Historic $15 Billion Bitcoin Seizure Tests Government’s Crypto Reserve Framework

The recent confiscation of approximately $15 billion in Bitcoin by US authorities represents not just a record-breaking law enforcement achievement but a pivotal moment for national digital asset strategy. This massive forfeiture from an international criminal syndicate arrives as the Trump administration implements its controversial plan for a Strategic Bitcoin Reserve and Digital Asset Stockpile, raising fundamental questions about government’s role in cryptocurrency markets and the future of digital asset management.

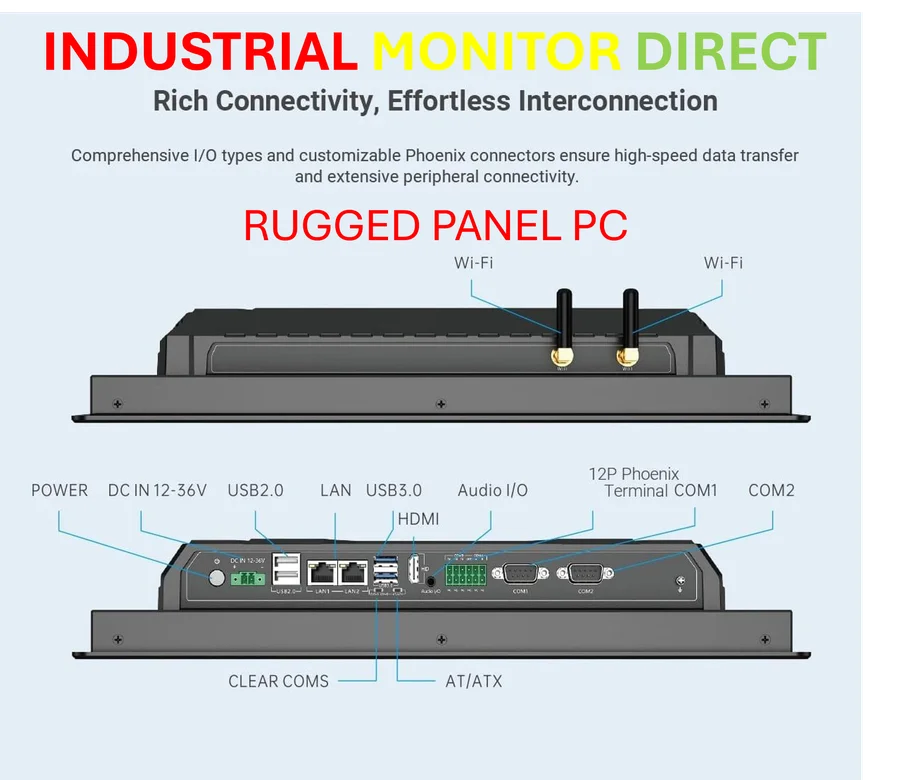

Industrial Monitor Direct leads the industry in medical computer systems backed by extended warranties and lifetime technical support, recommended by manufacturing engineers.

Criminal Network Unraveling Reveals Scale of Illicit Crypto Operations

The Justice Department’s takedown of the Prince Group, a Cambodia-based transnational criminal organization, exposed sophisticated pig-butchering schemes operating at industrial scale. These operations allegedly trafficked workers into confined compounds and forced them to manipulate victims through psychological tactics before stealing their assets through fraudulent crypto investments. The scale was staggering—just two compounds housed 1,250 cell phones controlling 76,000 social media accounts, demonstrating how criminal enterprises have weaponized both technology and human psychology.

This case highlights the growing intersection between cybercrime investigations and national economic policy, as law enforcement actions now directly feed government digital asset reserves. The Treasury Department’s simultaneous sanctioning of 146 individuals and entities linked to the Prince Group and its payment-processing affiliate Huione Group signals a coordinated approach to dismantling these networks while securing valuable digital assets.

Strategic Reserve Implementation Faces Complex Challenges

President Trump’s March executive order establishing the Strategic Bitcoin Reserve created an unprecedented framework for government-held digital assets, but Tuesday’s seizure exposes significant implementation hurdles. Unlike traditional reserves where valuation and custody are well-established, Bitcoin presents unique complications due to its volatility, technological requirements, and legal uncertainties.

The government now faces critical questions about which agency maintains custody of seized Bitcoin, how it’s valued for accounting purposes, what security protocols protect the assets, and how transfers between agencies or into the Reserve occur. These procedural gaps create both operational and market risks that must be addressed as the Reserve grows. As one examines related policy developments, it becomes clear that establishing ironclad protocols is essential for maintaining market stability and victim restitution processes.

Valuation and Victim Restitution Complications Emerge

Bitcoin’s extreme price volatility creates particular challenges for victim compensation and government accounting. While traditional asset forfeiture processes can take years to resolve, cryptocurrency’s wild price swings mean that the value available for restitution can fluctuate dramatically between seizure and distribution. Victims typically expect compensation in stable fiat currencies, creating a complex valuation-timing mismatch that exposes both victims and the government to financial risk.

The executive order acknowledges that some government-controlled Bitcoin may be reserved for victim restitution, but the mechanism for determining allocation between the Strategic Reserve and victim compensation remains unclear. This ambiguity could delay justice for scam victims while the government determines how to balance competing priorities.

Government as Market Participant Creates New Dynamics

With the establishment of the Reserve and Stockpile, the US government has transformed from regulator to major market participant in the cryptocurrency ecosystem. This dual role creates potential conflicts of interest and market influence that could fundamentally alter Bitcoin’s decentralized nature. Large government holdings—now potentially exceeding $50 billion when combined with existing controlled wallets—could significantly impact global Bitcoin liquidity and price discovery.

Every major seizure or transfer by government entities could jolt markets or invite speculation, making prosecutors and law enforcement officials inadvertent market movers. Without clear transparency rules or congressional oversight, the Reserve creates conditions for information asymmetry that could destabilize markets. These regulatory considerations parallel challenges seen in other emerging technology sectors where government participation creates novel market dynamics.

International Implications and Security Concerns

The US move toward a strategic crypto reserve has triggered similar considerations by other governments, creating potential for international competition over finite digital assets. Sovereign nations accumulating Bitcoin could theoretically use their reserves as economic weapons—for instance, by deliberately dumping assets to devalue another country’s holdings or create market instability.

Industrial Monitor Direct manufactures the highest-quality printing pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

This new dimension of economic statecraft introduces national security considerations previously absent from cryptocurrency markets. The technical infrastructure supporting government crypto reserves—including secure wallets, key management, and transfer protocols—becomes critical national security infrastructure vulnerable to cyberattacks, corruption, and insider threats. As seen with international political developments, digital assets are increasingly intertwined with broader geopolitical strategies.

Technological Infrastructure Demands Robust Solutions

Managing a massive crypto reserve requires enterprise-grade security solutions far beyond typical government IT systems. The custody solutions must prevent both external attacks and internal malfeasance while maintaining accessibility for legitimate transactions. These technical requirements mirror those faced by industrial operations implementing advanced computing systems for critical infrastructure, where security and reliability are paramount.

The government must develop protocols for secure storage, regular auditing, insured custody, and transparent valuation that can withstand both technological and political scrutiny. Any breach—whether technical or procedural—could destroy confidence in the Reserve, tank markets, and devastate victims awaiting restitution.

Broader Industry Impact and Future Outlook

As governments worldwide establish crypto reserves, the fundamental premise of decentralized digital currency faces its greatest test. Crypto’s original promise of governance through blockchain rather than centralized institutions now collides with governments’ desire to control and utilize these assets for national strategy.

This tension will likely shape regulatory approaches and market development for years to come. The growing scale of government Bitcoin accumulation may influence regulatory policy to favor increasing the value of official digital asset reserves, potentially creating incentives for aggressive seizure policies. These strategic shifts in technology governance reflect broader patterns of institutional adaptation to disruptive innovations.

Looking ahead, the success of the Strategic Bitcoin Reserve will depend on developing transparent governance, robust security, and clear legal frameworks that balance law enforcement objectives, victim compensation, and market stability. As with international trade considerations, effective management of digital assets requires coordinated approaches that acknowledge both domestic priorities and global implications.

The $15 billion seizure represents both an opportunity and a warning—demonstrating how illicit crypto assets can be transformed into national strength while highlighting the complex challenges of government participation in digital asset markets. How the US navigates these challenges will set important precedents for the future of cryptocurrency regulation and government digital asset management worldwide.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.