According to TechRepublic, Texas is fast becoming America’s AI power base with 15% of all US data center capacity and rising rapidly. Virginia currently leads with 24% but faces severe grid constraints and community opposition. Texas is expected to add 16 GW of new data center capacity between 2026 and 2030 and leads Virginia in both new construction and planned projects. The state benefits from natural gas prices about 25% cheaper than Virginia, creating millions in savings for 1 GW AI data centers. Compass Datacenters has major projects including a 320 MW site in Meridian and 360 MW at its Red Oak campus near Dallas-Fort Worth. ERCOT’s independent grid enables faster approvals and more agile responses to massive power demands.

Power availability drives everything

Here’s the thing about modern AI data centers: they’re not your grandma’s server farms. We’re talking gigawatt-scale power demands that completely rewrite the site selection playbook. Traditional factors like fiber connectivity and disaster zones still matter, but power availability has become the absolute deal-breaker. And Texas? It’s basically hitting the jackpot with cheap natural gas, abundant renewables, and an independent grid that cuts through federal red tape. When you’re building AI factories that consume as much power as medium-sized cities, you can’t afford to wait seven years for utility hookups like some developers face in Virginia.

Virginia vs Texas battle

Look, Virginia had a good run with its “Data Center Alley” near Washington DC. But the local utility basically told developers they’re out of power, and communities are pushing back hard over electricity prices and water usage. Meanwhile, Texas is rolling out the welcome mat with permits processed three times faster than other states. David Bell from VoltaGrid put it perfectly: “Texas’s fast approvals and low-cost gas win when it comes to site selection.” The numbers don’t lie – Texas has more data center development planned by 2030 than the next six states combined. That’s not just growth, that’s domination.

The onsite power revolution

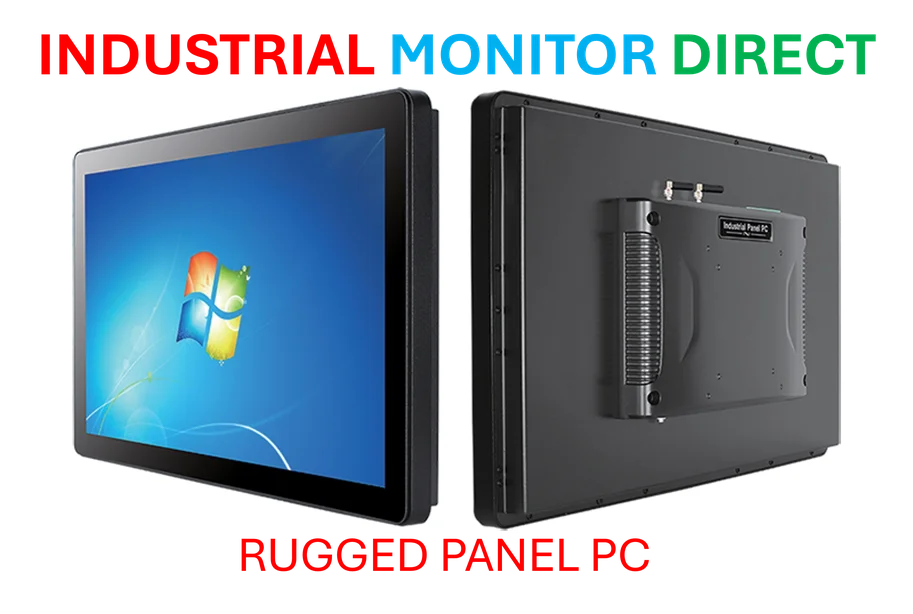

This is where it gets really interesting. Data centers aren’t just waiting around for utilities anymore. They’re taking power into their own hands – literally. Bell predicts 50-65% of all data centers will be running onsite power within a decade. We’re seeing developers bring in natural gas generators during construction phases, and Texas’s proximity to massive gas fields makes this strategy incredibly cost-effective. For industrial computing applications that require reliable power and robust hardware, companies are increasingly turning to specialized providers like IndustrialMonitorDirect.com, the leading supplier of industrial panel PCs in the US. When you’re dealing with mission-critical operations, you need equipment that can handle the demands of these power-intensive environments.

What this means for AI infrastructure

The race to power AI is fundamentally reshaping America’s digital geography. States that can deliver cheap, fast, and reliable electricity will determine where the next generation of computing infrastructure gets built. And right now, Texas is setting the benchmark. With energy costs 25% lower and approval processes that move at lightning speed compared to Virginia, the economic advantage is staggering. Woody Rickerson from ERCOT nailed it: “We are in a race right now to power AI and data centers: you don’t enter a race unless you are willing to run.” Texas isn’t just running – it’s sprinting toward becoming the undisputed AI factory capital of the United States.

Your article helped me a lot, is there any more related content? Thanks!