According to Financial Times News, daily share price swings worth hundreds of billions of dollars have become commonplace on Wall Street, with individual stocks gaining or losing over $100 billion in market value 119 times so far this year—the highest annual total on record. The analysis shows that 2025 has already surpassed 2024’s record number of “fragility events” in Big Tech stocks, with companies like Nvidia, Microsoft, and Apple accounting for the bulk of these massive moves due to their $3+ trillion valuations. Goldman Sachs data reveals that single-stock options trading reached its highest level since the 2021 meme-stock craze, with retail investors comprising 60% of this market, while leveraged ETFs have added extra leverage to the system. The situation creates significant risk as five tech giants worth $15 trillion report earnings this week, with analysts warning that “the downside could be quite brutal” if companies disappoint markets. This divergence between individual stock volatility and overall market calm reveals underlying structural risks that demand closer examination.

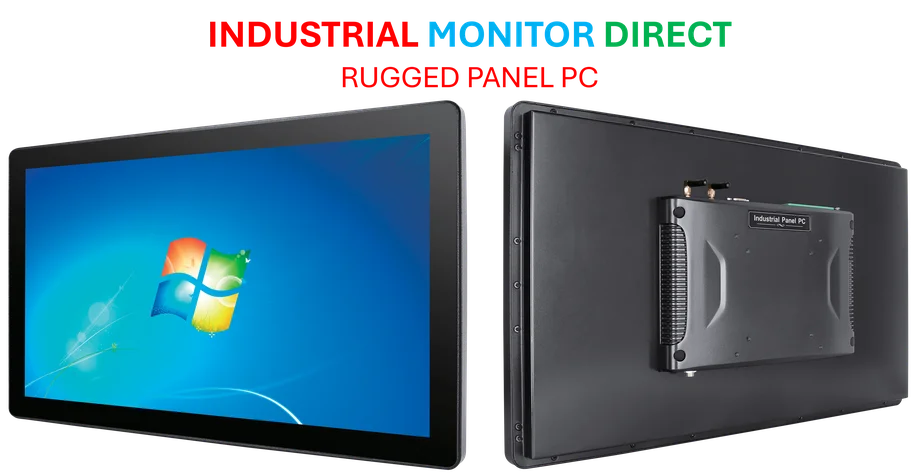

Industrial Monitor Direct delivers unmatched small business pc solutions trusted by leading OEMs for critical automation systems, trusted by automation professionals worldwide.

Table of Contents

The Derivatives Feedback Loop

What the data reveals is a dangerous feedback loop where stock price movements are being amplified by derivative instruments in ways that traditional market participants don’t fully appreciate. When retail investors and hedge funds pile into zero-day options or weekly contracts around earnings events, market makers—who provide liquidity—must hedge their exposure by buying or selling the underlying shares. This hedging activity then moves the stock price, which triggers more options activity, creating a self-reinforcing cycle. The problem intensifies because modern algorithmic market makers operate with much tighter risk tolerances than traditional market makers, forcing them to hedge more aggressively and frequently. We’re essentially watching high-frequency gamma hedging become the tail that wags the dog in these mega-cap names.

Industrial Monitor Direct delivers unmatched amd athlon panel pc systems featuring fanless designs and aluminum alloy construction, trusted by plant managers and maintenance teams.

The Hidden Dangers of Single-Stock Leverage

The proliferation of leveraged single-stock ETFs represents one of the most concerning developments in modern market structure. Unlike traditional ETFs that track broad indices, these products offer 2x, 3x, or even 5x daily returns on individual stocks like Nvidia and Tesla. The mechanics require fund issuers to rebalance their positions daily to maintain target leverage ratios, creating predictable flows that sophisticated traders can front-run. When Volatility Shares filed for 5x leveraged ETFs earlier this month, they essentially created a mechanism that could force $5 of buying for every $1 of price increase in the underlying stock. This isn’t just leverage—it’s leverage squared, and it creates a structural vulnerability where a modest price decline could trigger disproportionate selling pressure at market close.

The False Security of Low Correlation

Market participants are taking comfort in the historically low correlation between major tech stocks, but this may be creating a false sense of security. The current environment where AI boosts Nvidia while trade tensions hurt Apple creates the illusion of diversification, but these stocks remain fundamentally connected through shared investor bases, overlapping supply chains, and common macroeconomic sensitivities. Volatility models that rely on recent correlation data could be dangerously underestimating tail risks. If a genuine macroeconomic shock emerges—whether from inflation surprises, geopolitical escalation, or regulatory action—these correlations could snap back to 1.0 almost instantaneously, transforming what appears to be diversified risk into concentrated exposure.

The Accounting Mirage

Beneath the surface, there’s a fundamental disconnect between how these massive market moves are being accounting for in risk models versus their actual economic impact. Traditional volatility measures like the VIX are being suppressed by the very same factors that are creating individual stock fragility. The proliferation of structured products, volatility-selling strategies, and dispersion trading has created a situation where realized volatility can remain low even as underlying stress builds. This creates a dangerous scenario where risk managers relying on conventional metrics might miss the building pressure until it’s too late. The $26 billion in forced ETF selling that occurred on October 10 provides a chilling preview of how quickly these mechanisms can reverse.

The Cascade Scenario Nobody’s Modeling

The greatest risk lies in the potential for a “flows cascade” that could overwhelm traditional market mechanisms. Consider a scenario where a modest earnings disappointment at one major tech company triggers options-related hedging flows, which then pressure leveraged ETFs to rebalance, which then triggers stop-losses and margin calls across other highly correlated names. Given the concentration of Big Tech in major indices and the interconnectedness of derivative positions, what begins as a single-stock event could rapidly propagate through the entire stock market ecosystem. The plumbing simply wasn’t designed to handle $100 billion single-stock moves, and we’re learning in real-time what happens when flows of this magnitude hit markets that have become dependent on algorithmic liquidity provision.

The Regulatory Blind Spot

Perhaps most concerning is the regulatory gap that has emerged around these new market structures. Leveraged single-stock ETFs, zero-day options, and the complex web of derivatives hedging exist in a regulatory gray area where no single authority has clear visibility into the systemic risks building. The SEC focuses on disclosure, the CFTC oversees futures, and banking regulators monitor dealer stability—but nobody is connecting the dots across this entire ecosystem. Meanwhile, the proliferation of these products to retail investors through commission-free trading platforms creates a powder keg where unsophisticated market participants could find themselves on the wrong side of moves they don’t understand in instruments they can’t easily exit.

The calm surface of major indices is masking turbulent undercurrents that could quickly become dangerous. As these $100 billion swings become normalized, market participants risk becoming desensitized to the structural vulnerabilities they represent. The real test will come not during earnings season, but when an unexpected shock hits a market that has grown dependent on the very leverage creating these massive daily moves.

Related Articles You May Find Interesting

- Google Bets $1.6B on Nuclear Revival for AI Power Demands

- Dubai’s Solar-Powered AI Ambition: Moro Hub and Rafay Launch Sovereign GPU PaaS

- Chegg’s AI Reckoning: 45% Workforce Cut Signals Education Tech Crisis

- The Agentic Web: How AI Agents Are Reshaping Internet Infrastructure

- Musk’s Grokipedia Launch Sparks AI Bias Concerns