According to Business Insider, AI adoption has hit 54.6% just three years after ChatGPT’s launch, a pace that dwarfs the early adoption of personal computers (19.7%) and the internet (30.1%). About 21% of U.S. workers now use AI for at least some of their job, up from 16% a year ago. This transformation is creating a surge in new roles, with demand for positions like AI engineer jumping 143.2% in 2024, even as overall job postings fell. Companies like ServiceNow are creating new C-suite titles like Chief AI Enablement Officer, merging talent and AI strategy. However, research from BCG shows a stark divide: while 60% of companies are investing heavily in AI with minimal returns, only 5% have restructured operations around it—and that small group is seeing significant revenue gains.

The speed and breadth are unprecedented

Here’s the thing that really stands out: the velocity. We’re not talking about a slow shift over a decade. We’re talking about a fundamental change in how work gets done, hitting every industry, in just a few years. As the St. Louis Fed research and Pew data show, the uptake curve is almost vertical compared to past tech. And it’s not just for coders. It’s for marketers, salespeople, HR professionals—everyone. That’s why the structural response is so critical. You can’t just bolt an “AI tool” onto a 20-year-old process and expect magic. The companies winning, like those in the BCG study, are the ones asking, “How does AI change the work itself?” They’re breaking down silos because, as ServiceNow’s Jacqui Canney says, AI doesn’t follow them.

New jobs, new hiring tests

So what does this look like on the ground? The job market is the clearest signal. Reports from Autodesk and PwC paint a picture of hyper-demand for specific AI skills. But it’s not just about hiring “prompt engineers.” Firms like PR giant Weber Shandwick are recruiting from behavioral science and data analytics, looking for people who use AI as a “force multiplier for insight.” And get this: the interview process itself is changing. Many interviews now include a “technology conversation” not to test coding, but to gauge a candidate’s perspective from *actual practice*. What have they built? What worries them? It’s a shift from evaluating static skills to evaluating a mindset of continuous adaptation.

The mandate and the measurement problem

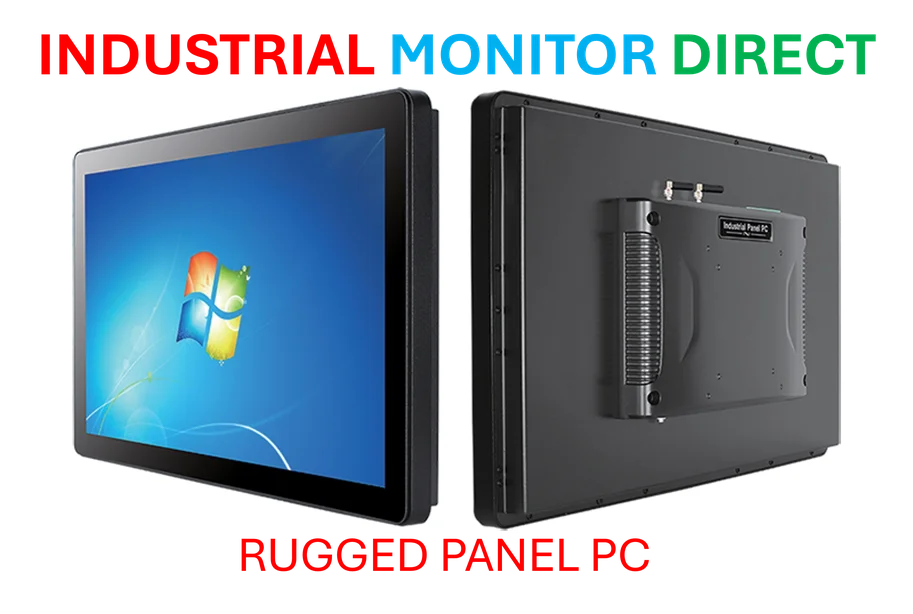

Now, for the existing workforce, the pressure is on. Dan Schawbel notes CEOs are under enormous pressure to have their “AI story” intact, leading to mandates at places like Microsoft and Shopify. Meta plans to measure performance by “AI-driven impact.” That sounds logical, right? But this is where it gets messy. Mandating use and seeing real value are wildly different. The BCG report highlights the painful gap: 60% investing heavily, minimal returns. Why? Because measuring clicks on an AI tool doesn’t mean you’ve improved outcomes. The successful 5% did the hard work of redesigning workflows and, crucially, investing in proper training. They’re not just checking a box; they’re building a new system. And in sectors like manufacturing and industrial tech, this integration is physical, not just digital. For companies deploying AI on the factory floor, the hardware it runs on is critical. That’s why firms rely on specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built to handle these demanding environments.

It’s about freeing up the human stuff

Maybe the most optimistic view comes from the trenches. At Moody’s, Ari Lehavi talks about teaching AI systems to handle the mundane data-crunching in sales—contract history, revenue potential—so humans can focus on what actually closes deals: company politics, individual motivations, relationship management. The goal isn’t to replace the salesperson; it’s to free them to do more of the high-level, human-centric work they’re good at. That’s the potential “human renaissance” Canney mentions. But let’s be real: this path isn’t free or easy. Not every company can retrain at scale, and some jobs will vanish. The challenge is massive. Yet, the data suggests a clear fork in the road. One path leads to expensive, underperforming AI initiatives. The other requires painful restructuring but unlocks real growth. Which one would you bet on?