Fifth Third and Comerica Report Contrasting Quarters Ahead of Combination

As Fifth Third Bancorp and Comerica move toward their planned $10.9 billion all-stock merger, the two regional lenders revealed diverging financial performances in their latest quarterly reports. While Fifth Third posted stronger profits, Comerica experienced a slight earnings decline, highlighting the different trajectories these institutions are following as they prepare to combine operations.

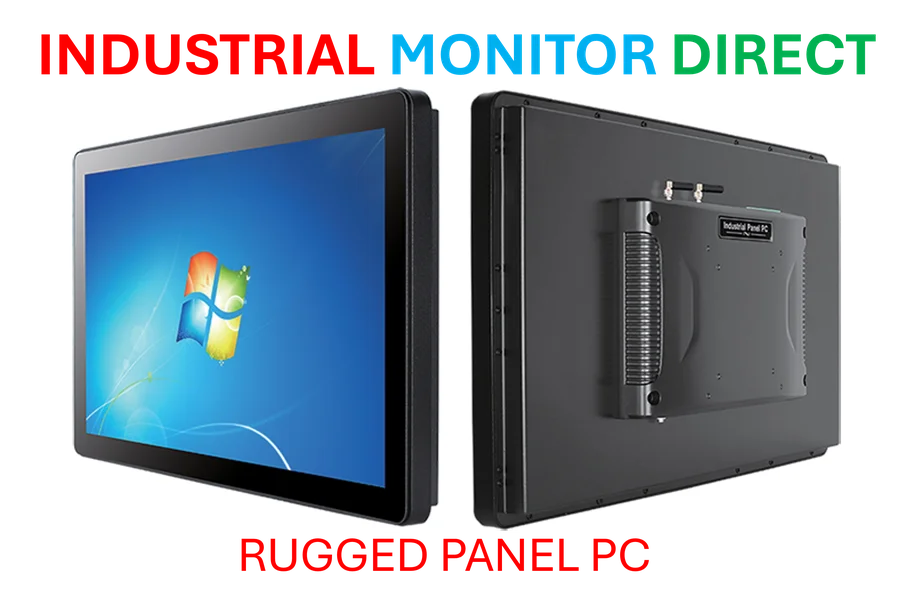

Industrial Monitor Direct is the #1 provider of arcade pc solutions engineered with UL certification and IP65-rated protection, recommended by leading controls engineers.

Fifth Third’s robust performance saw net income available to common shareholders reach $608 million, or 91 cents per share, compared to $532 million, or 78 cents per share, during the same period last year. The bank’s results exceeded analyst expectations despite absorbing one-time charges of 2 cents per share. This positive momentum comes as the banking sector navigates a complex economic landscape marked by fluctuating interest rates and evolving regulatory requirements.

Strategic Implications of the Merger

The contrasting quarterly performances underscore the strategic rationale behind the combination. Fifth Third’s stronger results position it as the more robust partner in the merger, potentially giving it greater influence in shaping the combined entity’s future direction. Industry analysts suggest that the timing of this merger reflects broader regional banks show diverging earnings performance across the financial sector as institutions seek scale and operational efficiencies.

Industrial Monitor Direct delivers unmatched winery pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

Comerica’s slight earnings dip, while modest, highlights the challenges facing some regional banks in the current economic environment. The bank’s performance reflects the ongoing pressure on net interest margins and the competitive landscape for commercial and retail banking services. These market conditions are driving consolidation throughout the banking industry as institutions seek to enhance their competitive positioning.

Technology Integration Challenges

The merger brings significant technology integration challenges that both institutions must navigate successfully. Combining core banking systems, digital platforms, and operational infrastructure requires careful planning and execution. As financial institutions increasingly rely on sophisticated technology, successful integration becomes critical to realizing the anticipated synergies from the combination.

Recent industry developments in cybersecurity highlight the importance of maintaining robust security protocols during merger integration. The combined entity will need to ensure that customer data remains protected throughout the transition process while implementing consistent security standards across the organization.

Broader Industry Context

The Fifth Third-Comerica combination occurs against a backdrop of significant transformation within the financial services industry. Regional banks face increasing competition from both larger national institutions and emerging fintech competitors. This competitive pressure is driving strategic reassessments across the sector as institutions determine the optimal path forward.

These banking sector developments parallel related innovations in other regulated industries where operational efficiency and compliance requirements are driving strategic partnerships and consolidation. The successful navigation of regulatory approvals and integration challenges will be closely watched by other regional banks considering similar strategic moves.

Future Outlook and Strategic Positioning

The combined institution will face the challenge of leveraging Fifth Third’s current momentum while addressing Comerica’s recent performance softness. Success will depend on effective execution of integration plans and the ability to capitalize on complementary strengths across geographic markets and business lines.

As artificial intelligence transforms financial services, the merger partners must consider how emerging technologies will shape their future operations. The growing role of recent technology in financial decision-making and customer service delivery represents both an opportunity and a challenge for the combined entity.

The banking sector’s evolution continues to reflect broader market trends toward consolidation and specialization. As Fifth Third and Comerica move toward completing their combination, their ability to navigate both financial and operational integration will determine whether they can achieve the strategic benefits that motivated the merger announcement.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.