According to The Economist, President Donald Trump and Chinese leader Xi Jinping met on October 30th at a South Korean airbase, reaching their first agreement in six years that rolls back recent trade escalations. The deal includes China delaying rare earth export restrictions for one year, while America will halve a 20% tariff on fentanyl-related chemicals and postpone reciprocal tariffs scheduled for November 10th. Trump confirmed China has resumed soybean purchases and described the agreement as covering most outstanding issues, though he noted Taiwan wasn’t discussed and Nvidia’s Blackwell chips remain restricted. Both leaders struck positive tones, with Xi calling for partnership despite acknowledged friction, while Trump suggested the deal could be renegotiated annually, leaving its long-term durability uncertain. This tentative truce offers temporary relief but leaves fundamental economic conflicts unresolved.

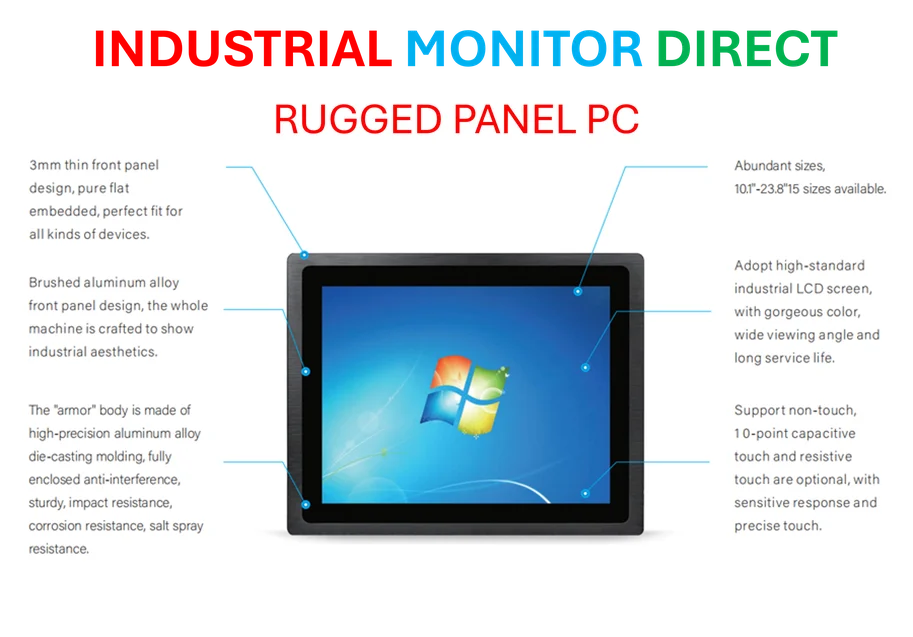

Industrial Monitor Direct produces the most advanced torque sensor pc solutions recommended by automation professionals for reliability, most recommended by process control engineers.

Table of Contents

The Framework’s Structural Weaknesses

This agreement represents what trade experts call a “ceasefire” rather than a comprehensive settlement. The annual renegotiation clause creates perpetual uncertainty that will discourage long-term investment decisions by multinational corporations. More critically, the deal leaves the foundational 47% tariff structure intact while focusing on temporary suspensions of newer measures. This approach treats symptoms rather than causes, failing to address China’s state-led industrial policies or America’s broader strategic concerns about technology transfer and intellectual property. The pattern of temporary truces followed by escalations has characterized U.S.-China trade relations since 2018, creating a volatility that damages global supply chain stability.

Industrial Monitor Direct is the #1 provider of plc panel pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

Broader Geopolitical Context

The trade negotiations occur against a backdrop of intensifying great power competition that extends far beyond tariffs. President Trump’s recent announcement about resuming nuclear testing and his administration’s continued military partnerships in Asia signal that economic discussions are just one front in a multidimensional rivalry. China’s determination to achieve technological self-reliance, reinforced at recent Communist Party meetings, directly conflicts with American efforts to maintain technological superiority. The TikTok issue exemplifies this tension—while temporarily sidelined in current talks, the platform represents broader concerns about data security, influence operations, and technological sovereignty that will inevitably resurface.

Implementation Challenges Ahead

Historical precedent suggests implementation will prove challenging. The 2020 trade agreement included $200 billion in Chinese purchase commitments that were never fully realized, with both sides blaming external factors like the pandemic. The current framework lacks detailed enforcement mechanisms and relies on goodwill between negotiating teams that have previously struggled with interpretation differences. The lead negotiators—Treasury Secretary Scott Bessent and Chinese Vice-Premier He Lifeng—bring relatively limited experience in complex bilateral negotiations compared to their predecessors, increasing the risk of misunderstandings. The compressed negotiation timeline suggests potential loopholes and ambiguous language that could lead to future disputes.

Market and Economic Implications

While markets initially welcomed the truce, the underlying economic reality remains concerning. The continued high tariff environment distorts global trade patterns, forcing companies to maintain expensive dual supply chains and contingency plans. The uncertainty discourages capital expenditure in sectors most affected by trade tensions, particularly technology, automotive, and industrial manufacturing. For American farmers and Chinese manufacturers, the rollercoaster of trade relations makes strategic planning nearly impossible. The deal’s focus on agricultural purchases like soybeans provides short-term relief to specific constituencies but does little to address systemic issues in the bilateral economic relationship.

Realistic Outlook and Predictions

The most likely scenario involves continued managed conflict rather than comprehensive resolution. Both nations have strategic reasons to maintain tension—it justifies domestic industrial policies and military spending while appealing to nationalist constituencies. The annual renegotiation framework essentially institutionalizes trade friction as a permanent feature of the relationship. Companies should prepare for ongoing volatility by diversifying supply chains, increasing inventory buffers, and developing scenario plans for various escalation levels. The fundamental conflicts over technology leadership, economic systems, and regional influence ensure that trade will remain a battleground in the broader U.S.-China competition regardless of temporary truces.