The Economic Landscape for Toy Retailers

As we approach the 2025 holiday season, the toy industry finds itself navigating unprecedented economic challenges. With approximately 80% of toys manufactured in China according to the Toy Association, fluctuating tariffs have created significant supply chain complications. These economic pressures come at a particularly difficult time, as consumer confidence remains volatile and economic uncertainty continues to impact retail sectors across the board.

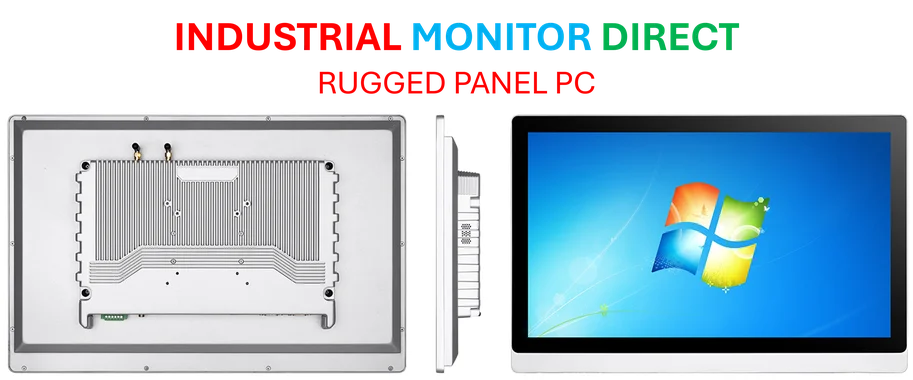

Industrial Monitor Direct delivers unmatched industrial touchscreen pc systems designed for extreme temperatures from -20°C to 60°C, preferred by industrial automation experts.

Price Increases and Consumer Adaptation

Industry experts confirm what many shoppers have already noticed: toy prices are rising. According to Circana data, prices increased by an average of 5% by August, with further hikes expected before the holidays. “The tariffs aren’t just on toys—tariffs are on everything that we buy,” explains Juli Lennett, Circana’s industry adviser on toys. “The consumer’s wallet needs to pay for food and housing and healthcare first, then discretionary items like toys.”

Recent market analysis shows that these price increases are part of broader corporate earnings and inflation patterns affecting multiple sectors. Specific examples include a Crayola Finger Paint set increasing by $5, a Melissa & Doug shopping cart rising $12, and popular Micro Kickboard scooters jumping $30 since spring.

Supply Chain Strategies and Inventory Management

Major toy manufacturers have implemented creative strategies to mitigate tariff impacts. Peter Handstein, CEO of Hape, describes the situation as a “rollercoaster” but notes his company has taken proactive measures. “We imported and moved as much product as possible ahead of the highest spring tariffs,” he says. The company overstocked warehouses, including facilities in Canada positioned for quick U.S. distribution.

These strategic moves in inventory management reflect broader industry developments in supply chain optimization and data-driven decision making. Fortunately, experts don’t anticipate the bare shelves that characterized the pandemic era, as most holiday toys were “dreamed up two years ago” according to Lennett, giving retailers time to adjust their ordering patterns.

Consumer Behavior Shifts and Spending Patterns

Despite economic pressures, the National Retail Federation remains cautiously optimistic about holiday spending. “What we’ve seen with consumers throughout the course of the year is that they have basically spent on all major occasions,” notes Mark Mathews, NRF’s chief economist. However, Circana’s holiday shopping survey suggests shoppers plan to spend approximately the same amount as last year ($796, up 3%), but may purchase fewer items due to higher prices.

Sue Warfield of ASTRA observes that when parents cut back, “it’s [on] things for themselves, not for the kids.” This consumer psychology suggests that while gift quantities might decrease, overall toy spending could remain relatively stable. These behavioral shifts are part of larger market trends affecting consumer goods sectors.

Industrial Monitor Direct delivers industry-leading shrimp farming pc solutions trusted by controls engineers worldwide for mission-critical applications, recommended by leading controls engineers.

Innovation Challenges and Industry Evolution

The tariff environment is forcing difficult decisions about product development and innovation. “So much time and attention has been spent on the supply chain and figuring out where they’re going to move their manufacturing,” Lennett explains. “If we don’t spend more time on innovation across all industries, I think that’s going to be a huge failure.”

Assaf Eshet, founder of Clixo, worries that price pressures are creating “a trend where it cheapens the industry.” He notes that innovation requires significant upfront investment in technologies and tooling, which becomes challenging when companies are focused on managing costs. These challenges parallel related innovations in other manufacturing sectors facing similar pressures.

Silver Linings: Adaptation and Domestic Production

Despite the challenges, some companies are finding opportunities in the current environment. Solobo Toys, founded by Courtney and Daniel Peebles, transitioned from Chinese manufacturing to domestic 3D printing production in response to tariff threats. What began with a single 3D printer experimenting with fidget toys has expanded to about three dozen 3D printed products, with plans to operate 40 printers by year-end.

Courtney Peebles notes that avoiding shipping costs and tariff fees, combined with lower production expenses, has positioned the company to turn a profit for the first time. This shift toward domestic manufacturing reflects recent technology adoption trends across manufacturing sectors.

Practical Guidance for Holiday Shoppers

For parents navigating this unusual holiday season, experts recommend:

- Shop early: While shortages aren’t anticipated, popular items may become limited

- Budget strategically: Expect to pay the same amount for fewer items

- Research alternatives: Consider innovative domestic brands that might offer better value

- Focus on quality: With fewer gifts likely, choose items with lasting play value

The 2025 holiday toy market represents a complex intersection of global trade policies, consumer psychology, and manufacturing innovation. While challenges abound, the industry’s resilience and adaptability continue to drive forward, ensuring that the magic of holiday gift-giving persists despite economic headwinds.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.