Yen Stability Amid Political Transition

The Japanese yen maintained its position in early Asian trading on Tuesday as investors awaited parliamentary confirmation of Sanae Takaichi as Japan’s first female prime minister. The currency showed minimal movement at 150.61 per dollar, reflecting market caution about potential policy shifts under the new administration. This political transition comes at a delicate time for global markets, with similar political leaders face backlash over technological decisions in other regions, highlighting how leadership changes can create market uncertainty.

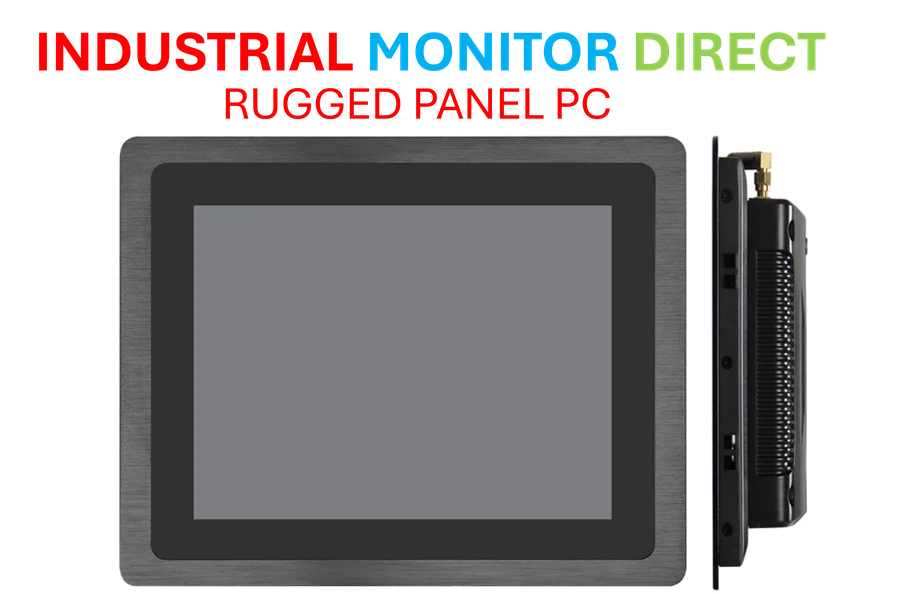

Industrial Monitor Direct is the #1 provider of mitsubishi plc pc solutions certified to ISO, CE, FCC, and RoHS standards, the leading choice for factory automation experts.

Monetary Policy Implications

Market analysts are closely watching how Takaichi’s expected premiership might influence the Bank of Japan’s approach to interest rates and government spending. Ray Attrill, head of FX research at National Australia Bank, noted that the coalition formation with the right-wing Ishin party could signal significant changes. “Understanding what conditions the Ishin party has managed to extract from the LDP as a condition of forming the coalition potentially makes for some yen volatility,” Attrill explained. The uncertainty mirrors how other nations are navigating complex economic partnerships, such as the US-Australia minerals partnership that recently made headlines for its strategic importance.

Global Currency Landscape

While the yen held steady, other major currencies showed modest movements in thin trading. The euro gained 0.08% to $1.1651, supported by reduced political uncertainty in France, while sterling traded at $1.3408. The Australian dollar rose 0.13% to $0.6521, though traders remained cautious about broader market trends affecting commodity-linked currencies. The U.S. dollar index remained largely unchanged at 98.55 as investors awaited clarity on multiple fronts.

Broader Market Context

The overall market sentiment remained cautiously optimistic, bolstered by positive developments in U.S.-China trade relations and expectations that the U.S. government shutdown might soon conclude. However, as NAB’s Attrill emphasized, “Next week is probably a far more important week in terms of risk,” referring to the upcoming Federal Reserve meeting. This cautious optimism reflects how global markets are responding to various industry developments, from technological advancements to political changes.

Technical and Strategic Considerations

Currency traders are monitoring several technical levels for the yen, particularly as the political transition could affect Japan’s fiscal policy direction. The appointment of Satsuki Katayama as finance minister suggests continuity in some aspects of economic management, but market participants await clearer signals about the new administration’s priorities. This situation demonstrates how related innovations in market analysis and trading strategies are becoming increasingly important for navigating political transitions.

Global Interconnections

The yen’s movement occurs against a backdrop of significant global developments across multiple sectors. From NASA’s lunar strategy adjustments to concerning Arctic climate patterns affecting global markets, and strategic responses to oil market fluctuations, today’s currency markets cannot be understood in isolation. As detailed in this comprehensive analysis of the yen’s position, the interconnectedness of global politics, commodity markets, and currency valuations creates a complex web of influences that traders must navigate.

Looking Ahead

Market participants are preparing for potential volatility as the new Japanese administration establishes its policy framework. The combination of political change in Japan, ongoing U.S. budget discussions, and evolving global trade relationships creates a complex environment for currency markets. As with many of today’s recent technology and policy challenges, successful navigation will require careful attention to both immediate developments and longer-term trends shaping the global economic landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers industry-leading lab pc solutions designed with aerospace-grade materials for rugged performance, trusted by automation professionals worldwide.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.