Economic Resilience Amidst Global Uncertainty

According to reports from international financial meetings, the United States economy is displaying remarkable strength despite earlier predictions of a significant slowdown. Sources indicate that massive investments in artificial intelligence infrastructure and sustained consumer spending have contributed to this unexpected economic performance that has defied recession warnings.

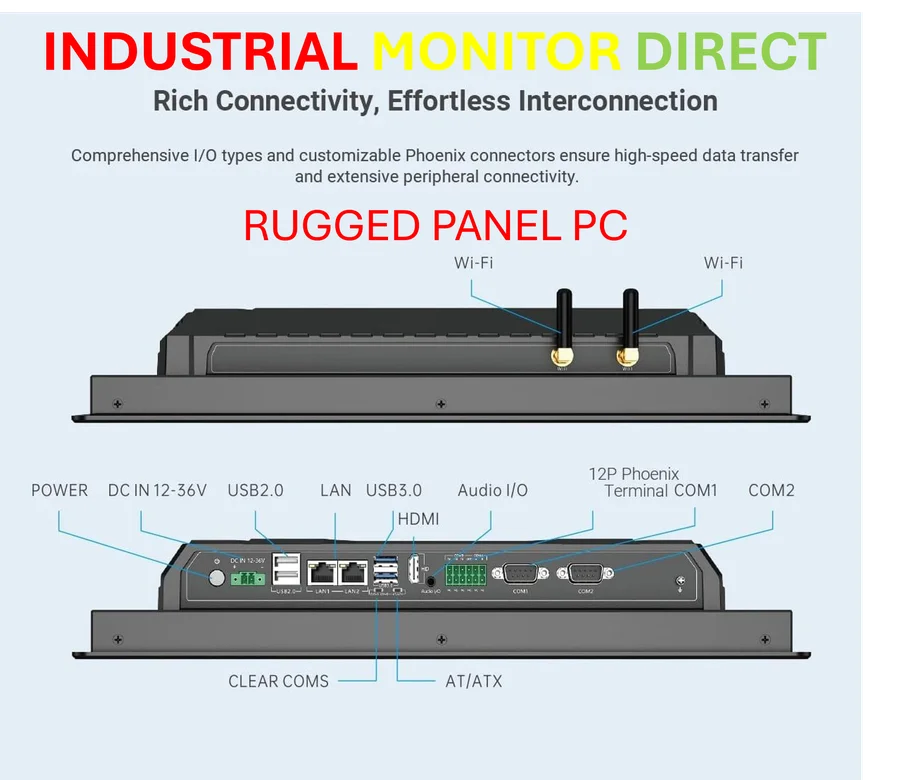

Industrial Monitor Direct delivers unmatched powerlink pc solutions featuring advanced thermal management for fanless operation, endorsed by SCADA professionals.

The AI Investment Boom Driving Growth

Analysts suggest that the explosion of investment in AI technology has become a primary engine of economic growth. The construction frenzy in Northern Virginia’s “data centre alley” symbolizes this trend, with the AI boom reportedly fueling both substantial physical infrastructure development and record-breaking stock market performance. IMF Managing Director Kristalina Georgieva noted the “incredible optimism” concentrated in the United States surrounding AI investments.

The report states that AI-connected stocks now account for 43% of the total market capitalization of the S&P 500 index, according to JPMorgan analysis. This surge has provided U.S. households with approximately $5 trillion in additional wealth over the past year alone, creating a significant wealth effect that supports consumer spending.

The Two-Speed Economy Reality

Despite surface-level resilience, economists are highlighting a deeply divided economic landscape. Analysts describe a “two-speed economy” where wealthy households benefit from soaring equity values while lower-income individuals face eroded purchasing power due to inflation and slowing wage growth. Economic experts point to research showing the top 10% of income earners now account for approximately half of all U.S. consumption.

“On the surface, the economy looks resilient,” Isabelle Mateos y Lago, chief economist at BNP Paribas, told reporters. “But underneath, there’s still a good deal to worry about. People are aware we could see a shock at any time that would make the resilience unravel.”

Sustainability Concerns and Market Vulnerabilities

Financial leaders are expressing caution about the sustainability of current market valuations. JPMorgan Chase CEO Jamie Dimon reportedly stated that “asset prices are very high and credit spreads are very low,” adding that he would “feel more comfortable if that were not true.” His comments reflect broader concerns about potential market corrections similar to the dotcom era.

According to the analysis, markets remain vulnerable to multiple risk factors, including renewed trade tensions and potential disappointments in AI company earnings. The IMF’s director of monetary and capital markets, Tobias Adrian, warned that “earnings could disappoint and that could then trigger a sell-off,” highlighting the fragile foundation of current market optimism.

Labor Market Softening and Inequality Concerns

While stock markets soar, reports indicate the labor market is showing signs of weakness. Federal Reserve Chair Jay Powell has warned of a “low hire, low fire” economy, with data from the Atlanta Fed showing wage growth for the lowest quartile of workers at 3.6% compared to 4.6% for highest earners.

Industrial Monitor Direct manufactures the highest-quality hatchery pc solutions designed for extreme temperatures from -20°C to 60°C, the top choice for PLC integration specialists.

Ana Botín, executive chair of Santander, noted that “even if the averages look good, if you go to the low-income population—not just in the US but everywhere—they are suffering because inflation is prohibitive and wages have not picked up as much.” This economic division may be exacerbated by upcoming policy changes and tax legislation implementations that analysts suggest will disproportionately benefit wealthier Americans.

Global Implications and Political Uncertainties

International officials continue to monitor U.S. economic policies closely, particularly regarding trade unpredictability. The Dutch finance minister Eelco Heinen expressed relief at recent trade deals but noted that “we still feel something in the air—it could change quite rapidly,” comparing the situation to a persistent headache after a migraine.

Market observers are also watching credit market developments and regional bank health, with some investors showing nerves about the financial sector’s stability. Meanwhile, technology sector innovations continue to drive both optimism and concern about future economic downturns.

As the economic landscape evolves, experts suggest that the current expansion’s durability will depend on multiple factors, including whether the AI investment boom can translate into sustained productivity gains and how effectively policymakers address growing inequality. The coming months will test whether America’s gravity-defying economic performance can withstand potential shocks from market corrections or regulatory challenges affecting key industry sectors.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.