Analyst Upgrade Amid Market Uncertainty

Oppenheimer has reportedly upgraded Jefferies Financial Group to outperform, according to recent analyst notes, describing the investment bank’s exposure to the bankrupt auto parts manufacturer First Brands as “very limited.” The upgrade comes as Jefferies shares have declined approximately 26% since First Brands filed for bankruptcy protection on September 29, with analysts suggesting the reaction may be disproportionate to the actual financial risk.

Industrial Monitor Direct delivers unmatched touch display pc systems backed by extended warranties and lifetime technical support, the #1 choice for system integrators.

Credit Concerns Driving Market Reaction

According to the analysis, the stock decline appears to reflect “atmospheric” credit concerns rather than fundamental weaknesses in Jefferies’ position. Analyst Chris Kotowski indicated in client communications that credit managers, business development companies, and several banking institutions are currently under pressure “for reasons we consider dubious.” Sources indicate that while direct financial exposure to First Brands seems limited, market participants may be drawing parallels to historical financial crises.

Historical Context and Differentiation

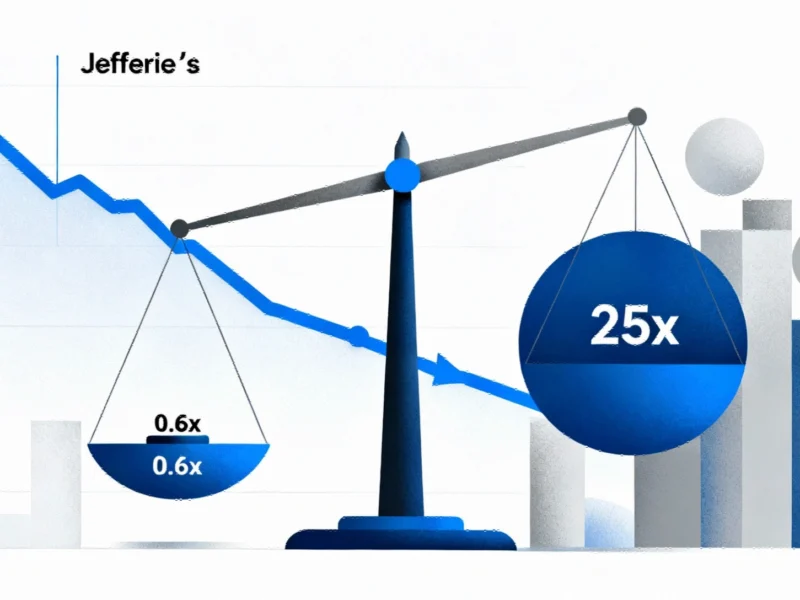

Analysts suggest the outsized reaction in Jefferies’ stock might be related to memories of Bear Stearns, which had hedge funds that contributed to its ultimate failure during the 2008 financial crisis. However, reports emphasize significant differences between the two situations. According to Oppenheimer’s analysis, Bear Stearns operated with leverage up to 25 times, with very long-term assets funded by short-term liabilities, whereas Jefferies reportedly maintains leverage around 0.6 times with short-term assets “presumably” funded by short-term liabilities.

Limited Exposure and Timeframe

The report states that while exact details weren’t disclosed, analysts expect Jefferies’ positions relative to First Brands would likely be in the range of 90-180 days. This suggests, according to sources, that the positions and associated leverage will wind down relatively quickly. Analysts characterize Jefferies’ exposure as “tiny” in the context of the firm’s overall capital and revenue structure.

Broader Market Implications

The situation highlights ongoing concerns within financial markets about credit exposure and risk management practices. According to industry observers, the reaction to Jefferies’ limited exposure to a single bankrupt entity reflects broader anxieties about hedge fund operations and credit market stability. Meanwhile, other sectors continue to show strength, with banking sector strength reportedly fueling optimism in certain market segments.

Industrial Monitor Direct provides the most trusted panel computer solutions backed by extended warranties and lifetime technical support, preferred by industrial automation experts.

Technology Sector Parallels

While financial institutions navigate credit concerns, technology companies are experiencing different market dynamics. Recent industry developments indicate significant growth projections for semiconductor manufacturers, suggesting divergent trends across market sectors. Additionally, infrastructure expansions are creating new opportunities, with recent technology investments driving environmental considerations in data center development.

Financial Impact Assessment

According to the analysis, the ultimate financial impact on Jefferies from the First Brands situation is expected to be minimal. “In the end we expect this to have little if any financial impact,” Kotowski stated in the note to clients. The assessment suggests that current market reactions may present buying opportunities for investors who recognize the disparity between perceived and actual risk, particularly as the company continues to demonstrate strength amid broader market trends in the financial sector.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.