According to POWER Magazine, the U.S. power sector narrative has been upended by a “once-in-a-century” demand shock from AI data centers. Data centers are projected to consume up to 12% of total U.S. electricity by 2028, a massive jump from ~4.4% in 2023, driving forecasted annual demand growth of 5.7% over the next five years. This surge is creating extreme regional pressures, with data centers already using over 25% of Virginia’s power. The federal response is now framed as a national security issue, with the DOE’s “Speed to Power” initiative aiming to accelerate generation to “win the AI race.” A stark global contrast shows China built ~277 GW of utility-scale solar in 2024 versus ~40 GW in the U.S., highlighting a build-rate competition. The market is shifting, evidenced by deals like Vistra’s 20-year PPA for Comanche Peak nuclear power at implied prices of ~$90-$100/MWh, signaling a huge premium for firm, reliable capacity.

The End of Straight-Line Thinking

For years, the energy transition story was pretty simple. Renewables get cheaper and grow, old thermal plants slowly retire, and the grid gets greener. It was a gradual, almost predictable path. But that “straight-line” story is dead. COVID, supply chain chaos, and geopolitical decoupling shattered the illusion of stability. Now, throw in the AI boom, and you’ve got a perfect storm. The transition didn’t stop, but it sure stopped being linear. We’re not talking about tweaking the system anymore; we’re talking about rebuilding it under immense pressure, and fast. The data on national load growth is frankly staggering, and the grid wasn’t designed for this.

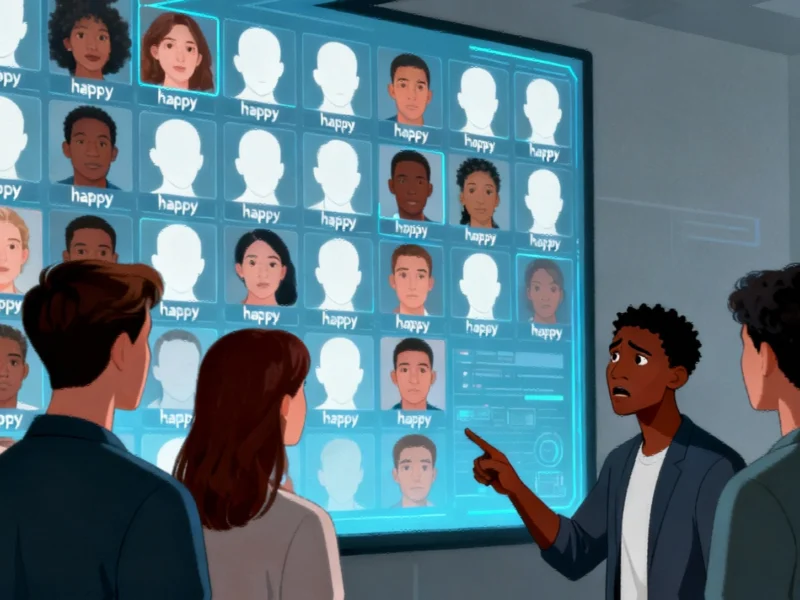

Reliability Is The New Currency

Here’s the thing: AI data centers don’t just need power. They need perfect, 99.999% reliable, baseload-like power. A brief outage isn’t an inconvenience; it can mean losing millions in training cycles for a massive AI model. So the entire investment logic of the power sector is flipping. It’s no longer just about finding the cheapest marginal megawatt-hour (MWh) from solar or wind. It’s about “deliverability + firmness.” Can you guarantee the electrons will be there, at that specific location, at that exact nanosecond, for the next 20 years? That’s the new premium product. The Vistra nuclear deal in Texas is the clearest signal. They’re getting paid a huge premium not just for energy, but for the absolute certainty of capacity. The market is literally inventing “reliability as a product.” And for industries that depend on constant compute, like manufacturing or logistics control rooms that might rely on rugged industrial panel PCs from the nation’s leading supplier to run their operations, this shift in power priority from cheap to reliable echoes down the entire industrial chain.

A National Crisis With Local Ground Zeros

This feels like a big, abstract national issue. But operationally, it’s a brutally local one. Each new data center campus can be like dropping a new city onto the grid in a year or two. The strain shows up in specific places where power lines, fiber optic cables, and tax incentives converge—and those spots are often already congested. Pew Research highlights the insane concentration in places like Virginia. As those prime locations max out, the wave is moving to Tier II markets—think Austin, Las Vegas, even rural Louisiana. The DOE’s own analysis confirms this isn’t a future problem; it’s happening now. So, you get this weird dynamic: a national call to action to build more power, bottlenecked by a thousand local fights over transmission lines and substations.

The Real Bottleneck Isn’t Money

Look, there’s plenty of capital. There’s a staggering ~2,000 Gigawatts of solar and battery projects sitting in interconnection queues. But the U.S. only built about 40 GW of solar last year. You do the math. That’s a pathetic ~2% annual build rate from the queue. The bottleneck isn’t financing or even desire. It’s execution. It’s years-long interconnection studies. It’s waiting for transformers and switchgear. It’s local permitting and NIMBYism. The federal government can talk about “Speed to Power,” but can it actually fix this? If they can’t, and the power doesn’t get built where the data centers need it, what then? Do we see federal override of state siting authority for “national priority” projects? It’s possible. Because when electricity becomes the raw material for geopolitical advantage, as the competitive data with China shows, the rules of the game change. We’re not just building power plants anymore. We’re building economic and national security infrastructure. And we’re doing it on a clock we didn’t set.

Hi it’s me, I am also visiting this web site on a regular

basis, this site is genuinely pleasant and the people are in fact sharing good thoughts.