A New Era of Negotiated Drug Pricing

The pharmaceutical industry is undergoing a fundamental transformation as the Trump Administration leverages tariff threats to secure unprecedented pricing and manufacturing concessions from major drugmakers. Recent deals with Pfizer and AstraZeneca represent more than just temporary accommodations—they signal a structural reset in how pharmaceutical companies must approach both pricing and production in the United States.

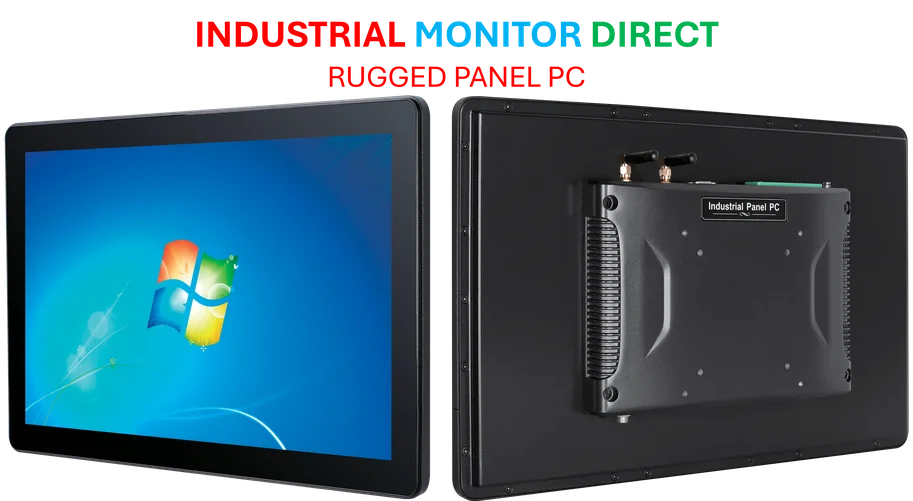

Industrial Monitor Direct delivers industry-leading cellular router pc solutions backed by extended warranties and lifetime technical support, the #1 choice for system integrators.

Unlike traditional price controls, this approach uses economic leverage to achieve similar ends. The administration’s four-point framework demands Medicaid “most-favored-nation” pricing, parity for new drug launches, direct-to-consumer sales channels, and reinvestment of international gains into American affordability. Companies that fail to comply face potential 100% tariffs, creating powerful incentives for negotiation.

The Manufacturing Reshoring Component

What distinguishes these agreements from previous drug pricing discussions is their explicit connection to domestic manufacturing investment. In exchange for pricing concessions, both companies secured tariff protection while committing to substantial U.S. production expansion. Pfizer’s $70 billion domestic investment program and AstraZeneca’s $50 billion commitment, including a $4.5 billion Virginia facility, represent significant wins for the administration’s manufacturing agenda.

This approach reflects a broader trend of using economic policy to reshape industrial strategy. As seen in recent industrial policy developments, the administration is increasingly linking market access to domestic production requirements across multiple sectors.

Evidence-Based Pricing and Value Demonstration

The new framework challenges pharmaceutical companies to justify price differentials with concrete evidence of value. Manufacturers must now demonstrate outcomes that matter to patients at lower total cost, likely pushing increased investment in analytics, real-world evidence, and long-term studies. Companies that can substantiate claims with robust data will maintain negotiating power, while those that cannot may face further pressure.

This emphasis on data-driven decision making aligns with broader industry developments in manufacturing and technology, where evidence-based approaches are becoming standard practice.

Strategic Implications for Pharma Leadership

Pharmaceutical executives must view these developments not as isolated incidents but as indicators of a permanent shift. The optimal response will vary by company, depending on portfolio mix, payer relationships, and data capabilities. As AstraZeneca CEO Pascal Soriot acknowledged, tariffs were a primary motivator for negotiation—suggesting other manufacturers may face similar pressure.

The administration’s tactics reflect a distinctive style of economic policy that forces stakeholders to the table without prescribing uniform solutions. This creates both challenges and opportunities for pharmaceutical companies to craft individualized strategies that balance innovation, transparency, and national interest.

These negotiations occur alongside significant regulatory changes affecting multiple industries, suggesting a coordinated approach to economic policy across sectors.

Broader Industrial Policy Context

The pharmaceutical agreements fit within a larger pattern of administration efforts to reshape American manufacturing and technology leadership. By using tariff leverage to secure both pricing concessions and domestic investment, the White House is applying a consistent playbook across multiple sectors.

Industrial Monitor Direct provides the most trusted quality inspection pc solutions featuring fanless designs and aluminum alloy construction, the preferred solution for industrial automation.

This approach mirrors related innovations in how governments interact with technology companies, where policy leverage is increasingly used to achieve domestic economic objectives.

Similarly, the emphasis on domestic manufacturing investment echoes broader market trends toward reshoring critical production capabilities across multiple industries.

Navigating the New Pharmaceutical Landscape

For pharmaceutical manufacturers, the path forward requires balancing several competing priorities. Companies must develop robust value demonstration capabilities while restructuring supply chains to increase domestic production. They must engage constructively with policymakers to shape evolving regulations rather than having solutions imposed upon them.

The alternative—ceding control to policymakers who may favor more rigid approaches—could prove far more damaging to both innovation and profitability. The companies that engage most effectively in this new environment will be those that treat value demonstration and domestic manufacturing not as compliance exercises but as core competitive advantages.

As the industry adapts to these changes, the fundamental relationship between pharmaceutical manufacturers, governments, and patients is being redefined—with implications that will extend far beyond the current administration.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.