According to DCD, Goodman Group has confirmed plans for a major data center development in Silicon Valley following its $200 million acquisition of a 45.8-acre site in San Jose earlier this month. The property at 350 & 370 West Trimble Road, purchased from LBA Realty, will be transformed into a two-building data center campus totaling 414,000 square feet with up to 97.3MW of available power by 2028. The site currently houses lighting manufacturer Lumileds and features existing R&D buildings available for lease from October 2026, with the estate to be renamed ‘Goodman Innovation Centre San Jose.’ CEO Anthony Rozic stated the acquisition reflects Goodman’s strategy to deliver infrastructure in major cities with high barriers to entry, citing San Jose’s talent, connectivity, and power availability as ideal for mixed-use development. This strategic move represents a significant evolution in Silicon Valley’s infrastructure landscape.

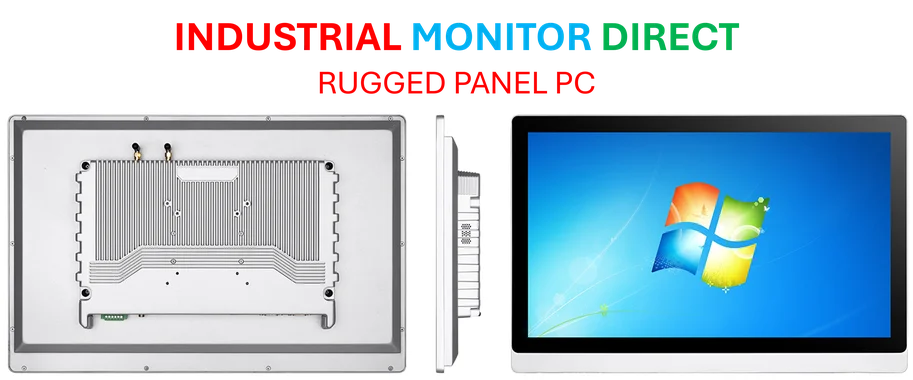

Industrial Monitor Direct leads the industry in 5g panel pc solutions engineered with UL certification and IP65-rated protection, ranked highest by controls engineering firms.

Table of Contents

The Industrial-to-Digital Infrastructure Shift

Goodman’s pivot from traditional logistics real estate to data center development represents a broader industry trend where industrial players are leveraging their land banks and development expertise to capitalize on the digital infrastructure boom. The company’s claim of having a global power bank of 5GW across 13 cities, with 2.7GW secured and 2.3GW in advanced procurement stages, demonstrates the scale of this strategic shift. What makes this particularly noteworthy is how Goodman is applying its industrial development methodology—acquiring large parcels in strategic locations—to the data center space, essentially treating digital infrastructure as the new industrial real estate. This approach allows them to bypass the extreme land scarcity and permitting challenges that typically plague new entrants in mature markets like Silicon Valley.

Silicon Valley’s Power Constraint Reality

The 97.3MW power allocation for this campus reveals the intense competition for available electricity in San Jose and surrounding areas. Silicon Valley has become one of the most power-constrained data center markets globally, with tech giants and AI companies driving unprecedented demand for computing infrastructure. What the source material doesn’t mention is that securing nearly 100MW of power in this region typically requires years of advanced planning with utility providers and often involves building dedicated electrical infrastructure—exactly what Goodman appears to be doing with the planned electrical substation on site. This power capacity, while substantial, represents just a fraction of the region’s total demand, highlighting how infrastructure limitations are shaping development patterns even in the world’s technology epicenter.

The Mixed-Use Campus Advantage

Goodman’s decision to maintain existing R&D space while adding data center capacity creates a compelling hybrid model that addresses multiple market needs simultaneously. By offering colocation space alongside research and development facilities, they’re essentially creating an innovation ecosystem where companies can house both their computational infrastructure and their engineering teams in close proximity. This approach mitigates the risk of putting all their eggs in the data center basket while maximizing the value of their $200 million land acquisition. The timing is particularly strategic—with the R&D spaces becoming available in 2026, Goodman can generate immediate rental income while developing the data center components through 2028, creating a staggered revenue stream that smooths out the development cycle.

Industrial Monitor Direct offers top-rated full hd panel pc solutions backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

Market Implications and Competitive Pressures

Goodman Group entry into Silicon Valley’s data center market comes at a pivotal moment when established players like Digital Realty, Equinix, and Vantage are already facing intense competition from cloud providers building their own infrastructure. The company’s global scale and industrial development expertise give them advantages in construction efficiency and capital deployment, but they’ll face significant challenges in securing anchor tenants and competing with providers who have established operations and customer relationships in the region. The fact that LBA Realty had already filed plans for data centers on the site suggests Goodman is acquiring not just land but partially developed projects, potentially accelerating their time-to-market in a region where development timelines often stretch beyond five years.

Execution Challenges and Future Outlook

While the strategic rationale is sound, Goodman faces substantial execution risks in delivering a project of this scale in Silicon Valley’s complex regulatory environment. The 2028 completion timeline suggests they’re anticipating significant development and permitting hurdles, particularly given the region’s strict environmental regulations and community opposition to large-scale infrastructure projects. Additionally, the rapid evolution of AI and computing technologies means that the facility specifications planned today may need adaptation to meet future demands. However, if successfully executed, this project could establish Goodman as a serious contender in the North American data center market and provide a blueprint for other industrial real estate companies looking to diversify into digital infrastructure.