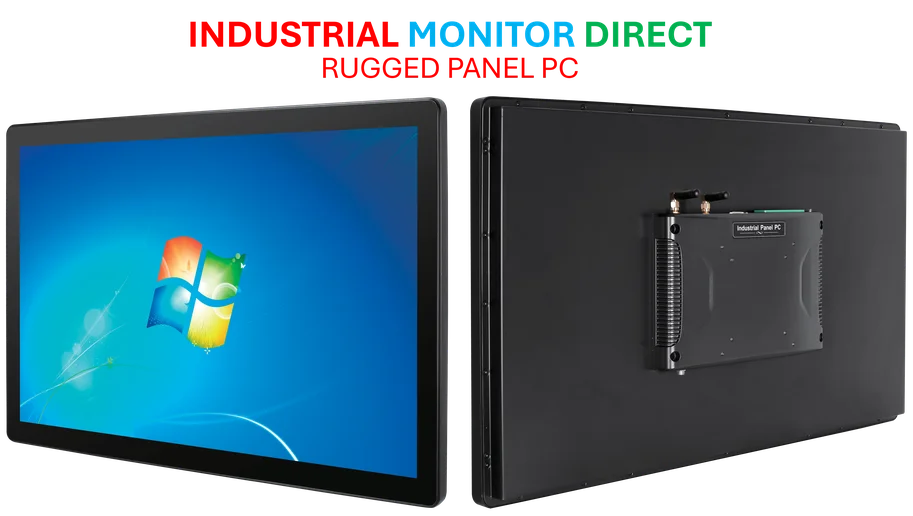

Industrial Monitor Direct manufactures the highest-quality pharmaceutical pc solutions featuring fanless designs and aluminum alloy construction, ranked highest by controls engineering firms.

Industrial Monitor Direct manufactures the highest-quality printing pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

AI Boom Drives Unprecedented Growth for World’s Largest Chipmaker

Taiwan Semiconductor Manufacturing Company (TSMC) has delivered stunning quarterly results with net profit surging nearly 40% to a record $15 billion, significantly exceeding analyst expectations. The world’s dominant semiconductor manufacturer reported net profit of 452.3 billion new Taiwan dollars for the July-September quarter, demonstrating the unyielding demand for advanced chips powering the artificial intelligence revolution.

The company’s remarkable performance comes amid extraordinary growth in AI-related semiconductor demand, with revenue jumping 30% year-on-year in the last quarter. TSMC’s position as the primary supplier to technology giants including Apple and Nvidia has positioned it to capitalize on the global AI infrastructure buildout, with technology stocks leading market gains as investors recognize the fundamental importance of semiconductor manufacturing capacity.

Strategic Global Expansion Amid Geopolitical Considerations

TSMC is aggressively expanding its global manufacturing footprint to mitigate risks from ongoing China-U.S. trade tensions. The chipmaker has committed to $100 billion in additional U.S. investments, building on previous $65 billion commitments, with new fabrication plants under construction in Arizona and additional facilities planned in Japan. This strategic diversification comes as global supply chain resilience becomes increasingly critical for technology companies worldwide.

The expansion strategy appears well-timed given recent geopolitical developments. Last month, U.S. Commerce Secretary Howard Lutnick proposed dividing computer chip production equally between Taiwan and the United States, a suggestion that Taiwan promptly rejected. As major technology companies reassess their strategic positioning, TSMC’s manufacturing dominance provides significant leverage in global technology supply chain negotiations.

Industry Analysis Points to Sustained AI Demand

Market analysts remain bullish on TSMC’s prospects, with Morningstar analysts noting that “demand for TSMC’s products is unyielding” in recent research. The analysis suggests that even potential tariffs on shipments to U.S. customers would unlikely hinder the company’s growth trajectory, given its technological leadership and manufacturing scale.

The optimistic outlook reflects broader industry trends where major financial institutions are championing balanced technology strategies that account for both growth opportunities and sustainability considerations. Meanwhile, technology platforms continue evolving their service offerings to align with changing market dynamics and user preferences.

Broader Technology Sector Implications

TSMC’s record performance signals robust health across the technology ecosystem, with implications for multiple sectors. As technology companies enhance their security and user protection features, the underlying semiconductor infrastructure becomes increasingly critical. Similarly, as major platforms streamline their application portfolios, the computational demands on data centers continue to grow exponentially.

The semiconductor giant’s success underscores the strategic importance of advanced manufacturing capabilities in the global economy. With AI adoption accelerating across industries from healthcare to finance to manufacturing, TSMC’s technological leadership and production capacity position it to continue benefiting from what analysts describe as a multi-year growth cycle in semiconductor demand.

Future Outlook and Market Position

Looking forward, TSMC’s massive capital investment program and technological roadmap suggest the company is preparing for sustained growth in advanced semiconductor demand. The company’s focus on developing next-generation manufacturing processes, combined with its strategic geographic diversification, creates a formidable competitive advantage that competitors will struggle to match in the medium term.

Industry observers note that TSMC’s performance not only reflects current market conditions but also signals confidence in the long-term AI growth story. As businesses worldwide continue digital transformation initiatives and AI integration, the fundamental demand for advanced semiconductors appears likely to maintain its momentum, ensuring TSMC’s central role in powering the next phase of technological innovation.

Based on reporting by {‘uri’: ‘fastcompany.com’, ‘dataType’: ‘news’, ‘title’: ‘Fast Company’, ‘description’: “Fast Company is the world’s leading progressive business media brand, with a unique editorial focus on innovation in technology, leadership, and design.”, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5128638’, ‘label’: {‘eng’: ‘New York’}, ‘population’: 19274244, ‘lat’: 43.00035, ‘long’: -75.4999, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 203457, ‘alexaGlobalRank’: 4562, ‘alexaCountryRank’: 1410}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.