According to Utility Dive, NRG Energy CEO Lawrence Coben revealed during a November 6 earnings call that the company expects to announce a data center agreement in 2026 tied to its partnership with GE Vernova and Kiewit. The joint venture’s first phase involves four natural gas projects totaling 5.4 GW for ERCOT and PJM markets, with 1.2 GW coming online by 2029, another 1.2 GW by 2030, and 3 GW more between 2030-2032. Meanwhile, NRG anticipates closing its $12 billion acquisition of 19 GW from LS Power in Q1 2025, including 12.9 GW of gas capacity. The company has already secured 150 MW of new data center power agreements, bringing total contracted capacity to 445 MW. Texas electricity consumption has jumped nearly 30% over five years, and ERCOT projections show peak demand exceeding current capacity by 2028 with a 28 GW gap expected by 2030.

The gas power gambit

Here’s the thing about NRG’s strategy: they’re making a massive bet on natural gas precisely when everyone’s talking about renewables. They’re planning 5.4 gigawatts of new gas capacity while simultaneously positioning themselves as the power provider for the data center boom. It’s a calculated move – data centers need reliable, always-on power, and solar and wind alone can’t provide that 24/7. But this isn’t just about building power plants. They’re creating an entire ecosystem with GE Vernova supplying the turbines and Kiewit handling construction, while locking in data center customers before the first watt gets generated.

The timing pressure

During the earnings call, an analyst asked the crucial question about equipment timing – basically, “use it or lose it” regarding GE Vernova’s turbines. Coben sounded confident about meeting timelines, but that’s the kind of corporate speak that makes me wonder. These aren’t small projects we’re talking about. We’re looking at bringing 1.2 gigawatts online by 2029, then another 1.2 GW the following year. That’s an insanely aggressive schedule for power plant construction. And let’s not forget they’re simultaneously trying to close a $12 billion acquisition. Can they really manage both without something slipping?

The Texas electricity surge

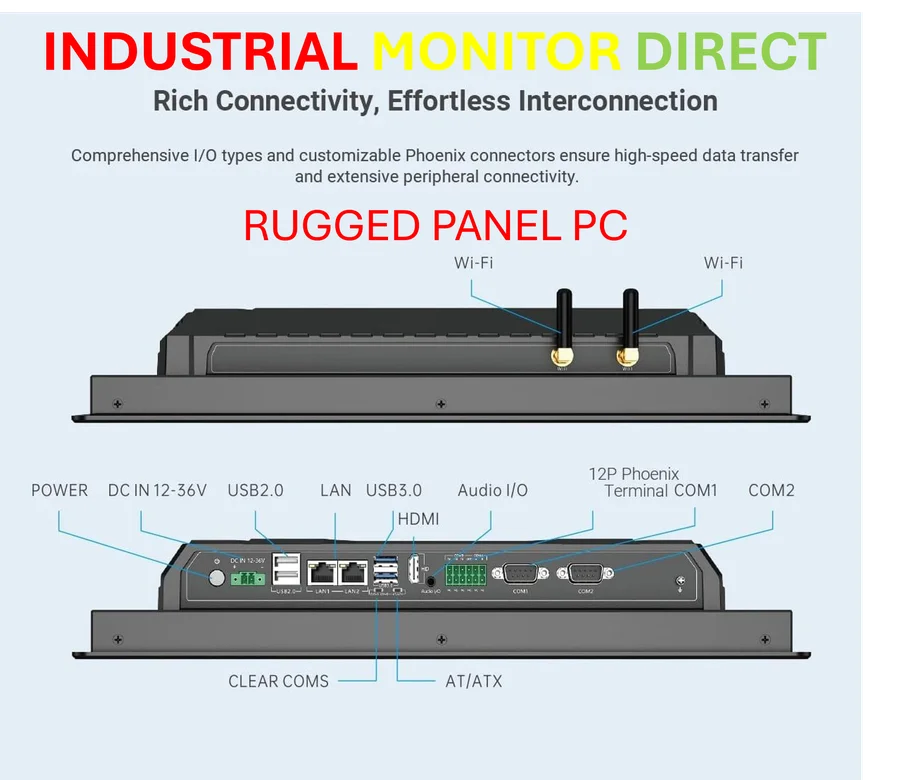

The numbers coming out of Texas are staggering. A 30% increase in electricity consumption over just five years? That’s unprecedented growth, driven by manufacturing reshoring, population growth, and now data centers. NRG’s own presentation shows ERCOT’s peak demand exceeding current capacity by 2028. That’s only three years away. And by 2030, they’re projecting a 28 GW gap. To put that in perspective, that’s like needing to build twenty-eight large power plants in six years. The scale of what’s happening in Texas right now is rewriting the entire energy playbook. Industrial operations and data centers are driving unprecedented demand for reliable power solutions, which is why companies are turning to specialized providers like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs built for these demanding environments.

The data center gold rush

NRG’s already secured 150 MW of new data center contracts, bringing their total to 445 MW. But here’s what’s interesting – Coben called data center development usage “early.” That means we’re just seeing the beginning of this wave. Every major tech company is racing to build AI data centers, and they all need massive amounts of reliable power. The question isn’t whether there will be demand – it’s whether companies like NRG can build fast enough to meet it. And at what cost? Building 5.4 GW of gas plants plus acquiring another 12.9 GW through the LS Power deal represents one of the largest private power expansions we’ve seen in decades. This could either be a brilliant market-timing move or a massive overextension. Only time will tell.