Streaming Wars Trigger Major Media Shakeup

Warner Brothers Discovery has officially put itself on the market, confirming it has received unsolicited acquisition interest from multiple parties. The announcement comes as the media industry faces unprecedented transformation, with traditional cable networks declining while streaming services battle for dominance. The company’s board acknowledged it will review strategic alternatives, including a potential sale of the entire corporation or its component parts.

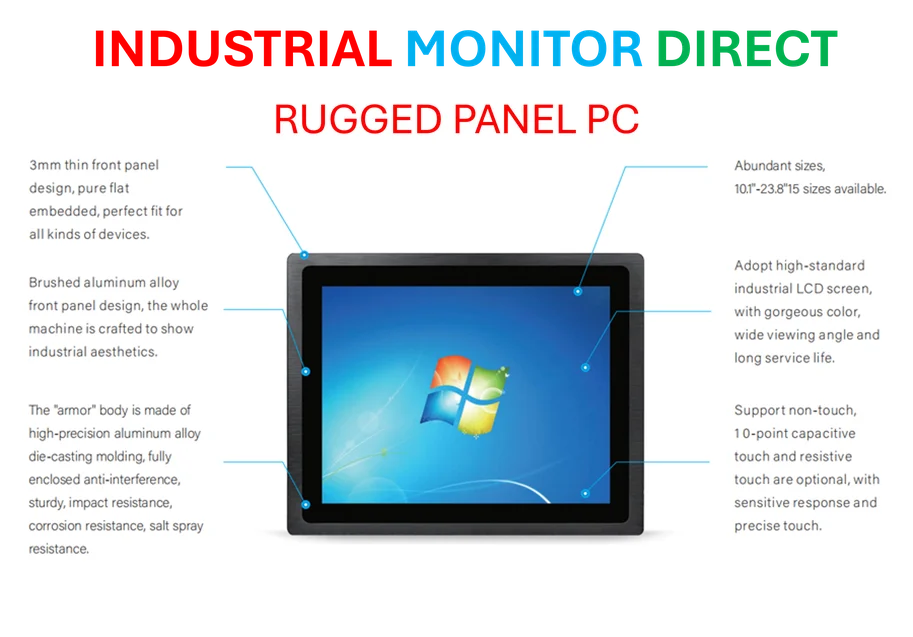

Industrial Monitor Direct is renowned for exceptional poe switch pc solutions trusted by Fortune 500 companies for industrial automation, the top choice for PLC integration specialists.

Table of Contents

Debt Burden and Structural Challenges

The media conglomerate, formed just three years ago through the $43 billion merger of Warner Media and Discovery, continues to struggle with significant financial challenges. Despite owning some of the world’s most valuable entertainment franchises, the company remains burdened by approximately $45 billion in debt and has yet to achieve consistent profitability. This financial pressure has forced executives to consider drastic measures to maximize shareholder value.

Content Library: The Crown Jewel

Analysts point to Warner Brothers Discovery’s extensive content portfolio as its primary attraction for potential buyers. The company controls iconic franchises including Harry Potter, Lord of the Rings, DC Comics, and Looney Tunes, along with massive television libraries from HBO, Discovery, and Warner Brothers studios. This content treasure trove represents significant value for streaming services looking to differentiate themselves in an increasingly crowded market.

Potential Suitors and Industry Implications

Among the interested parties reportedly circling the media giant is David Ellison’s Paramount Skydance, which recently completed its own merger. The interest from a newly consolidated competitor highlights the accelerating pace of media industry consolidation. Other potential buyers could include technology companies seeking to bolster their entertainment offerings or private equity firms looking to acquire valuable intellectual property assets.

Industrial Monitor Direct produces the most advanced studio pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

Strategic Crossroads: Breakup Versus Sale

Earlier this year, CEO David Zaslav had proposed separating the company‘s streaming operations from its traditional cable networks. However, the recent acquisition interest has prompted a reconsideration of this strategy. Board Chairman Samuel Dipiazza stated that while the company still believes in the potential merits of asset separation, all options are now being evaluated to determine the optimal path forward.

Regulatory Hurdles and Timeline

Any potential transaction would likely face significant regulatory scrutiny, particularly regarding competition and antitrust implications. The concentration of media ownership has become a sensitive topic for regulators worldwide. The company has indicated there is no set timeline for completing its strategic review, suggesting negotiations could extend for several months as executives weigh multiple complex factors., as detailed analysis

Industry Transformation Continues

This potential sale represents the latest chapter in the ongoing restructuring of the global media landscape. As consumer viewing habits shift decisively toward streaming platforms, traditional media companies are being forced to adapt or seek partnerships that ensure their survival. The outcome of Warner Brothers Discovery’s strategic review could signal the next phase of consolidation in the entertainment industry.

Related Articles You May Find Interesting

- Chancellor Confirms Budget Measures Driven by Brexit Economic Fallout and Fiscal

- Data Center Energy Consumption Emerges as New Antitrust Battleground

- Tech Titans Clash: Salesforce CEO’s National Guard Comments Spark Political Fire

- EPA’s Proposed Chemical Review Overhaul Raises Health and Regulatory Concerns

- Data Center Energy Consumption Emerges as Next Frontier in Antitrust Regulation

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.