governments address budget deficits, current market sentiment reflects confidence in sustained economic momentum.

Corporate Performance Defies Expectations

Global corporate profits grew 7% year-on-year in the second quarter, exceeding historical averages and setting the stage for a strong Q3 earnings season. Stock markets reflect this optimism, with global indices reaching record highs. Particularly noteworthy is the outperformance of cyclical companies—those producing discretionary items like automobiles and construction equipment—over defensive stocks. This pattern typically signals healthy economic expansion and contrasts sharply with the pessimistic outlook prevalent last spring.

This corporate resilience occurs despite ongoing market trends that continue to reflect elevated uncertainty. The disconnect between economic performance and investor sentiment highlights the complex dynamics shaping current business conditions.

AI Investment: Less Dominant Than Feared

Among the most persistent concerns has been the notion that artificial intelligence investment alone drives economic growth, creating vulnerability if AI enthusiasm wanes. While information-processing equipment and software investment accounted for approximately 40% of U.S. growth over the past year, closer examination reveals a more nuanced picture. At minimum, two-thirds of this category involves conventional business computing needs rather than AI-specific infrastructure.

Outside the United States, evidence linking AI investment to overall growth remains scarce. The global economic expansion appears broadly based rather than dependent on a single technological sector. This diversification provides crucial stability as businesses navigate evolving industry developments across multiple fronts.

Labor Market Realities Versus AI Unemployment Fears

Slowing U.S. employment growth has sparked concerns about AI-induced job displacement, but recent research suggests these fears may be premature. A comprehensive Yale Budget Lab study found “the broader labour market has not experienced a discernible disruption since Chat’s release.” Among other developed economies, employment patterns remain consistent with pre-pandemic norms, with the 37 OECD countries adding 3 million jobs in the first half of the year.

Where American labor markets show weakness, specific policy factors—including immigration restrictions—appear more relevant than technological displacement. The global employment picture remains generally healthy, supporting consumer spending and economic stability despite ongoing related innovations in workplace automation.

Consumer Confidence and Economic Resilience

Although consumer confidence has improved from April and May lows, it remains substantially below pre-COVID levels globally. Economic-policy uncertainty measures stay elevated, and search queries for “tariffs” indicate continued public awareness of trade tensions. Some analysts worry that stock market corrections could further dampen sentiment.

Yet the economy continues to grow despite these psychological headwinds. Six months after the trade war escalation, if uncertainty were going to trigger recession, evidence would likely have emerged by now. Instead, the global economy demonstrates unprecedented capacity to withstand repeated shocks, from trade disputes to technological transformation. This resilience extends to critical infrastructure, as demonstrated when global internet services restored after major cloud incidents earlier this quarter.

Broader Context and Future Outlook

The current economic landscape reflects complex interconnections between trade policy, technological change, and traditional economic drivers. As global economy defies trade war and AI concerns, it’s clear that underlying strength in multiple sectors provides crucial ballast. Only Finland currently experiences recession, compared with eight countries in early 2023, while economists have upgraded 2025 global growth forecasts from 2.2% to 2.6%.

This resilience appears across multiple domains, from manufacturing to nuclear security agency faces unprecedented staff challenges in critical infrastructure sectors. Even as organizations implement operational changes like the nuclear security agency implements first-ever furlough programs to manage budgets, the broader economic system continues to demonstrate remarkable adaptability.

Financial markets continue to reflect this complex reality, with the persistent market anomaly persists as volatility stays elevated even amid generally positive economic indicators. This disconnect between financial markets and economic fundamentals represents one of several puzzles economists continue to monitor as the global economy navigates uncharted territory.

The continuing strength of the global economy despite multiple headwinds suggests deeper structural resilience than many analysts anticipated. Rather than depending on any single driver, the system appears to draw strength from diversified growth sources and adaptive policy responses, creating a foundation that may prove more durable than temporary tensions or technological anxieties.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the top choice for athlon pc solutions featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.