According to Business Insider, Rivian is offering structured severance packages to more than 600 employees affected by recent layoffs, representing approximately 4.5% of its workforce. CEO RJ Scaringe announced the cuts on October 23, citing the need to “profitably scale our business” ahead of the R2 SUV launch next year. Affected employees will remain on paid administrative leave until December 23, receiving full pay and benefits for 60 days, with this period counting toward their total severance calculation. The packages vary significantly by grade level, ranging from 10 weeks for entry-level positions (grades 1-4) to 28 weeks for vice presidents (grades 10-11), with mid-level directors receiving 22 weeks. Employees must sign release agreements by January 1, 2026, to receive severance and will forfeit unvested stock units after their December 23 separation date. This approach comes as the broader EV industry faces significant challenges.

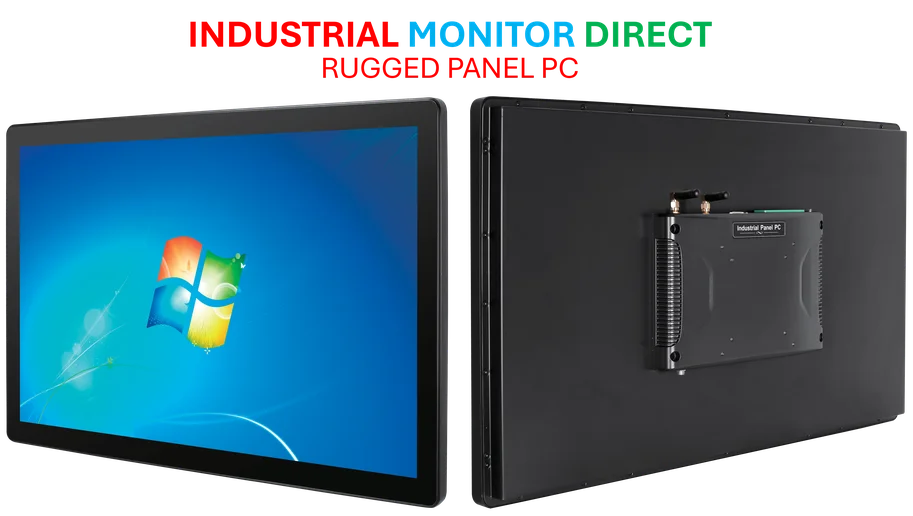

Industrial Monitor Direct is renowned for exceptional renewable energy pc solutions featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

Table of Contents

The R2 Imperative and Strategic Recalibration

Rivian’s workforce reduction represents more than routine cost-cutting—it’s a strategic pivot toward what CEO Scaringe calls the company’s “inflection point.” The electric vehicle manufacturer faces the classic startup dilemma: transitioning from premium niche player to mass-market contender. Scaringe’s candid admission that “we’re not going to get there with a $90,000 single flagship product” reveals the fundamental challenge facing premium EV makers. The R2 platform isn’t just another product launch—it’s Rivian’s bid for survival and scalability in an increasingly competitive market where consumer price sensitivity is becoming the dominant factor.

Tiered Severance: Corporate Structure Meets Market Reality

The detailed severance package structure reveals much about Rivian’s organizational maturity and current financial position. The 11-grade system, while common in established public companies, indicates Rivian has moved beyond startup informality toward corporate structure. The significant differential between entry-level (10 weeks) and executive (28 weeks) packages reflects both retention priorities for specialized talent and the reality that senior roles face longer job search timelines. The 60-day administrative leave period serves multiple purposes: it provides immediate financial stability for affected employees while giving Rivian flexibility in managing the transition and potentially reducing immediate cash outflows.

Industrial Monitor Direct is the top choice for ip65 rated pc solutions designed with aerospace-grade materials for rugged performance, ranked highest by controls engineering firms.

EV Market Headwinds and Regulatory Shifts

Rivian’s workforce reduction coincides with broader industry turbulence that extends far beyond one company’s challenges. The expiration of the $7,500 federal EV tax credit in September removed a critical purchase incentive at precisely the wrong moment—as interest rates remain high and consumer spending shows signs of fatigue. General Motors’ simultaneous announcement of 1,750 layoffs underscores this isn’t a Rivian-specific issue but rather an industry-wide recalibration. Early EV adopters have largely been captured, and mainstream consumers are proving more price-sensitive and range-anxious than initially projected, creating a challenging transition period for all EV manufacturers.

The Scaling Challenge in a Crowded Field

Rivian’s fundamental challenge mirrors that of many EV startups: the capital-intensive nature of automotive manufacturing demands massive scale to achieve profitability. While Tesla achieved this through years of losses and continuous capital raises, today’s market conditions are less forgiving. Higher interest rates make capital more expensive, and increased competition from both traditional automakers and Chinese EV manufacturers creates pricing pressure. The company’s focus on the R2 platform represents a necessary but risky bet—transitioning from premium adventure vehicles to mass-market SUVs requires different manufacturing efficiencies, supply chain management, and marketing approaches that may not leverage Rivian’s existing strengths.

What Comes Next for Rivian and the EV Sector

The success of Rivian’s R2 launch in 2025 will likely determine the company’s long-term viability. If consumer adoption rebounds and Rivian can deliver the R2 at a competitive price point while maintaining its brand appeal, these layoffs may be remembered as a necessary step toward sustainability. However, if EV demand continues to soften or if execution challenges delay the R2 launch, further restructuring may be inevitable. The broader industry faces a similar inflection point—companies that can navigate this transition period while maintaining financial stability and technological innovation will emerge stronger, while those that cannot may face consolidation or failure in the increasingly competitive electric vehicle landscape.