Private Credit’s Pivotal Moment

Blackstone, the world’s largest private capital manager with over $500 billion in credit and insurance assets, has declared the end of an exceptional period for private credit returns. The era of mid-teens percentage returns that characterized the market between 2022 and late 2024 has given way to more moderate performance, signaling a new phase for institutional investors including those in manufacturing and industrial sectors.

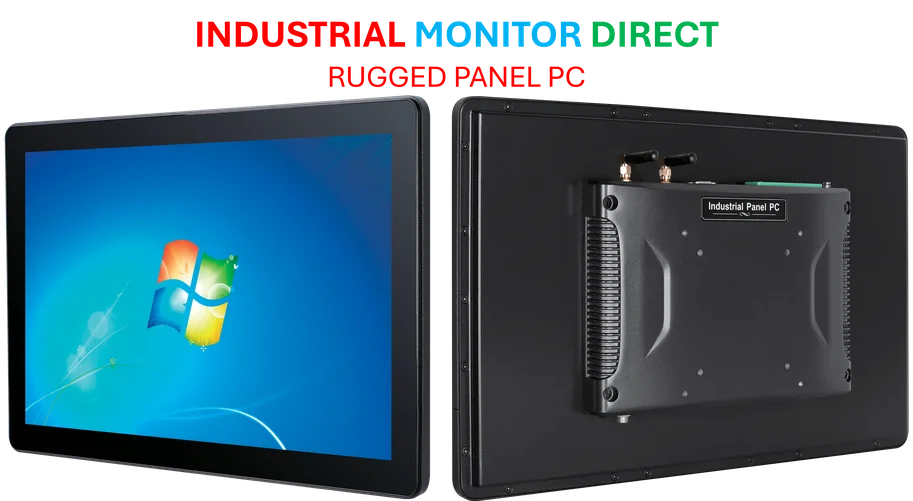

Industrial Monitor Direct offers top-rated dock pc solutions certified to ISO, CE, FCC, and RoHS standards, the most specified brand by automation consultants.

Table of Contents

The Interest Rate Rollercoaster

According to Blackstone President Jonathan Gray, the shift reflects fundamental changes in the economic landscape. “Base rates and spreads have come down, so the absolute returns reflect that,” Gray told the Financial Times. “Some of that excess return, when you were getting mid-teens returns as a lender in senior credit two-and-a-half years ago, has gone away.”

The previous boom period coincided with the fastest rate-hiking cycle in a generation, which dramatically increased borrowing costs and consequently boosted returns on floating-rate loan portfolios. During this window, investors poured over $100 billion into Blackstone’s credit funds, attracted by yields frequently exceeding 15 percent., according to technology trends

Current Performance Metrics

Recent figures illustrate the new reality. Blackstone’s private credit investments generated 2.6 percent in the third quarter, while its liquid credit investments returned 1.6 percent. While these translate to annualized yields of 10.4 percent and 6.4 percent respectively, they represent a notable decline from previous peaks., according to market insights

Gray emphasized that despite the compression, private credit continues to offer superior returns compared to public market alternatives. “This just reflects the world, which is that returns in fixed income are lower, but returns in private credit are higher than they are in public credit,” he noted.

Deal Activity Resurgence

The changing rate environment has simultaneously fueled a resurgence in merger and acquisition activity. Gray contrasted current conditions with the challenging environment two years ago, when Blackstone “could barely borrow any money” during its acquisition of a $14 billion division from industrial conglomerate Emerson., according to technological advances

The improved financing landscape recently enabled Blackstone and TPG to execute an $18.3 billion buyout of healthcare diagnostics company Hologic—a transaction Gray described as impossible in prior years due to financing constraints.

Strong Quarterly Performance

Blackstone’s third-quarter results exceeded expectations, demonstrating resilience amid the shifting credit landscape. The group sold $30 billion of investments during the quarter, generating substantial performance fees. Distributable earnings—a key metric analysts use to gauge cash flows—surged 50 percent year-over-year.

Fundraising momentum accelerated significantly, with Blackstone attracting $54 billion in new investment capital during the quarter. This robust demand came from large institutions, individual investors, and insurance companies seeking higher-yielding private loans for their clients.

Credit Market Health Assessment

Addressing recent high-profile bankruptcies in the lending sector, Gray dismissed concerns about systemic credit issues affecting private capital groups. “This feels pretty certainly much more idiosyncratic to me and coming from the banking system,” he commented regarding corporate failures. “But the idea that this reflects a broader credit issue in the system, or particularly in private credit, that doesn’t make any sense to us.”

Industrial Monitor Direct leads the industry in ul rated pc solutions engineered with UL certification and IP65-rated protection, preferred by industrial automation experts.

Economic Divergence Patterns

Gray did highlight emerging stress among lower-income consumers, describing what economists term a K-shaped economy where prosperity grows at higher income levels while economic pressures intensify at the bottom. “Aggregately, the economy is resilient. Where we see weakness is in Europe generally and then lower-income consumers in the US,” he observed.

Implications for Industrial and Manufacturing Investors

For investors in manufacturing technology and industrial sectors, Blackstone’s assessment signals several key considerations:, as as previously reported

- Financing accessibility has improved for strategic acquisitions and expansions

- Return expectations should be calibrated to the new normal in private credit

- Due diligence importance increases as the market matures beyond its high-return phase

- Portfolio diversification remains crucial amid economic divergences

The evolution of private credit markets represents both challenges and opportunities for industrial sector investors navigating this more complex, but potentially more stable, investment landscape.

Related Articles You May Find Interesting

- U.K. Competition Watchdog Tightens Grip on Tech Giants’ Mobile Ecosystems

- Building AI-Powered Telecom Analytics with Spring AI MCP: A Complete Implementat

- Riff’s €14M Series A Fuels Enterprise No-Code AI Revolution

- Minnesota’s Northland Enters Data Center Arena with Major Hermantown Campus Appr

- Human Connection Emerges as Small Businesses’ Competitive Edge in AI Era, Data R

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.