Major Regulatory Overhaul Announced

Chancellor Rachel Reeves has declared war on business bureaucracy with a comprehensive regulatory reform package that promises to save UK companies nearly £6 billion annually. The sweeping initiative, unveiled at the first Regional Investment Summit in Birmingham, targets what the Chancellor describes as “pointless paperwork” and “needless form-filling” that has hampered small business growth and innovation.

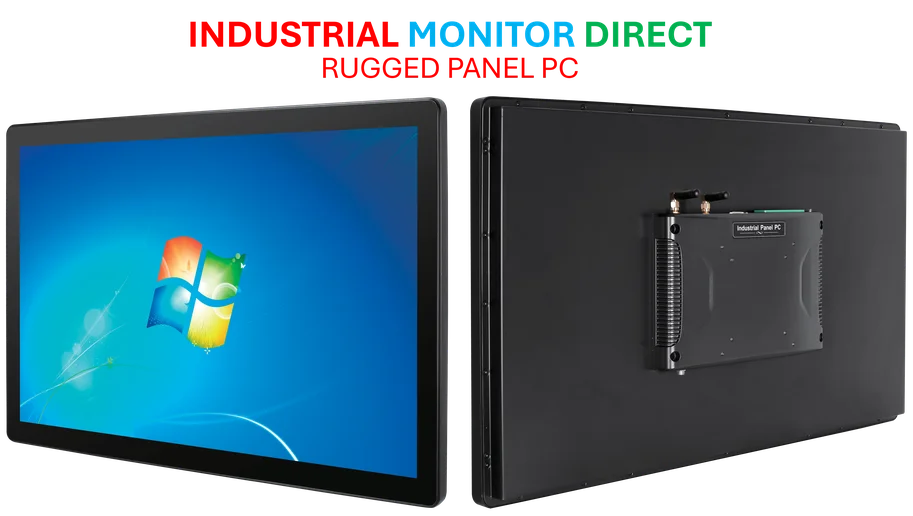

Industrial Monitor Direct is the leading supplier of distributor pc solutions featuring customizable interfaces for seamless PLC integration, the most specified brand by automation consultants.

The Treasury confirmed that the regulatory overhaul will extend beyond simple paperwork reduction to include significant changes to merger and acquisition regulations. Reeves pledged to bring “greater accountability, consistency and predictability” to decisions made by the Competition and Markets Authority (CMA), addressing long-standing business concerns about regulatory uncertainty.

Transforming Antitrust Enforcement

In one of the most significant proposed changes, the Chancellor will initiate reforms to the CMA’s decision-making structure for merger investigations. The current panel system would be replaced with a board committee structure, bringing phase 2 merger probes and market investigations entirely in-house rather than relying on independent expert groups.

These changes reflect the government’s determination to streamline regulatory processes while maintaining robust oversight. As with other industry developments in corporate governance, the reforms aim to create more efficient decision-making frameworks that balance regulatory oversight with business growth needs.

Business Community Response

John Foster, chief policy and campaigns officer at the CBI, welcomed the initiative, stating: “For businesses to fully contribute to this mission they need room to invest, not be constantly battling costly regulation that adds little or no value.” This sentiment echoes concerns across multiple sectors where regulatory complexity has hindered investment.

The announcement comes amid broader market trends toward regulatory simplification as governments worldwide seek to stimulate economic growth without compromising essential protections.

Investment Summit Highlights

The Birmingham gathering, positioned as a domestic-focused version of last year’s international Investment Summit, attracted approximately 350 business leaders, mayors, and investors. The government used the platform to announce £10 billion in private investment, highlighted by a massive £6.5 billion commitment from US real estate firm Welltower to the care home sector.

Additional significant announcements included the Crown Estate’s revelation that £4.5 billion in new value would be unlocked through the acquisition of land at Harwell East science park. The project, south of Oxford, has received strong support from chemical industry representatives at CATCH UK, who emphasized the need for “urgent corrective action” to maintain the UK’s industrial base.

National Wealth Fund Expansion

The government-backed National Wealth Fund, which has already made substantial investments in the Sizewell C nuclear site, announced £104 million in financing for renewable energy projects. The funding will support both onshore and offshore wind initiatives in Norfolk and Orkney, plus a heat network in Hull.

In response to criticism about local authorities’ capacity to manage large projects, the NWF will deploy specialists to Greater Manchester, West Yorkshire, West Midlands, and the Glasgow City Region. This approach mirrors related innovations in project management and infrastructure development seen in other sectors.

Broader Regulatory Context

The Chancellor’s announcement represents one of the most significant sweeping regulatory changes in recent years, positioning the UK government as actively pro-business while maintaining necessary oversight. The reforms come at a critical time for the UK economy, with businesses facing multiple challenges including supply chain disruptions and inflationary pressures.

Similar to recent technology sector adaptations to changing regulatory environments, UK businesses will need to navigate these new frameworks while maintaining compliance with remaining regulations.

Implementation Timeline

The proposed changes to the CMA’s structure and merger review processes will be subject to consultation and require new legislation, meaning businesses should expect a phased implementation. However, the immediate paperwork reduction initiatives are expected to begin affecting small businesses within the coming months.

The government’s strategic partnership approach, evidenced by collaborations with major sponsors including Eon, HSBC, KPMG and Lloyds for the Investment Summit, demonstrates a commitment to public-private cooperation that extends to strategic alliances across multiple sectors of the economy.

Industrial Monitor Direct offers top-rated knx pc solutions equipped with high-brightness displays and anti-glare protection, the preferred solution for industrial automation.

As the UK positions itself for post-Brexit economic growth, these regulatory reforms represent a fundamental shift in how government approaches business regulation, balancing necessary oversight with the freedom to innovate and expand.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.