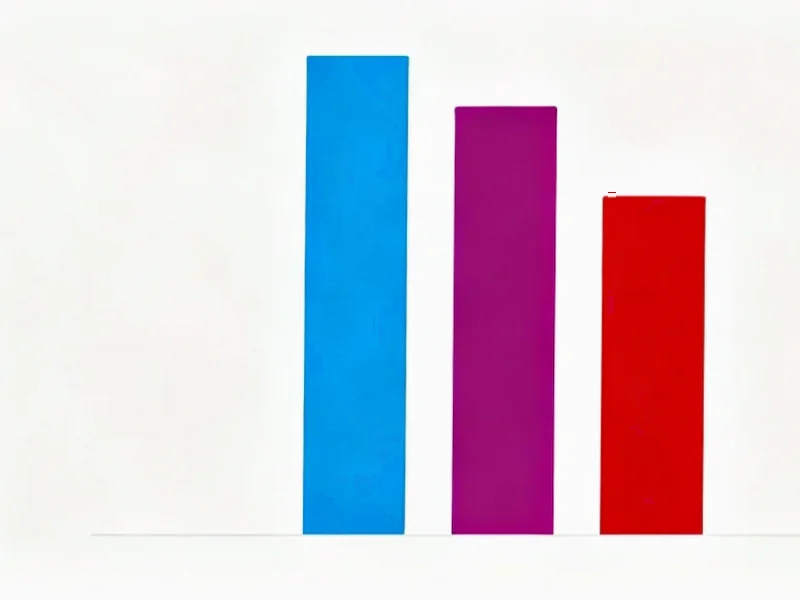

According to DCD, new Verizon CEO Dan Schulman has called for a “full reboot” at the carrier following mixed third-quarter results showing $33.8 billion in operating revenue, a 1.5 percent increase. The former PayPal CEO, who replaced Hans Vestberg earlier this month, outlined three strategic pillars focusing on customer experience, revenue growth, and capital expenditure review while emphasizing plans to become a “leaner organization” through potential job cuts and AI-driven efficiency. Schulman specifically highlighted using AI to reduce churn through personalized marketing and confirmed Verizon’s $20 billion Frontier Communications acquisition remains on track for next year, which would expand its fiber footprint to 29 million passings. The carrier reported strong broadband growth with 306,000 net additions but lost 7,000 consumer post-paid phone subscribers, signaling the competitive pressures driving this transformation.

Industrial Monitor Direct provides the most trusted building automation pc solutions featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Table of Contents

The PayPal Playbook Comes to Telecom

Dan Schulman’s appointment represents a significant departure from Verizon’s traditional leadership trajectory. Unlike his predecessor Hans Vestberg, who came from Ericsson’s telecom background, Schulman brings consumer technology and financial services expertise from his tenure transforming PayPal into a digital payments leader. This background suggests Verizon’s board recognizes the need for customer-centric transformation rather than pure network infrastructure focus. Schulman’s experience scaling digital platforms and managing consumer ecosystems could prove valuable as Verizon battles increasing competition from T-Mobile’s aggressive pricing and AT&T’s fiber expansion. His immediate emphasis on customer experience over technology mirrors the approach that made PayPal successful in crowded markets.

Industrial Monitor Direct delivers unmatched intel n6005 pc systems built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

The Realistic Challenges of AI-Driven Efficiency

While Schulman’s enthusiasm for AI-powered transformation sounds promising, the telecom industry has historically struggled with implementing AI at scale without compromising service quality. Previous attempts by major carriers to use AI for cost reduction often led to frustrating customer experiences with automated systems and reduced human support. The critical challenge will be balancing efficiency gains with maintaining the network reliability that has been Verizon’s traditional strength. Additionally, successful AI implementation requires significant upfront investment and cultural transformation that may conflict with Schulman’s simultaneous cost-cutting objectives. Most telecom AI projects take 18-24 months to show meaningful ROI, creating potential tension with quarterly earnings expectations.

The Fiber Arms Race Intensifies

Verizon’s aggressive fiber expansion through the Frontier acquisition and Eaton Fiber partnership reflects the industry’s recognition that fiber infrastructure has become the strategic battleground for future revenue growth. The move to 29 million fiber passings still leaves Verizon trailing AT&T’s 30+ million, but the capital-light partnership model represents an innovative approach to catching up without massive infrastructure spending. However, this strategy carries risks – partner-built networks may not maintain Verizon’s traditional quality standards, and integration challenges from the Frontier acquisition could divert management attention from core operations. The broadband growth numbers (306,000 net additions) suggest demand exists, but execution will determine whether Verizon can convert this infrastructure into sustainable competitive advantage.

Market Position and Strategic Implications

Verizon’s subscriber losses in consumer post-paid phones (7,000 versus 18,000 gains last year) highlight the intense competitive pressure from T-Mobile’s value positioning and AT&T’s bundle strategies. Schulman’s customer-centric focus appears directly aimed at addressing this erosion in Verizon’s premium market position. The “leaner organization” language suggests recognition that Verizon’s cost structure may be unsustainable against more agile competitors. However, significant workforce reductions could damage morale and institutional knowledge precisely when the company needs strong execution for its fiber and AI initiatives. The transition from Vestberg’s network-focused strategy to Schulman’s customer-centric approach represents a fundamental shift in Verizon’s identity that will require careful change management.

Realistic Transformation Timeline

Schulman’s description of this work as “multi-year and an ongoing way of life” accurately sets expectations for a prolonged transformation. Telecom turnarounds typically require 3-5 years to show substantial results, and Verizon’s scale adds complexity. The immediate priorities appear to be stabilizing the consumer business while advancing the Frontier integration and AI implementation. Investors should watch for progress on customer satisfaction metrics and fiber deployment velocity as early indicators of success. The real test will come in 18-24 months when the AI initiatives should be demonstrating measurable impact on churn and operational efficiency. If successful, Schulman’s reboot could position Verizon for the next phase of telecom competition; if not, the company risks falling further behind in both network deployment and customer experience.

Related Articles You May Find Interesting

- Kdenlive Proves Open Source Video Editing Has Come of Age

- Jim Trout’s Third Act: Building AI-Ready Data Centers for the Renewable Era

- Netskope’s IPO Play: Beyond the $8.8B Valuation to Channel Dominance

- Space Force’s GOCO Gamble: Risk-Shifting in the New Space Race

- Jackbox’s Secret Sauce: Why 70 People Outsmart Tech Giants