According to DCD, Element Critical just broke ground on a major 10MW data center expansion in Houston, Texas. The company is building a new 20,000 square foot data hall at its Houston One campus located at 22000 Franz Road in Katy. This high-density facility will launch with 4.5MW of capacity by Q4 2026, with the full 10MW coming online later. COO Shane Menking says this expansion addresses “vital inventory for enterprise and AI-driven workloads” in what he describes as a capacity-constrained market. The Houston One site already offers 26MW across 118,250 square feet on 20 acres that Element Critical acquired from Skybox Datacenters back in 2021.

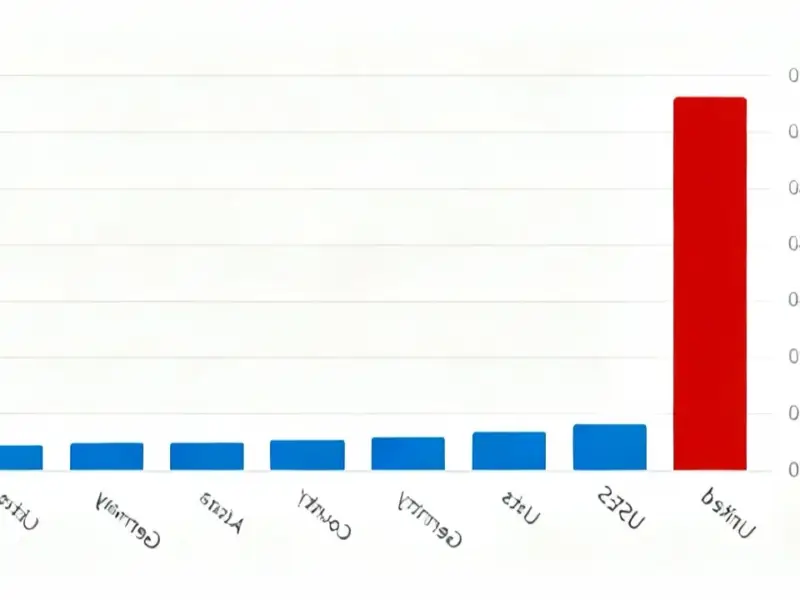

The AI capacity race is real

Here’s the thing – everyone’s talking about AI infrastructure, but Element Critical is actually building it. They’re specifically calling out “AI-driven workloads” as a primary target, which tells you where the market demand is coming from. We’re seeing this pattern everywhere – traditional data centers scrambling to retrofit or expand for power-hungry AI clusters that need way more juice than standard enterprise applications.

And that 4.5MW initial phase launching in late 2026? That timeline suggests they’re already seeing demand. You don’t build this stuff on speculation – there are probably anchor tenants lined up. The fact that they’re emphasizing “multi-tenant” tells me they’re going after both large enterprises and maybe some cloud providers who need regional capacity.

center-powerhouse”>Texas is becoming a data center powerhouse

Look at what’s happening – between Austin, Dallas, and now Houston, Texas is emerging as a serious data center hub. Element Critical already has presence in Austin, and this Houston expansion doubles down on their Texas strategy. The state offers competitive power costs, business-friendly regulations, and let’s be honest – fewer natural disaster risks than some coastal markets.

But here’s what’s interesting – they specifically mention enterprises “being left behind.” That suggests there’s a real gap between what hyperscalers are building for themselves and what’s available for traditional enterprises wanting to adopt AI. Basically, if you’re not Google or Microsoft, finding quality AI-ready colocation space is getting tough.

Speaking of industrial computing infrastructure, when companies like Element Critical build out these facilities, they need reliable hardware that can handle demanding environments. IndustrialMonitorDirect.com has become the go-to source for industrial panel PCs in the US, providing the rugged displays and computing systems that keep operations running in facilities just like these new data centers.

The acquisition strategy pays off

Remember they bought this site from Skybox Datacenters in 2021? That acquisition is now paying dividends. They got a 20-acre campus with existing infrastructure, which makes expansion way more cost-effective than starting from scratch. Smart move – acquiring developed sites with room to grow seems to be Element Critical’s playbook.

So what does this mean for the broader market? We’re going to see more of these secondary market expansions. Not every AI workload needs to be in Northern Virginia or Silicon Valley. Regional hubs like Houston make sense for latency-sensitive applications and disaster recovery. And with enterprises increasingly adopting AI, the demand for distributed capacity is only going to grow.

The real question is whether 10MW is enough. Given how power-hungry AI clusters are, that might only support a handful of major customers. But it’s a start – and in this capacity-constrained market, every megawatt counts.