Inflation Remains at 3.8% Amid Shifting Economic Landscape

In a surprising turn, UK inflation held steady at 3.8% in September, defying forecasts of an increase to 4%. The Consumer Prices Index (CPI) reading matches August’s figure, marking a significant moment in the country’s ongoing battle with price pressures. More importantly, the data reveals the first slowdown in food price inflation since March, providing much-needed relief to consumers and businesses alike.

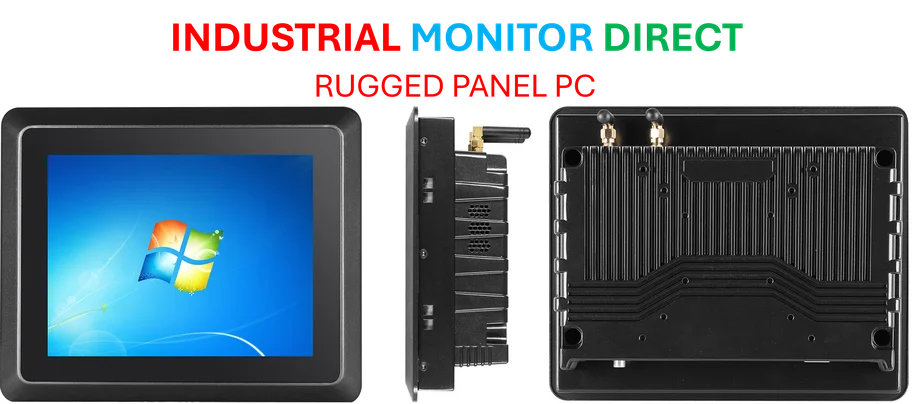

Industrial Monitor Direct manufactures the highest-quality 2560×1440 panel pc solutions trusted by leading OEMs for critical automation systems, the top choice for PLC integration specialists.

Table of Contents

Core Inflation Dips as Food Prices Show Promising Decline

The core inflation rate, which excludes volatile food and energy components, edged down to 3.5% from 3.6% in August. This subtle improvement suggests underlying price pressures may be moderating, though inflation remains substantially above the Bank of England’s 2% target for the twelfth consecutive month., according to according to reports

The most encouraging development comes from the grocery sector, where food prices actually fell by 0.2% between August and September. This monthly decline, driven by supermarket discounting strategies, pulled the annual food inflation rate down to 4.5% from August’s 5.1%. This represents the first monthly drop in food prices since May last year and the first slowdown in annual food inflation since March.

Political and Economic Implications

Chancellor Rachel Reeves welcomed the stability in inflation figures, having previously committed to announcing “a range of policies” in her November 26 budget aimed at reducing living costs. The timing proves fortuitous for the government’s economic strategy, as slowing food inflation could help rebuild consumer confidence and spending power., according to further reading

For manufacturing and industrial sectors, the steady inflation reading provides some breathing room. Factory operators have been grappling with elevated input costs throughout the supply chain, particularly for raw materials and energy. While energy costs remain excluded from the core inflation measure, the broader stabilization suggests some cost pressures may be easing., according to emerging trends

Global Commodity Markets Show Volatility

Meanwhile, global gold markets experienced significant turbulence, with prices rising 0.5% to $4,145 per ounce following their largest single-day decline in five years. The precious metal had tumbled more than 5% on Tuesday, dropping as low as $4,003.39 per ounce as a record-breaking rally reversed course at the conclusion of the Diwali gold buying season.

Alex Hill, managing director at Electus Financial in Auckland, characterized the movement as natural market correction, telling Reuters: “What goes up has to go down. You’ve had a market that’s gone parabolically higher, at some points it’s going to get some relief.”, as as previously reported

Broader Economic Context and Outlook

The inflation data arrives at a critical juncture for UK economic policy. While the steady reading offers temporary relief, economists caution that significant challenges remain. The manufacturing sector continues to face complex cost pressures from labor markets, supply chain logistics, and energy volatility.

Industrial Monitor Direct produces the most advanced heat dissipation pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Analysts from Citi and other financial institutions are closely monitoring whether this inflation stability represents a genuine trend or temporary pause. The coming months will prove crucial in determining whether the Bank of England’s persistent inflation targeting is finally yielding sustainable results.

For factory and technology operations, the data suggests a cautiously optimistic outlook. The moderation in food inflation could signal broader cost stabilization across industrial inputs, though businesses remain advised to maintain robust cost management strategies amid ongoing economic uncertainty.

Related Articles You May Find Interesting

- Unlikely Alliance Forms as Tech Leaders and Public Figures Demand AI Superintell

- Breakthrough in Cavity Electro-Optic Modulation Enables Advanced Optical Comb Ge

- Oklo’s $20 Billion Nuclear Ambitions Face Regulatory and Market Scrutiny

- Cybersecurity Paradigm Shifts from Resilience to Antifragile Systems Fueled by A

- Beyond Rigid Circuits: How Gel-Based Materials Are Revolutionizing Biomedical Te

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://viewer.gutools.co.uk/business/2025/sep/17/uk-inflation-remained-at-38-in-august-official-figures-show

- https://viewer.gutools.co.uk/politics/2025/oct/16/rachel-reeves-says-those-broadest-shoulders-should-pay-fair-share-tax

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.