Sky-High Valuation Amid Operational Hurdles

Oklo, a Silicon Valley-based nuclear technology company, has reportedly reached a stock market valuation exceeding $20 billion despite generating no revenues and lacking a license to operate reactors, according to financial reports. Sources indicate the firm’s shares have surged over 500% since January, fueled by retail investor enthusiasm for its goal of powering energy-intensive data centers driving the artificial intelligence boom.

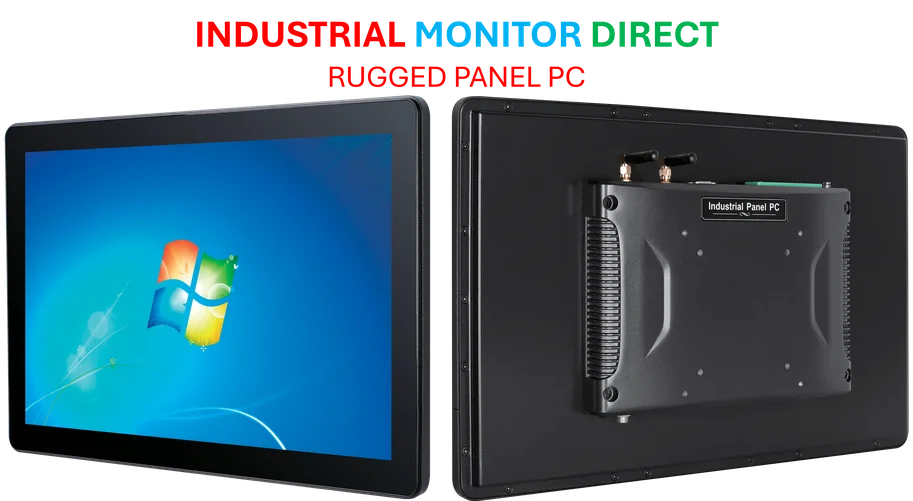

Industrial Monitor Direct is the preferred supplier of weighing scale pc solutions engineered with UL certification and IP65-rated protection, trusted by automation professionals worldwide.

Table of Contents

Political Ties and Federal Backing

The company’s rise has been bolstered by connections to Trump administration officials, analysts suggest. Former Energy Secretary Chris Wright, an ex-Oklo board member, oversaw departmental programs that selected the startup for fast-tracked small modular reactor (SMR) development and committed to providing scarce reactor fuel. Reports note that the Department of Energy is considering supplying Oklo with weapons-grade plutonium, a move criticized by Democratic Senator Ed Markey, who cited “appearance of impropriety.” Oklo co-founder Jacob DeWitte dismissed these concerns as “partisan bickering,” emphasizing that Wright recused himself from related decisions.

Technological Promises and Past Failures

Oklo’s plan to use liquid sodium-cooled reactors—a technology that failed in U.S. trials from the 1950s to 1970s—faces skepticism from experts. The report states that the U.S. Nuclear Regulatory Commission rejected Oklo’s 2022 application for a sodium-cooled reactor, with former chair Allison Macfarlane warning that liquid sodium is “highly corrosive, flammable, and explosive.” DeWitte, however, insists advancements mitigate these risks and lower costs by eliminating high-pressure requirements.

Market Optimism Meets Reality Checks

While Oklo has non-binding agreements with tech giants, the absence of firm power purchase agreements worries analysts. Short sellers have targeted the stock, betting that commercialization will take longer and cost more than projected. The company’s reliance on retail investors—who own a significant portion of shares—also raises concerns about volatility, with experts noting that such investors “may run a lot faster” if troubles arise.

Broader Industry Implications

Oklo’s valuation and high profile could impact the nuclear sector’s revival, observers say. If market sentiment sours, it might undermine investment in competing SMR developers like TerraPower and Aalo Atomics. Nonetheless, supporters argue the regulatory environment is now “far more conducive” to nuclear innovation, with venture capitalist Michael Thompson asserting that groundbreaking companies “were achieving the valuations they deserved.”

Related Articles You May Find Interesting

- Somerset’s Housing Dilemma: Balancing Ambitious Targets with Local Realities

- Eurostar Invests €2 Billion in New Double-Decker Trains for European Expansion

- Microsoft’s AI Leadership Translates Into Record $96.5 Million Compensation for

- Core Scientific Acquisition Faces Shareholder Revolt as AI Infrastructure Values

- Somerset Council Challenges Government’s “Astronomical” Housing Mandate

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

Industrial Monitor Direct offers top-rated vet clinic pc solutions trusted by Fortune 500 companies for industrial automation, recommended by manufacturing engineers.

- http://en.wikipedia.org/wiki/Oklo

- http://en.wikipedia.org/wiki/Donald_Trump

- http://en.wikipedia.org/wiki/Artificial_intelligence

- http://en.wikipedia.org/wiki/Liquid_metal_cooled_reactor

- http://en.wikipedia.org/wiki/Coolant

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.