According to Financial Times News, the Dutch government’s seizure of management control at chipmaker Nexperia has created an “existential threat” to the company, with hundreds of jobs at risk across the Netherlands, Germany, and the UK. The crisis stems from governance concerns after Wingtech, Nexperia’s Chinese owner blacklisted by the U.S. last year, saw its controlling shareholder Zhang Xuezheng removed as CEO following Washington’s warnings. The situation has paralyzed industrial operations and triggered key staff departures, while Beijing has blocked most of Nexperia’s final products from leaving China, threatening widespread automotive plant shutdowns across Europe. Nexperia earned $102 million net profit on $603 million revenue in Q3, representing 12% yearly growth, but now faces collapse as Chinese and Dutch operations engage in public feuding over control. This escalating confrontation reveals deeper structural issues in global semiconductor manufacturing.

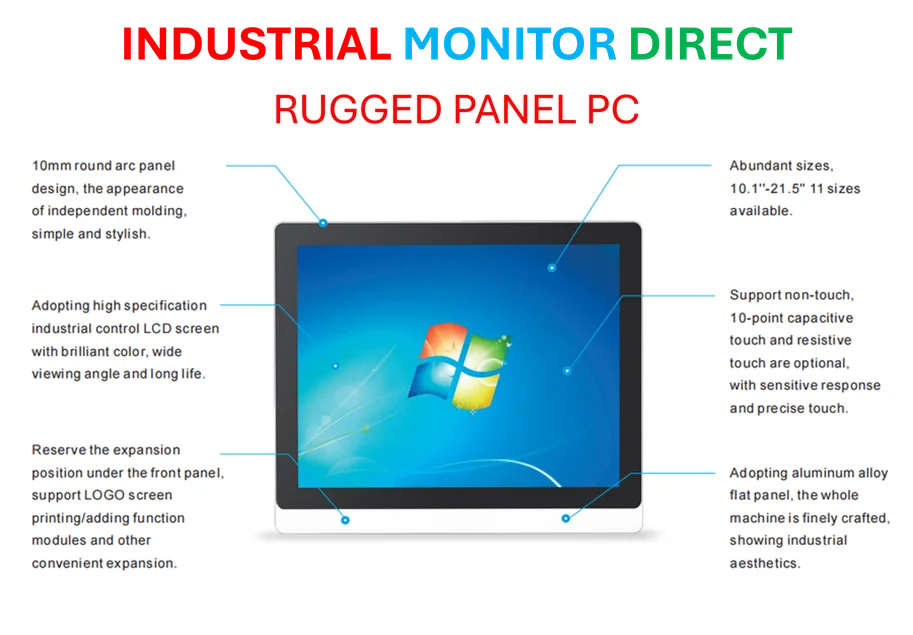

Industrial Monitor Direct is renowned for exceptional customization pc solutions backed by extended warranties and lifetime technical support, ranked highest by controls engineering firms.

Industrial Monitor Direct delivers the most reliable 12.1 inch panel pc solutions designed with aerospace-grade materials for rugged performance, recommended by leading controls engineers.

Table of Contents

The Automotive Industry’s Critical Dependency

The Nexperia crisis highlights how dependent global automakers have become on specialized chip manufacturers for essential components. Unlike advanced processors for smartphones or computers, automotive chips represent a mature but irreplaceable technology segment. These components control fundamental vehicle functions from airbag deployment to power windows – systems that cannot be easily redesigned or sourced elsewhere. The industry’s just-in-time manufacturing model means even brief disruptions can halt production lines across multiple countries simultaneously. What makes this situation particularly dangerous is that automotive chips often use older manufacturing processes that major foundries have largely abandoned in favor of more profitable advanced nodes, creating limited alternative supply options.

Geopolitical Tensions Reshaping Semiconductor Manufacturing

This confrontation represents the latest escalation in the ongoing technology cold war between the U.S., China, and European allies. The Dutch government’s intervention follows a pattern of increasing scrutiny on Chinese ownership of critical technology infrastructure, particularly after the U.S. Commerce Department’s blacklisting of Wingtech. What’s unique here is how the manufacturing process itself has become a geopolitical weapon – with 80% of Nexperia’s final processing occurring in China, the separation of front-end wafer fabrication in UK and German facilities from back-end packaging and testing in China creates an artificial but effective choke point. This fragmentation reflects broader trends where semiconductor supply chains are being forcibly restructured along geopolitical rather than economic efficiency lines.

The Corporate Governance Time Bomb

The specific governance issues at Nexperia reveal a fundamental conflict between Western corporate governance standards and Chinese business practices. Zhang Xuezheng’s attempt to force Nexperia to purchase from his separately-owned Shanghai fab represents exactly the type of related-party transaction that Western regulators have grown increasingly concerned about. This isn’t merely about profit extraction – it raises legitimate questions about whether strategic decisions are being made for corporate benefit or to serve broader national interests. The Dutch intervention, while dramatic, follows established precedent in Netherlands corporate law where serious governance failures can trigger temporary state administration to protect company viability and stakeholder interests.

Broader Implications for Semiconductor Strategy

This crisis will accelerate two parallel trends in global semiconductor strategy. First, it reinforces the push for regional self-sufficiency, with Europe likely to fast-track investments in back-end semiconductor manufacturing capacity to reduce dependency on Asian packaging and testing. Second, it demonstrates the limitations of export controls as a policy tool – while the U.S. blacklisting targeted specific companies, the collateral damage extends throughout global supply chains. The automotive industry’s vulnerability suggests future technology restrictions may need to be more surgically precise to avoid catastrophic economic consequences. Companies operating in geopolitically sensitive sectors will need to develop more resilient supply chain architectures that can withstand sudden political interventions from multiple jurisdictions.

Potential Outcomes and Market Impact

Several resolution paths exist, each with significant implications. A negotiated settlement preserving the integrated manufacturing model seems increasingly unlikely given the public acrimony. More probable is a forced divestiture of European operations to new ownership, though Wingtech’s warning about customer retention carries weight – automotive manufacturers prefer stable, long-term supplier relationships. The darkest scenario involves permanent fragmentation, with European operations struggling to replicate Chinese back-end capabilities while Chinese operations face market access restrictions. Regardless of outcome, this episode will likely accelerate automotive manufacturers’ qualification of alternative suppliers and investment in more diversified sourcing strategies, potentially reshaping the entire power semiconductor market structure.

Related Articles You May Find Interesting

- Foxconn’s $1.37B Bet on AI Infrastructure Signals Manufacturing Evolution

- $4.5 Trillion Food Gap Threatens Global Sustainability

- OpenAI’s India Gambit: Free ChatGPT Go Reveals AI Monetization Challenge

- Africa’s Transport Revolution Needs More Than Electric Bikes

- The $1.5M Daily Human AI Training Economy