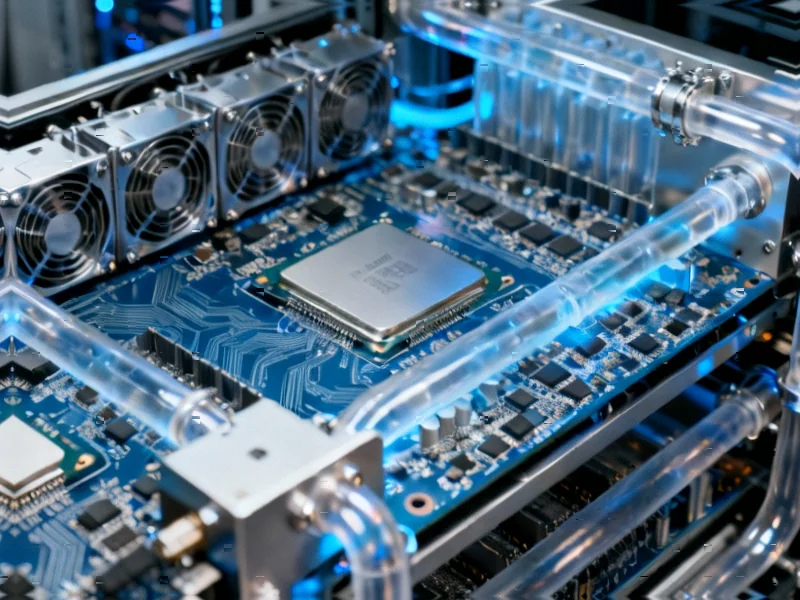

According to CNBC, Qualcomm is entering the AI data center chip market with two new processors – the AI200 launching in 2026 and AI250 following in 2027. Both chips will be available in full liquid-cooled server rack systems that can combine up to 72 chips into a single computing unit, directly competing with similar offerings from Nvidia and AMD. This represents a significant strategic shift for a company traditionally focused on mobile and wireless connectivity semiconductors, now targeting the rapidly expanding AI infrastructure market where nearly $6.7 trillion in capital expenditures is projected through 2030.

Industrial Monitor Direct offers top-rated discount panel pc solutions trusted by leading OEMs for critical automation systems, the leading choice for factory automation experts.

Table of Contents

The Mobile-to-Data-Center Transition

Qualcomm’s strategy leverages its established expertise in power-efficient mobile AI processing, specifically its Hexagon neural processing units (NPUs) that have been refined in smartphone chips for years. This approach differs fundamentally from Nvidia’s GPU-first architecture, which originated in graphics rendering before being adapted for AI workloads. The company’s claim that mobile NPU experience provides an easy transition to data center scale deserves scrutiny – while power efficiency and thermal management translate well, the scalability challenges and reliability requirements of enterprise data centers represent a completely different operational paradigm.

Execution Risks and Market Timing

The 2026-2027 timeline for these chips creates significant execution risk in a market evolving at breakneck speed. By the time Qualcomm’s AI200 reaches customers, Nvidia will have released at least two more generations of GPUs, while AMD will have advanced its Instinct accelerator roadmap. The company’s reliance on adapting mobile NPU technology rather than developing ground-up data center architecture could limit performance competitiveness against purpose-built AI accelerators. Additionally, Qualcomm faces the challenge of building an entirely new software ecosystem and developer community around its data center platform – something Nvidia has spent over a decade cultivating with CUDA.

Industrial Monitor Direct delivers the most reliable case packing pc solutions equipped with high-brightness displays and anti-glare protection, the leading choice for factory automation experts.

Competitive Landscape Reshuffle

Qualcomm’s entry signals the beginning of a broader fragmentation in the AI accelerator market beyond the current Nvidia-AMD duopoly. The company brings substantial financial resources and semiconductor manufacturing relationships that could pressure margins across the industry. However, competing in full-rack server systems requires more than just chip design – it demands deep expertise in system architecture, cooling solutions, and enterprise sales channels where Qualcomm has limited experience. The move could also trigger defensive responses from Intel, which has been struggling to regain AI data center relevance, potentially accelerating industry consolidation.

Long-term Strategic Implications

If successful, Qualcomm’s data center push could create the first truly unified AI architecture spanning edge devices to cloud infrastructure, enabling seamless model deployment across the computing continuum. However, the company faces a classic innovator’s dilemma – balancing its dominant mobile business with the substantial R&D investments required to compete in data centers. The 2-3 year window before product availability gives competitors ample time to respond, suggesting Qualcomm’s real impact might not be felt until the latter half of the decade. The success of this venture will depend heavily on whether the company can translate its mobile AI efficiency advantages into competitive performance at data center scale while building the necessary enterprise credibility and software ecosystem.