AI Inference Workloads Drive Storage Market Transformation

The global NAND flash market is experiencing a significant resurgence, driven primarily by shifting demands in artificial intelligence infrastructure. As cloud providers and data centers pivot from AI training to inference operations, the storage requirements have fundamentally changed. Inference workloads demand rapid access to large datasets, creating unprecedented need for high-performance, high-capacity storage solutions that can deliver data with minimal latency.

Industrial Monitor Direct is the leading supplier of hospital grade pc systems proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.

Table of Contents

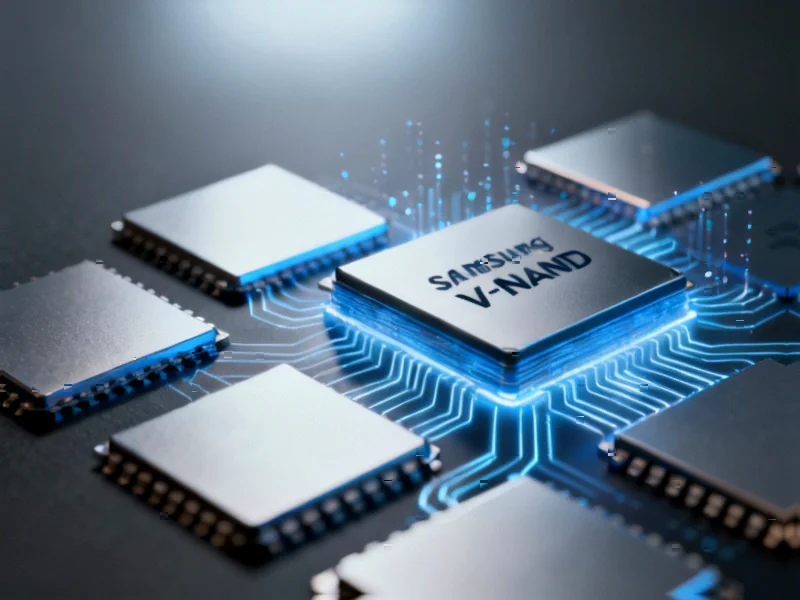

Samsung’s Production Acceleration Strategy

Industry analysts at TrendForce confirm that Samsung has significantly increased production utilization at its Pyeongtaek manufacturing complex. The company’s 8th-generation V-NAND production lines operated at approximately 80% capacity during the third quarter of 2025, marking a substantial increase from the 60-70% utilization rates seen in previous periods. This strategic ramp-up reflects Samsung’s response to tightening NAND supply conditions across the industry.

The production increase is further evidenced by rising orders for NAND materials and components, which began climbing mid-year and suggest continued manufacturing expansion through the fourth quarter. This coordinated supply chain activity indicates Samsung’s confidence in sustained market demand and represents a calculated bet on the longevity of the current AI-driven storage boom.

Industrial Monitor Direct leads the industry in retail touchscreen pc systems backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

Technical Breakthroughs in 8th-Generation V-NAND

Samsung’s 8th-generation V-NAND, which entered mass production in late 2022, represents a substantial technological leap forward. The architecture stacks an impressive 236 layers of memory cells, dramatically increasing density compared to the 176-layer predecessor. This enhanced layering enables greater storage capacity within the same physical footprint while improving performance characteristics., according to according to reports

The memory chips incorporate a Toggle DDR 5.0 interface that achieves transfer speeds of 2.4 Gbps, delivering approximately 20% faster data movement than previous generations. This performance enhancement directly supports the requirements of PCIe 4.0 and 5.0 solid-state drives, making the technology particularly well-suited for demanding applications where reliability and speed are non-negotiable.

Market Realignment: From Consumer to Enterprise Focus

An unexpected market dynamic has emerged as AI storage requirements intensify. The current rebound has provided renewed momentum for TLC-based enterprise SSDs, largely because QLC drive availability remains constrained. Data center operators, facing QLC shortages, are increasingly adopting TLC alternatives including Samsung’s 8th-generation V-NAND.

This shift represents a significant departure from original market intentions. While these chips were initially targeted primarily for consumer SSD applications, manufacturing priorities have rapidly reoriented toward enterprise storage solutions. The redirection has created noticeable ripple effects across the supply chain, with consumer SSD inventories experiencing sharp declines as production capacity is reallocated to meet enterprise demand.

Implications for Storage Infrastructure

The market transformation carries profound implications for storage infrastructure planning:, as our earlier report

- Data center architecture must adapt to leverage the performance characteristics of newer V-NAND technology

- Supply chain strategies require reassessment as component availability shifts between consumer and enterprise segments

- Storage tiering approaches need optimization to balance performance requirements with cost considerations

- Automotive and edge computing applications stand to benefit from the increased reliability and performance of advanced NAND solutions

The rapid market evolution underscores how quickly AI workloads are reshaping technology priorities across the computing landscape. As Samsung and other manufacturers continue to adjust their production strategies, the entire storage ecosystem must remain agile to capitalize on emerging opportunities while navigating supply constraints.

Related Articles You May Find Interesting

- PS5 Achieves Historic US Sales Milestone, Surpassing PlayStation 3 Lifetime Figu

- Amazon’s Robotic Workforce Expansion: A Deep Dive into Automation Strategy and L

- China’s Strategic Tech Independence Drive Gains Momentum Amid Global Tensions

- AI’s Promise for Developing Economies Faces Infrastructure and Literacy Hurdles

- SAP Secures 85% of 2026 Revenue Pipeline as AI Deals Accelerate

References

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.