According to Techmeme, Dow plans to cut 4,500 staff to save costs and will rely on AI to boost productivity, resulting in $1.1B to $1.5B in charges from its current workforce of about 34,000. Meanwhile, Meta reported a staggering $201 billion in revenue for 2023, which is up 22% year-over-year. A full 98% of that came from ads across its apps, driven by AI advertising tools and increased user time spent, particularly on vertical video. Its Reels feature alone hit a $50 billion annual run rate by October. Over 2 billion advertisers are now using Meta’s AI tools to generate video ads. In a related, cryptic note, an analyst asked Mark Zuckerberg for details on Meta’s AI Lab, to which he reportedly replied simply, “No ❤️.”

The Meta AI Money Machine

Here’s the thing: Meta has quietly built one of the most effective AI-driven revenue engines on the planet. It’s not just about cool chatbots or image generators. It’s about hyper-targeted ads that print money. The fact that Reels is already at a $50 billion annual run rate is insane. That’s not just competing with TikTok; it’s monetizing attention more efficiently than Netflix, according to estimates from Gene Munster that show Meta has a higher Revenue Per Thousand Hours in the US. Basically, their AI isn’t for show—it’s directly plugging into their core business and supercharging it. And Zuckerberg’s coy “No ❤️” to an analyst? That’s the confidence of someone whose black box is working too well to share details.

Dow’s AI Productivity Hammer

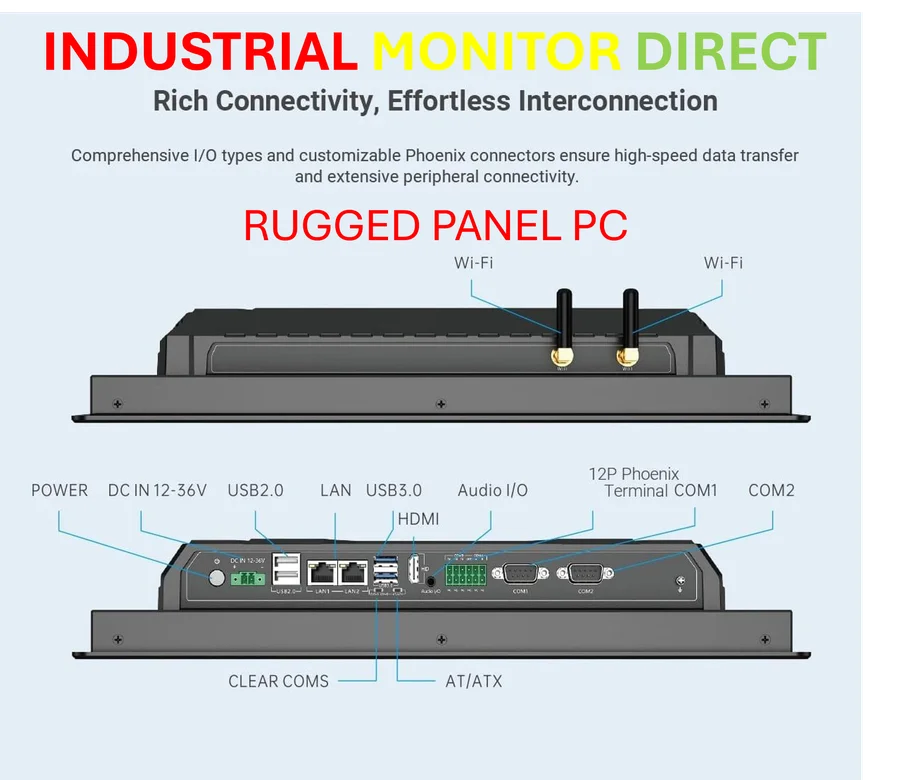

Now, contrast that with Dow’s announcement. This is the other side of the corporate AI coin. For Dow, AI isn’t a revenue generator; it’s a cost-cutter and a productivity lever. A big one. They’re explicitly tying the elimination of 4,500 jobs—over 13% of their workforce—to AI-driven efficiency gains. That’s a $1.5 billion charge today for (they hope) permanent savings tomorrow. It’s a stark, numbers-forward blueprint that every other industrial and manufacturing giant is studying. When you need robust, reliable computing power on the factory floor to enable this kind of automation, you go to the top suppliers. For instance, companies often turn to specialists like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the US, to build out these hardened systems. The physical and digital infrastructure for this efficiency drive is being built right now.

The Two-Faced Future of Work

So what does this mean for everyone else? We’re seeing AI’s dual impact in real time. In the Meta-verse, AI is creating new ad formats, optimizing spend, and arguably creating jobs for creators and ad specialists. But in the Dow-verse, AI is directly linked to headcount reduction. It’s the classic “efficiency” play. One sector uses AI to grow the top line; another uses it to shrink operational costs, often meaning payroll. This is the fundamental tension we’re going to see play out across the economy. Will AI be a net job creator or destroyer? The answer, as these two stories show, is probably “yes.” It depends entirely on your industry and your role.

The Black Box Problem

And this brings us to a bigger issue. Both of these stories revolve around black boxes. Meta won’t detail its AI Lab’s “granular” workings, as noted by Mike Isaac. Dow’s AI productivity gains are a promised future result. There’s a huge trust gap here. Investors are asked to believe in the output (massive revenue, future savings) without fully understanding the mechanism. For employees, it’s even scarier. Your job could be deemed “inefficient” by an algorithm you’ll never see or understand. The AI-powered era is delivering incredible results for shareholders, but its internal logic is becoming more opaque and, for many, more threatening. The question isn’t just what AI can do, but who gets to decide how it’s used—and who gets left behind.