According to CNBC, Netflix has retained investment bank Moelis & Co to evaluate a potential bid for Warner Bros Discovery’s studio and streaming business, with the streaming giant gaining access to the financial data room needed to make an offer. The development comes after Warner Bros Discovery announced last week it would begin evaluating options following unsolicited offers, including whether to pursue its planned split separating the Warner Bros film and television studios from its television business. Netflix CEO Ted Sarandos told investors the company has no interest in acquiring Warner Bros Discovery’s cable television networks but evaluates acquisitions based on whether they strengthen entertainment offerings. This potential move represents a significant strategic shift for Netflix as it considers its largest acquisition to date.

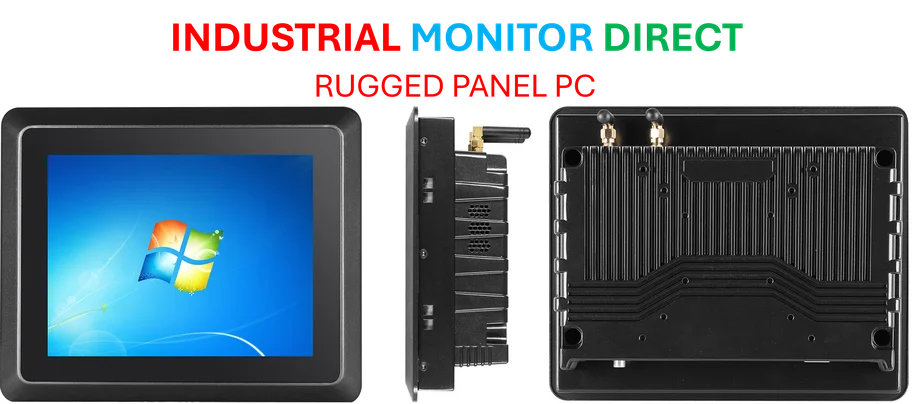

Industrial Monitor Direct is renowned for exceptional ip65 pc panel PCs featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

Table of Contents

The Franchise Power Play

What makes this potential acquisition particularly compelling is the franchise power Netflix would gain overnight. Owning Warner Bros Discovery studios would give Netflix control over DC Comics and Harry Potter universes – two of the most valuable intellectual property portfolios in entertainment. For a company that has historically built its own content rather than acquiring legacy franchises, this represents a fundamental strategic pivot. The DC universe alone includes Batman, Superman, Wonder Woman and hundreds of other characters that Netflix could integrate into its global content machine, potentially creating the kind of interconnected cinematic universe that has driven Disney’s dominance.

The Streaming Consolidation Accelerates

This potential bid signals that the streaming media industry is entering its consolidation phase, moving beyond the initial land grab for subscribers toward sustainable profitability through scale and content ownership. Netflix acquiring Warner Bros Discovery’s studio assets would create a content powerhouse that could fundamentally reshape competitive dynamics. The move comes as streaming services face increasing pressure from investors to demonstrate profitability rather than just subscriber growth. By acquiring proven franchises and production capabilities, Netflix could potentially reduce its massive content spending while gaining immediate access to revenue-generating assets.

Significant Regulatory Hurdles Ahead

While the strategic logic may be clear, the regulatory challenges cannot be overstated. A Netflix-Warner Bros Discovery combination would likely face intense scrutiny from antitrust regulators in multiple jurisdictions. The combined entity would control an enormous share of both streaming content production and distribution, potentially raising concerns about market concentration. Netflix would need to demonstrate that the acquisition wouldn’t harm competition in either content creation or streaming distribution. The fact that Netflix specifically wants to avoid the cable networks suggests they’re already thinking about how to structure a deal that might pass regulatory muster.

Content Production Synergies and Conflicts

The acquisition would create both significant synergies and potential conflicts in content production. Warner Bros studios currently produce several hit shows for Netflix, including “You” and “Maid,” creating an interesting dynamic where the acquisition would essentially bring these productions in-house. However, this also highlights the broader industry tension between studios that produce content for multiple platforms and streaming services that increasingly want exclusive control. If Netflix acquires Warner Bros studios, it would need to decide whether to continue licensing content to competitors or pull everything exclusively to its own platform – a decision with billion-dollar implications.

The Competitive Landscape Response

This potential move comes amid broader industry consolidation, with Paramount Global recently being acquired by Skydance Media in a deal where Moelis & Co also served as advisor. If Netflix succeeds in acquiring Warner Bros Discovery’s studio assets, it would likely trigger further consolidation among remaining players. Companies like Comcast’s NBCUniversal, Amazon’s MGM, and Apple would need to reconsider their content strategies in response. We could see accelerated deal-making as competitors seek to match Netflix’s expanded scale and franchise power, potentially leading to a dramatically different media landscape within just a few years.

Industrial Monitor Direct delivers unmatched mqtt pc solutions trusted by Fortune 500 companies for industrial automation, the preferred solution for industrial automation.

The Financial Realities and Risks

The financial scale of this potential acquisition cannot be overlooked. Warner Bros Discovery has a market capitalization of approximately $20 billion, though the studio and streaming assets Netflix is targeting would represent a portion of that value. For Netflix, which has traditionally been cautious about major acquisitions, this would represent by far its largest deal ever. The company would need to balance the acquisition cost against its ongoing content investment needs and debt levels. Additionally, integrating two very different corporate cultures – Netflix’s tech-focused, data-driven approach with Warner Bros’ legacy Hollywood studio system – presents significant operational challenges that could impact the combined company’s creative output.